- Unstable environment. The recent market volatility is having a disparate impact on organizations’ talent and compensation strategies and is creating difficult conversation around equity strategy following several years of strong market multiples and valuations.

- Ongoing evolution. As companies across all industries continue to battle for tech-enabled/digital talent, there are “flight to safety” and “port-in-the-storm” companies. Other companies will need to determine which resources are available and which pay elements will drive the best ROI.

- Next steps. We expect to see a range of actions heading into the 2023 pay cycle and anticipate that: pay increases will soften; equity burn rates will increase from lower share prices; and companies will lean on other non-compensation elements and value propositions.

Navigating the executive pay landscape to support operational and talent priorities has likely never been more challenging, particularly for those in the technology sector.

Several significant macroeconomic events place pressure on companies’ talent and compensation decisions. Companies have grappled with the future of work accelerated by COVID-19 and increased market valuations over the past 12-24 months. Today, businesses face challenges from the recent drop in market valuations over the past several months driven by rising inflation and interest rates.

What is the right balance between shareholder alignment, fiscal responsibility and retaining and attracting critical talent?

A Significant Reset in Valuations

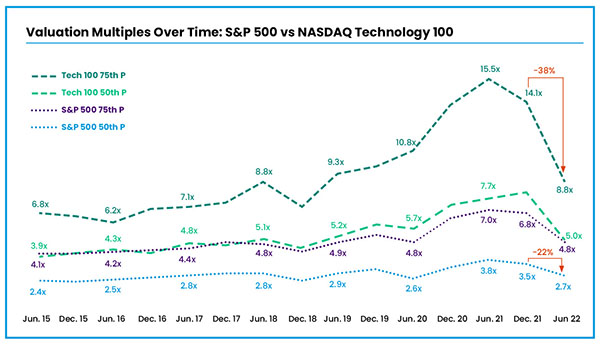

Companies across the market, particularly within the technology sector, experienced a significant and somewhat anomalous uptick in market valuations that started in early 2020 and lasted through 2021. Early in 2022, there was a large reset in technology company valuations. General industry companies experienced a similar trend, and all now operate under a new normal, wrestling with the talent and pay implications (see Figure 1).

An Ongoing Evolution of Talent and Pay Strategy

The heightened need for digital/technical talent and the increased desire to “work from anywhere” created an employee-friendly talent market and elevated the urgency around attracting and retaining key talent. Technology industry annual pay increases typically outpaced general industry increases as technology stock valuations soared. The intensity in the talent market grew. Strong stock price performance bolstered unvested equity value, adding to the expense of attracting new talent.

Companies used several levers to differentiate pay offerings and opportunities, for technology and digital roles in particular:

- Reassessed philosophy on competitive positioning versus market and raised pay positioning aggressively in many cases (e.g., positioned above median)

- Increased new hire and annual equity grant guidelines

- Shortened/modified vesting schedules (e.g., one-year or two-year awards, quarterly vesting, eliminating service requirement for any equity vests)

- Used generous cash sign-on awards to close external candidates

One-time special performance-based awards dramatically increased, partly spurred by multiyear, front-loaded high-risk, high-reward “moonshot” awards in newly public entities. Time will tell how these highly leveraged awards will play out (most of which are based on hitting aggressive stock price hurdles), particularly given the current market dynamics.

It is too early to know how the current dynamics will affect the talent supply and demand over the mid- to long-term. So far, the talent market has softened slightly but remains robust overall. The strategic talent and pay implications play out differently for individual companies:

- Numerous companies have announced hiring freezes or headcount reductions (e.g., Lyft, Redfin, PayPal, Netflix, Carvana, Robinhood)

- Many “port-in-the-storm" companies with strong valuations are aggressively poaching talent from affected companies (e.g., Microsoft, Amazon, Apple)

Overall, there is a flight to safety, as port-in-the-storm companies with stable outlooks and strong cultures/missions are better positioned to weather market volatility.

What’s Next?

In real-time discussions, most companies are waiting to gain more clarity around where the equity markets will settle and see how early movers react and the effectiveness of their actions. We expect these trends over the coming months:

1. Companies will consider actions to address lower equity holdings and retention concerns, with any off-cycle actions more common below the executive level. Decisions about whether to act and, if so, the scale/mechanics will be highly circumstantial.

- Most will consider immediate/near-term action for acute issues (e.g., critical new hires)

- Others will make additional targeted grants or top-ups for top talent and/or critical roles

- Few will do something programmatically for the full population (any actions will be skewed toward those most affected)

2. A modest softening of structural pay actions will occur in six-to-12 months.

- Lowering total pay increases (e.g., prior double-digit increases are not sustainable).

- Softening new hire grants (e.g., fewer exceptions, grants on the lower end of guidelines).

- Recalibrating how companies define strong retention hold going forward.

- Emphasizing cash compensation to address inflation concerns and offset equity volatility

3. Companies will take a fresh look at pay designs to optimize for the current dynamics and heightened volatility, though we do not expect wholesale changes for most companies.

- Companies will slow the move to a “value delivery” model. Affordability will be the biggest challenge, and those willing to take it on could become more competitive in the talent market.

- Companies facing significant dilution constraints will consider shorter vesting to deliver competitive value and/or shift to share-based new hire guidelines (versus dollar-based).

- Companies will explore mitigating stock price volatility through specific mechanics (e.g., conversion periods, granting frequency), but we do not expect major changes.

4. Gross burn rates will increase materially during the next one-to-two years for many companies. Increases will be softened by signals from the investor community that they will closely watch share-based compensation.

- Many companies will manage overall cost and dilution through headcount while maintaining differentiated pay for top performers.

- Many will feel comfortable increasing share burn materially (e.g., +1% to +2%).

- Historical top decile levels will serve as a soft cap for many companies. It will be difficult to increase to or beyond these levels for more than one or two cycles.

The path forward will depend highly on each organization's profile. For simplicity, we’ve identified four potential categories companies will likely fall in and share how those companies might address the current dynamics. Each company's unique business context and talent strategy will inform where/how they choose to act and respond to the new order of talent priorities.

Growth and profitability: higher-margin businesses insulated from recent valuation corrections.

- Limited pay philosophy changes; may face pressure on cash from port-in-the-storm companies.

- Equity compensation remains a selling point and will be attractive for specific talent markets.

- Will lean in on dilution and balance aggressiveness while ensuring sustainable practices.

Port-in-the-storm: companies with excess cash/equity reserves and strong credibility with investors.

- No compelling need to change pay philosophy based on external factors.

- Stock-piled resources create a safety net to retain talent and be aggressive in the market.

- Likely modest increases in dilution but with limited overall concerns from shareholders.

- Will rely heavily on brand/reputation to convey stability and other value propositions.

Growth and unprofitable: companies moving to profitability with near-term cash and equity pressures.

- Meaningful reset of hiring targets and reducing current headcount.

- Reassessing pay philosophy to determine the right balance of retention and performance.

- Pressure to add performance elements to become profitable and recover lost market value.

- Meaningful dilution challenges (in top quartile) and facing critical equity strategy decisions.

Survival model: slowed growth, no profitability and skeptical investors about business viability.

- Focused on mission-critical individuals/functions and limited new hires to weather the storm.

- More likely to consider one-time actions and significant near-term changes to programs.

- Attracting talent will require significant effort on communication and value proposition.

Addressing the Current State of Pay

Every company experiences the current market and talent dynamics differently. The following questions can help to scope the potential issues:

1. What is the company’s dilution story? What are the potential challenges when facing the current market dynamics (e.g., affordability, burn rate, share availability)?

2. What role can cash play to complement or offset adjustments in the equity strategy and respond to employee perception of value in the face of inflation and increasing equity volatility?

3. What other levers outside of compensation make the company attractive to current and new employees (e.g., mission, progression, development, culture, stability)?

After identifying the potential issues, these guiding principles can help assess possible actions:

1. Lead with caution and communicate proactively. Where possible, avoid taking significant actions until there is more visibility around when the dust will settle and determine an internal communication strategy (e.g., acknowledging current dynamics, continuing to monitor, etc.).

2. Develop a long-term plan. Any actions should be done within the context of a longer-term strategy, focusing on potential dilution and sharing availability and compatibility with culture and compensation philosophy.

3. Be targeted and differentiated. Focus actions on critical roles and top talent through a rigorous and intentional performance management process as well as those most affect impacted (e.g., recent new hires or promotions). These actions are subject to overall affordability and other constraints.

4. Anticipate potential knock-on effects and plan different scenarios. Significant actions today will create a precedent and introduce potential longer-term implications.

5. Double down on other aspects of the employee value proposition. Non-compensatory elements become even more critical in volatile and fluid talent markets. These include pay/performance transparency, long-term ownership, mission, career development opportunities, long-term strategy and viability of the business.

The macro environment has introduced pressures that will be a new experience for many technology companies that have benefited from prolonged favorable market conditions. Companies with great intention and clarity around the program objectives and potential actions that connect to the business and talent strategy will be better positioned.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: