- Invest in employee development. As you look to invest in employee growth, think hard about what career progression in your organization looks like, and recognize that many employees place value on acquiring diverse skills and experiences rather than a traditional climb-the-ladder growth model.

- Foster a transparent environment. Given increasing regulatory changes and general pressure from the public, employees likely will expect more transparency from their employers about why certain investments or decisions are made.

- Learn from the past. Building resilience across an organization’s total rewards programs and practices requires an appreciation for the idea that the decisions you make today will have a long-lasting effect on your business going forward.

Editor’s Note: This is Part II of a two-part series. Part I focused on the critical need to update old total rewards playbooks in light of the likely impending recession, and to prepare for a host of potential unknowns. Part II focuses on investing in employee growth to deliver an exceptional employee experience.

Do: Invest in Employee Growth and Careers

Don’t: Presume the Only Motivator Is Pay

Workers are your greatest asset, particularly during a recession. Engaged employees can improve your bottom line when times are tough. Disengaged employees can be a distraction and work against the organization.

While it’s tempting to believe that one factor — like pay — will magically cause employees to become engaged, that is not reality. And one area we have seen an increase in interest among workers is their future career development and opportunities. While this isn’t exactly “compensation” or even really “benefits,” career development is emerging as a space that leaders need to consider and take seriously as they develop their approach to total rewards.

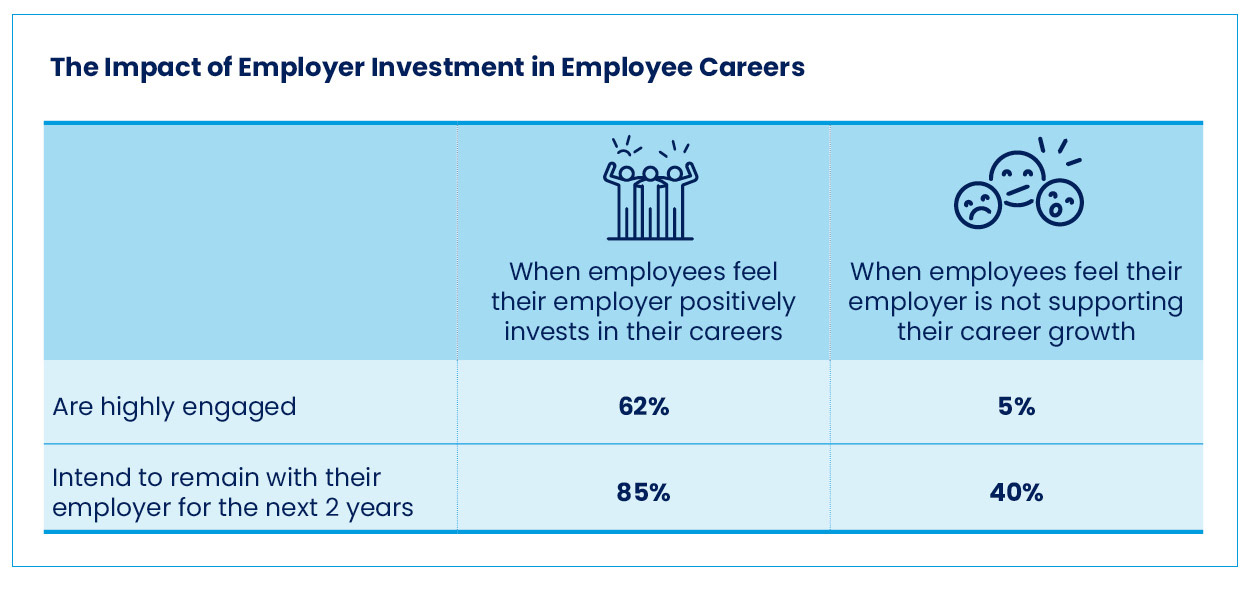

Consider that nearly one in five employees reported prioritizing careers and career growth above all other things — including pay, benefits, emotional well-being and social responsibility. The data also show that investing in careers can pay off in both engagement and retention.

Source: WTW 2022 Global Benefits Attitudes Survey

As you look to invest in employee growth, think hard about what career progression in your organization looks like, and recognize that many employees place value on acquiring diverse skills and experiences rather than a traditional climb-the-ladder growth model. Respond to talent shortages by reviewing your reskilling and upskilling programs to ensure they help you retain and develop the talent you need.

Finally, do not forget the role of equity when you are (re)shaping your career strategy. Oftentimes, your most vulnerable employees are the most affected by recessions, rising inflation and other market shocks. Are you purposeful in how you invest in employee growth and opportunities for underrepresented talent? Do you have a plan to address not only pay equity, but also career equity?

Do: Create an Open, Honest Dialogue

Don’t: Make Assumptions

A low unemployment rate, broad worker shortages, spiking inflation and changing employee expectations will make this recession fundamentally different from those of the past. While employers can’t support every challenge employees face through this experience, future-thinking leaders (again) are taking a holistic view.

Employees will be watching to see how their employers respond. Prior commitments by leadership to values and inclusion can take on new meaning if leadership actions don’t align. If there isn’t an open dialogue and “why” provided, this will inevitably hurt the organization’s perception and reputation among both employees and potential employees.

Given increasing regulatory changes and general pressure from the public, employees likely will expect more transparency from their employers about why certain investments or decisions are made. Additionally, younger employees who haven’t experienced a recession need to be considered. How will they react? What type of discussions will help build greater understanding of total rewards decisions?

Learnings from the largest, most recent crisis showed that organizations that managed changes well during the pandemic saw better engagement and productivity than others. As recession fears loom, it’s important to take this lesson forward.

Be Honest About What’s Happening

- Explain how decisions are made. Provide an inside view into how the organization’s total rewards philosophy and strategy guide decisions, and how its values help prioritize what’s most important. If employees know the approach and considerations taken, they are more likely to accept the outcome.

- Be clear about how those decisions will affect employees as early as you can. If you’re limiting merit funding or raising benefit costs, give employees time to make any adjustments to their personal cash flow.

- Be forthright regarding when and how you deliver the message; remember, if you leave room for confusion or something unsaid, employees will fill the gap with their own story (which will probably be worse than reality).

Demonstrate Listening

- Employees want to tell you something, so be sure to listen with intent through employee opinions and preferences.

- Encourage employees to ask questions and offer their perspectives via department meetings or town hall Q&A sessions; if you don’t provide this opportunity, pressure will build and employees will feel devalued. Making employees feel involved and valued goes a long way toward calming fears.

- Provide resources to managers and leaders so they are supported and, in turn, are prepared to support employees through challenging times.

Show Employees They Are Valued

- Highlight the value employees receive for their ongoing contributions. Ensure employees understand that the company is investing in them through pay, benefits, well-being and career programs.

- Show how you support diversity, equity and inclusion as well as emotional and financial resilience by reminding employees about the resources available to them.

Do: Learn from the Past

Don’t: Repeat It

If we have learned nothing else in the past three years, it has been to expect the unexpected. A pandemic, a climate crisis, civil unrest and global economic volatility have combined to effectively wreak havoc on a level of stability we once took for granted. And today, depending on which economist you listen to, we are either in or staring down a future recession.

Building resilience across an organization’s total rewards programs and practices requires an appreciation for the idea that the decisions you make today will have a long-lasting effect on your business going forward. And consider the risk: If your total rewards programs don’t attract the right talent or if they cause your current workforce to seek greener pastures, you may not have much of a future business to worry about.

Forward-thinking leaders need to understand the current state of their employees against the efficacy of the organization’s total rewards programs and their ability to withstand unforeseen scenarios.

That’s simply the barrier to entry if you want to keep up with the current pace of change. The best way to overcome that barrier? High-quality data combined with intelligence and new thinking to deliver the best, most defensible decisions to every level of the organization.

Recessions are inevitable. Coupled with a fundamentally altered talent market and a workforce that has reset its expectations for employers, turning to old playbooks from bygone days is the equivalent of hiding under your desk.

Now is the time to lift your head, assess your organization’s situation, learn what matters most to your employees, and not necessarily pull back, but rather make intentional investments.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: