- Specialization preferred. While most serial acquirers deploy the same Corp Dev teams across deal phases and types, the most acquisitive companies tend to prefer specialization, with dedicated teams focusing on due diligence and deal negotiation versus integration and harmonization, or focusing on acquisitions versus divestures and joint ventures.

- Deal-based incentives for Corp Dev teams are rare among serial acquirers. There may be circumstances where deal-based incentives have their merits, but they should be used with caution to ensure alignment with shareholder value creation.

- Consider deferrals. A deferral mechanism in Corp Dev incentives may be worth considering, especially for leadership roles, as measuring deal performance may take place over a multiyear period

Editor’s Note: Workspan Daily will be publishing a monthly executive compensation column from Willis Towers Watson for the benefit of our readers and to encourage further discourse on topics vital to compensation professionals. New to WorldatWork? Please feel free to join the discussion in our new online community, Engage, or send your thoughts to workspan@worldatwork.org.

For most companies, mergers and acquisitions (M&A) play an important role in their growth strategy, and corporate development (Corp Dev) teams play a key part in driving corporate M&A activities.

They can identify deals that are fit for purpose, develop the optimal deal structure, negotiate the right price and formulate a compelling integration model to realize the deal objectives and synergies. It’s a specialized level of expertise in which serial acquirers invest heavily to assemble the best possible Corp Dev team.

Given this importance, acquirers have sought to understand how to reward, structure and incentivize Corp Dev teams most effectively. Acquirers often hire M&A talent not only from other acquisitive companies but also from the financial services and consulting sectors. The typical incentive structure for corporate functions may not be attractive enough for talent from a deal-making background. On the other hand, the behaviors needed in a corporate M&A environment are fundamentally different from those in banking, private equity and management consulting.

Earlier this year, Willis Towers Watson conducted a survey of 24 U.S.-based serial acquirers to understand how they incentivize their Corp Dev teams. The median respondent employs more than 20,000 employees and does about three transactions annually.

Following are three major takeaways from our research:

1. Most serial acquirers hire corporate development generalists, but the most acquisitive companies may have highly specialized corporate development roles.

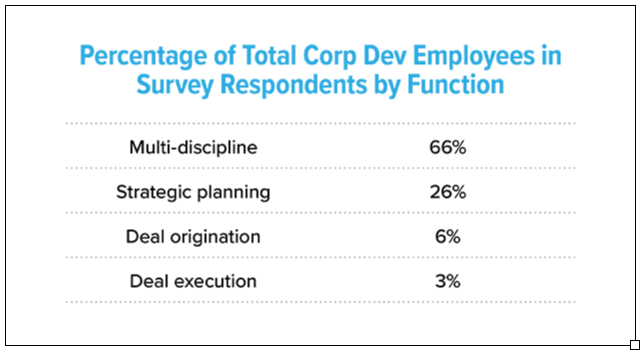

Most companies structure their Corp Dev roles as fungible across deal types and M&A phases. These companies expect team members to work on all kinds of transactions — including acquisitions, divestitures and joint ventures — and work on them at all phases of the deal from planning to origination to execution and integration; however, companies that close fiver or more deals per year are much more likely to require role specialization, such as origination versus execution.

Figure 1. Percentage of total Corp Dev employees in survey respondents by function

This is likely a result of three factors:

- Very few serial acquirers have enough deal volume to justify differentiating roles for deal phases.

- Given the pace of most deals, transitioning deal responsibilities from one team to another can create inefficiencies.

- Integration approaches can be vastly different from deal to deal, each requiring a different resource deployment model to execute properly.

2. Very few serial acquirers set up deal-based cash incentive schemes for corporate development roles.

Only three of the 24 surveyed companies administer a separate cash incentive plan for corporate development teams. For the other 21 companies, the most prevalent cash reward system remains the typical “salary plus target bonus” model, similar to other functional roles, such as finance, HR and legal. With this model, variable pay for Corp Dev staff is consistent with the rest of the organization.

Most surveyed companies report determining Corp Dev bonuses based on a combination of enterprise/business performance funding and individual performance, measured using a holistic scorecard. The scorecard may include key performance indicators on specific transactions, but they do not typically pay higher cash incentives for closing higher-value deals.

The three companies that provide deal-based incentives typically tie a portion of the bonus or the entire bonus to the success of the corporate transactions. Two of those companies offer deal-based incentives in addition to the bonus program used for the rest of the organization. The third funds an incentive pool based on a percentage of deal value, and then individual payout from the pool is based on management discretion. This type of arrangement is rare and should be used with caution, as it may result in undesired behaviors, such as pushing for deals to close that are not the right fit for the buyer or settling for a higher deal value than necessary.

Deal-based incentives typically have a deferral feature, as the success of corporate transactions may materialize over a multiyear period; for example, one company implements a two-year deferral period on deal-based incentives, with a mechanism to modify payouts based on management assessment of deal performance.

While common in the financial sector, none of the surveyed companies reported linking deal-based incentives to the internal rate of return of the transaction. Instead, serial acquirers acknowledge that deal performance may not always be captured through financial metrics and that some latitude for qualitative assessment is necessary.

3. Equity compensation for Corp Dev roles follows corporate practice.

Like other leadership roles, Corp Dev executives are typically eligible to receive equity compensation. The plan design for equity compensation does not differ when compared with other functional roles. Restricted stock is the most prevalent equity compensation vehicle, followed by stock options and performance shares or units. The most prevalent vesting period is three years, mostly on a ratable schedule except in cases of performance-based vesting.

One area where equity compensation practice may vary for Corp Dev roles is hiring. A small number of respondents reported that they often make significant new-hire equity awards to attract M&A leadership talent from the financial services industry. This approach, while creating significant dilution to shareholders’ equity, establishes a direct link between the executive’s individual wealth and company performance, thereby creating the “ultimate reward” for “doing good deals.”

Understanding how Corp Dev teams are structured and rewarded in the market is critical for organizations that rely on corporate transactions as a key component of their growth strategies.

Using the right balance of incentives to reward individuals and teams that select the right deals and execute deals well can be a value creation differentiator, especially in the current environment where there is significant pressure in rising wages and broader challenges in attracting and retaining talent.