- Next steps for companies. Now that the first pay versus performance disclosure is complete, organizations should shift their attention from their own internal calculations to understanding how they compare to the market.

- Review peer disclosures. Companies should review available market information and assess how their approach aligns to the market, and whether there is a need for any refinements for 2024 disclosure.

- Collect and analyze compensation actually paid (CAP) data. Companies should start to collect CAP data for compensation peer groups and understand how the information could fit into existing frameworks for assessing alignment of pay and performance.

- Anticipate outside interest. Companies should be prepared for questions from investors on their PVP disclosures. Talking points will need to include some level of education in addition to any narrative, as the new terminology and methodology may not be familiar to all stakeholders.

Most companies have filed their first pay versus performance (PVP) disclosure. Compensation committees and management teams can now start to shift their attention from their own internal calculations to understanding how their disclosure compares to market, as well as how to use and interpret the resulting bevy of new information available.

To prepare for upcoming disclosures, WTW recommends companies take the following three steps:

- Review peer disclosures and any Security and Exchange Commission (SEC) comment letters to understand normative market practices.

- Collect and analyze readily available peer data.

- Understand how external observers will use and interpret PVP.

Review Peer Disclosures

In a recent blog post, WTW reviewed disclosures from approximately 600 S&P 1500 companies that filed Pay Versus Performance data on or before March 31, 2023.

We observed a high level of consistency across these first filings. We recommend companies review this type of market information and assess how their approach aligns to the market, and whether there is a need for any refinements for 2024 disclosure.

Companies should also review any comment letters or other additional guidance from the SEC. While we don’t expect the SEC to come down harshly on companies in the first year, it is possible that we will see expanded Compliance & Disclosure Interpretations (C&DIs) to address areas of continuing ambiguity as the commission looks ahead to 2024 and beyond.

Collect and Analyze Peer Data

The new Compensation Actually Paid (CAP) figures can supplement existing analytics used to evaluate alignment between pay and performance. The most common historical approaches utilize realizable or earned pay concepts, comparing relative pay to relative performance (often TSR, but sometimes including other measures or a composite of several measures).

CAP, while arguably more complex to calculate for individual companies, will have several advantages in pay and performance analyses that use peer data:

- Ease of collection: Straightforward to collect from peer disclosures

- Comparability: Consistent calculation methodologies allow for comparability across companies

- Transparency: Shareholders and other external observers have access to the same underlying data

WTW recommends that companies start to collect CAP data for compensation peer groups and understand how the information could fit into existing frameworks for assessing alignment of pay and performance.

Understanding how similar or dissimilar the findings are utilizing CAP when compared to current approaches of assessing pay and performance alignment will indicate whether these are a helpful supplement or potential replacement of existing analyses in the future.

Additionally, for any companies that might not have been performing pay for performance alignment tests with regularity, the new disclosures provide a much easier avenue for assessments than prior frameworks where compensation needed to be calculated by the named executive officer (NEO) for each peer.

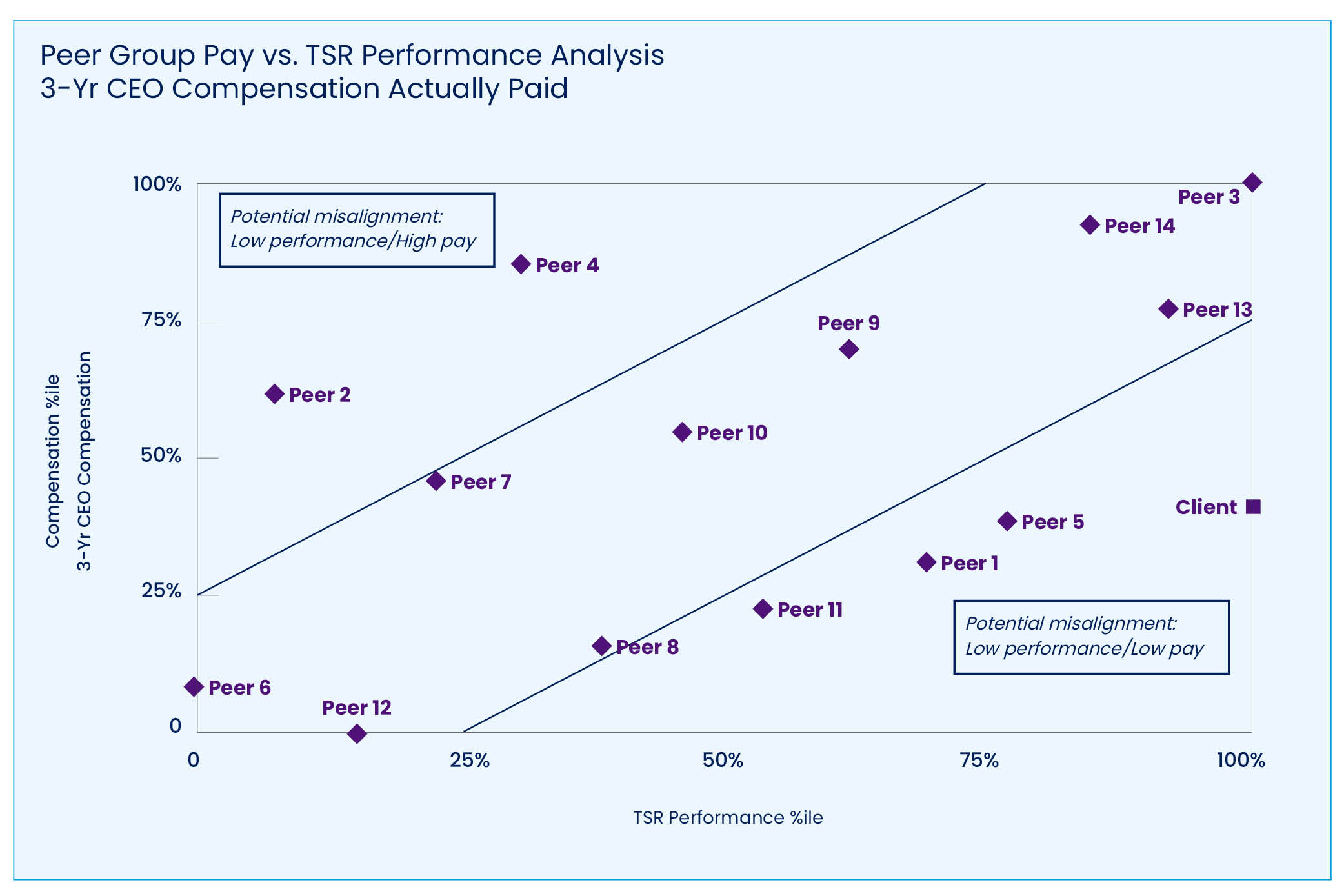

An example analysis might compare a company’s relative three-year CEO CAP and three-year total shareholder return (TSR) relative to a compensation peer group. Assuming the compensation peer group is well-calibrated to reflect the company’s size and industry, this type of analysis should provide a useful lens for understanding pay and performance alignment.

Companies will also want to be thoughtful when considering the impact of measurement dates on TSR when peer companies operate under different fiscal years.

Variations of this analysis could focus on other performance measures, average CAP for other NEOs and eventually incorporate more than three years.

Companies may also wish to collect information on performance measures from peer PVP disclosures. However, we don’t expect much new information that isn’t already disclosed in companies’ Compensation Disclosure & Analysis’ (CD&As), so it may be of limited value. The CD&A will continue to provide more detailed information, including the weighting of specific performance measures, along with how and where they are used.

WTW recommends focusing initial attention on understanding how PVP and CAP concepts compare to existing frameworks for understanding alignment of pay and performance.

Anticipate PVP Reactions from Key Stakeholders

Finally, companies should monitor how key stakeholders are using and interpreting the information.

Companies should be prepared for investor questions about their PVP disclosures. Talking points will need to include some level of education in addition to any narrative because the new terminology and methodology may not be familiar to all stakeholders.

It remains to be seen how proxy advisers will use and interpret PVP disclosures going forward. Institutional Shareholder Services (ISS) said it would not use the PVP data in quantitative tests in 2023, but that they may include as a qualitative consideration.

In practice, we have not observed many cases where PVP was mentioned in this way. Companies will want to stay abreast of any proxy adviser PVP-related policy updates heading into next year.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: