More employees are delaying their retirement due to the rising cost of living, according to a recent Nationwide Retirement Institute survey. As a result, many of them are either working or planning to work beyond the traditional retirement age of 65.

The survey found that 40% of employees ages 35 and older are expecting to retire later than planned — double the number who said so during the COVID-19 pandemic.

“Our research shows that employers and employees alike are starting to realize that guaranteed lifetime income offers unique confidence that workers are protected against inflation and market volatility and that individuals won’t outlive their savings,” Amelia Dunlap, vice president of Nationwide Retirement Solutions Marketing, said in a statement.

According to the Bureau of Labor Statistics, 32% of individuals ages 65 to 74 are projected to be working in 2030.

Because this population is expected to play an important role in the labor force in the coming years, employers should take time to understand their needs and support them to help foster a successful transition into retirement. That includes providing more education, more guidance and tools, and more benefits to meet older employees’ unique needs.

Other Concerns

In addition to the rising cost of living, other reasons employees are forgoing retirement include concerns about the current economic climate and a lack of confidence that they have enough money saved.

According to the 2023 Retirement Confidence Survey, 40% of workers and 30% of retirees are not confident their money will keep pace with inflation in retirement. This represented a significant drop compared to recent years, falling to levels last seen in 2018. In addition, more than 80% of workers said they are concerned that the increasing cost of living will make it harder to save for retirement.

In a separate study of 1,062 “Employment Extenders” by Voya Cares and Easterseals, respondents cited the current economic climate as one of the main reasons they are continuing to work beyond the traditional retirement age. Employment Extenders were defined as adults ages 50 and older who previously retired from one career but are still working at another job today, as well as adults who are at least 65 and currently working or planning to work past retirement age.

The pandemic played a big part in opening people’s eyes to their financial situations, according to Jessica Tuman, vice president of Voya Cares and Voya Financial’s ESG Practice Centers of Excellence. Older workers who were either laid off or decided to take a break during the pandemic realized they hadn’t saved enough money for retirement and had to rejoin the workforce, she said.

Well over half of Employment Extenders (60%) said they had less than $500,000 in retirement savings; this figure included money in investments, savings accounts, pension plans or defined benefit plans, employer-sponsored retirement plans such as 401(k)s, and IRAs or Roth IRAs. Nearly a third of respondents (30%) admitted to having less than $100,000 in savings.

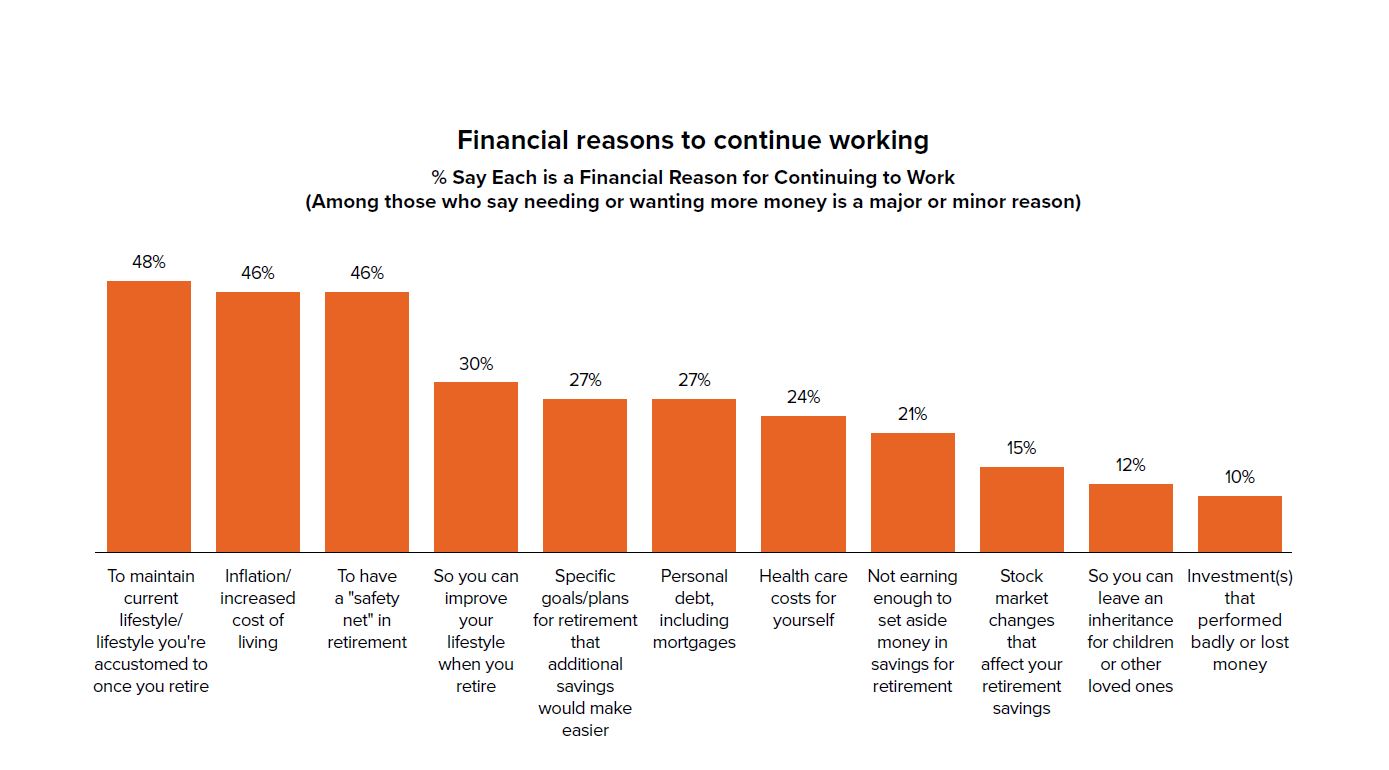

When asked to select all the financial concerns or considerations contributing to their decision to continue working (see chart below), survey respondents identified these as the top three:

- Maintain current lifestyle (48%)

- Prepare for inflation or increased cost of living (46%)

- Have a safety net (46%)

“There are complex reasons to why people are working longer,” Tuman said. “For example, we’re finding employees in their late 50s, 60s, even their 70s who are not prepared for the demand and cost [associated] with caregiving…[so] it’s not factored into retirement plans.”

In fact, the Voya Cares survey found that only a quarter of Employment Extenders are planning for the possibility of providing care or support for a partner or loved one.

Adding Benefits

Employers have an opportunity to help meet the needs of older employees by providing additional benefits and resources, according to Tuman.

In the Voya Cares survey, Employment Extenders shared what benefits they had, what benefits they lacked and what benefits might be of interest to them. Beyond traditional retirement benefits, respondents were interested in gaining access to products and services that:

- Explain Social Security benefits, healthcare costs and Medicare.

- Provide guidance on managing predictable, non-guaranteed streams of income in retirement, including withdrawal strategies.

- Maximize benefits dollars across retirement savings, health savings accounts (HSAs), healthcare insurance coverage and voluntary benefits.

- Estimate income needs in retirement, including future healthcare costs.

- Help keep retirement savings on track, even in times of financial difficulties.

- Allow employees to see all of their financial and employer benefits information in a single place.

The good news is that some companies are repositioning benefits to better aid Employment Extenders, according to Tuman.

“After the pandemic, they looked at their shelf of products and services and added benefits such as HSAs (health savings accounts), emergency savings accounts and student loan debt management programs,” she said.

Education Strategies

Providing more education is another way employers can help older workers prepare for retirement.

A survey of 210 U.S.-based employers by HR strategy and compliance provider XpertHR found that more than a third of companies rarely or never send employee benefits communications related to retirement. Of those that do, about 2 in 5 (39%) use emails or letters. Smaller percentages of companies host one-on-one meetings (27%) or in-person sessions (20%) to discuss retirement with employees.

Voya’s Tuman said education is the No. 1 need for this segment of workers. The Voya Cares survey found that 60% of Employment Extenders need help understanding their retirement plans.

“Some of the information they seek is basic financial education that employers can offer,” the Voya report authors wrote. “Many don’t know, for example, that Social Security won’t be enough to cover even basic expenses for most people. They don’t know that waiting until age 70 will guarantee the highest Social Security benefits. Or they don’t understand that Medicare won’t cover all their healthcare expenses, especially the expense of long-term care.”

Retirement Readiness

When an employee is ready to announce their retirement, they’ll feel more comfortable doing so if the environment is safe and supportive.

“Employers need to have a trusting culture,” said Beth Ritter, professor of practice in the Department of Management, Innovation and Entrepreneurship at North Carolina State University. “[Employees] don’t want to reveal that it’s time to retire and then be removed from projects or end up on a termination list if the company is performing layoffs. That’s illegal, but that’s still a fear that people have.”

According to Ritter, seeing how the employer handled retirements and knowledge transfer in the past sets the tone (Ritter recently wrote about the topic for The Journal of Total Rewards).

“Associates watch to see how situations are managed,” she said, “so be sure to demonstrate, one retiree at a time, how the company will respect the individual while protecting the firm’s interests.”

For instance, when knowledge transfer begins, employers should ensure that the retiree’s authority and contributions continue to be recognized. Policies may need to be created to support the process, Ritter noted. One policy might make it possible for the retiree to work flexible hours. Another might allow a department to have extra head count while transitions occur. A different policy could maintain accountability by including clarification of deadlines, deliverables and responsibilities.

There is room for improvement in knowledge sharing in most organizations, Ritter said. Her tips include starting the process early and having retirees share what they know with more than one other person.

Set Employees Up for Success

Employers would be remiss to ignore older workers and their contributions, since many of these folks aren’t planning to leave the workforce anytime soon.

“It’s a growing segment,” Tuman said. “They’re living longer and working longer.”

Ideally, employees would be in a position to either keep working or retire when they reach retirement age, experts said during a webinar hosted by the Economic Policy Institute.

“You work your lifetime,” Siavash Radpour, associate research director of the Retirement Equity Lab at the New School’s Schwartz Center for Economic Policy Analysis, said during the event. “When you’re old, you deserve to work if you want to and retire if you want to. We’re not saying everyone should retire or everyone should work. We’re saying you deserve to have the choice. And the choice will empower you to have better work and better retirement.”

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: