For WorldatWork Members

- Five Thought Leaders Dive Deeper into Executive Compensation Issues, Journal of Total Rewards article

- Compensation Structure Policies and Practices, research

- Compensation Committee Toolkit, tool

For Everyone

- Executive Decisions: Considering CEO Comp in Pre-Retirement Years, Workspan Daily article

- By the Numbers: How Companies Pay Execs They Promote to CEO, Workspan Daily article

- The CEO Left. Now What? Interim Leaders Bring Critical Pay Decisions, Workspan Daily article

How should a CEO’s individual performance be assessed and rewarded? To what extent can a CEO’s individual performance — and, therefore, compensation — differ from broader organizational outcomes?

These are critical questions faced by every board and compensation committee. Although there is no definitive answer, this article presents a summary of North American market practices for annual incentive plans and a framework that organizations and their total rewards professionals may find valuable when addressing these questions.

Prevalence of Individual Performance Assessments in Annual Plans

To evaluate and reward CEO performance, 52% of companies in the Standards & Poor (S&P) 500 and 50% of the S&P/Toronto Stock Exchange (TSX) 60 incorporate an individual weighting or modifier in their annual incentive plans. A weighted approach assigns part of the overall score to individual performance. On average, the weighting for CEOs is 26% in the United States and 29% in Canada.

A modifier, on the other hand, is applied to the overall enterprise performance to adjust the annual incentive payout up or down based on individual performance. Typical modifiers are plus or minus 10% to 25%. Among S&P 500 companies, modifiers are slightly more common than weighted components. However, 80% of those S&P/TSX 60 companies noted above use a weighted approach.

Actual Annual Incentive Plan Performance

How did CEOs perform relative to their corporate scorecards in 2023? In short, the results were better.

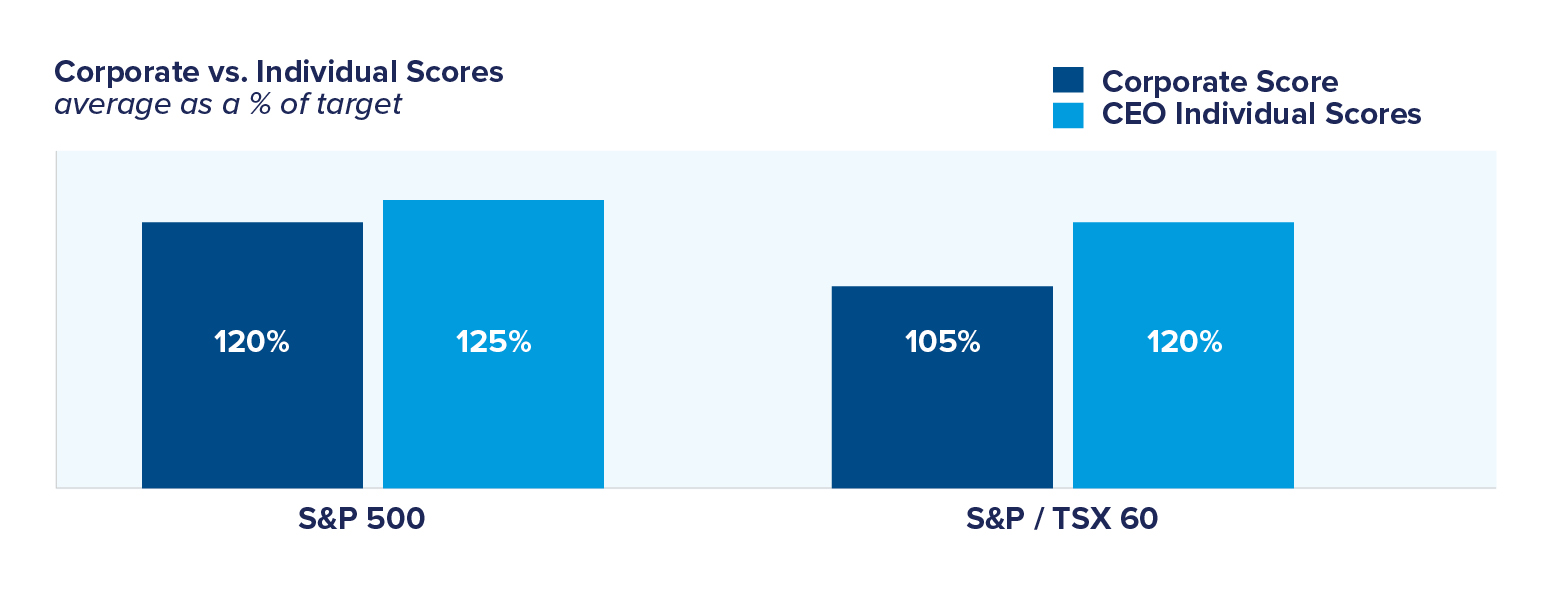

Among U.S. companies disclosing both corporate and individual weighted outcomes, 47% of CEOs received an individual performance score (125% of target, on average) that exceeded their company’s corporate scorecard (120% of target, on average).

Comparably and where disclosed, 61% of S&P/TSX 60 CEOs achieved higher individual performance scores (120% of target) than corporate performance scores (105%) (see figure below.)

CEOs Are Less Likely to Be Scored Below Target

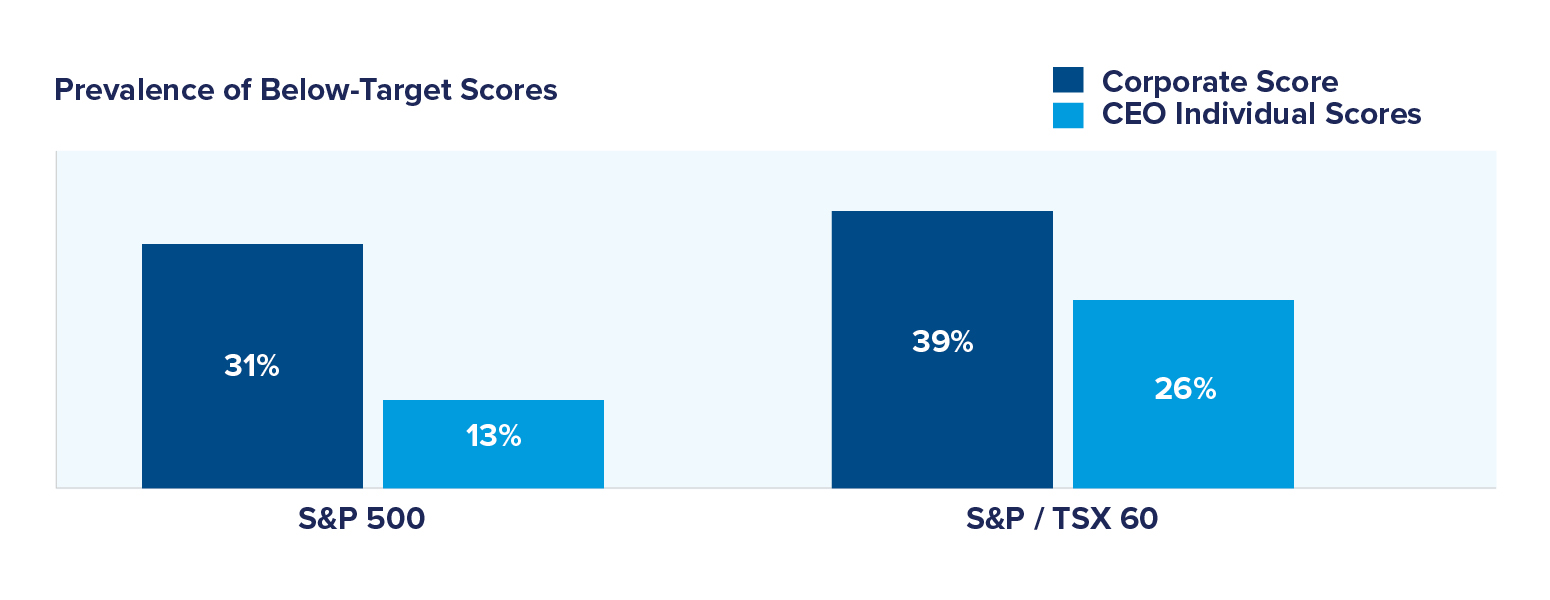

In addition to higher average annual incentive scores, individual CEO outcomes were much less likely to be scored below target and performance modifiers were less likely to decrease CEO outcomes.

As shown in the figure below, 31% of the aforementioned U.S. companies had below-target corporate scores vs. only 13% of individual CEO scores. Additionally, performance modifiers were four times more likely among S&P 500 companies to increase than decrease CEO annual incentive outcomes.

Meanwhile, 39% of S&P/TSX 60 corporate scorecards were below target, but only 26% of CEOs received below-target scores on their weighted component. No Canadian company used a modifier to decrease the annual bonus.

Cases for and against an Individual CEO Component in Annual Plans

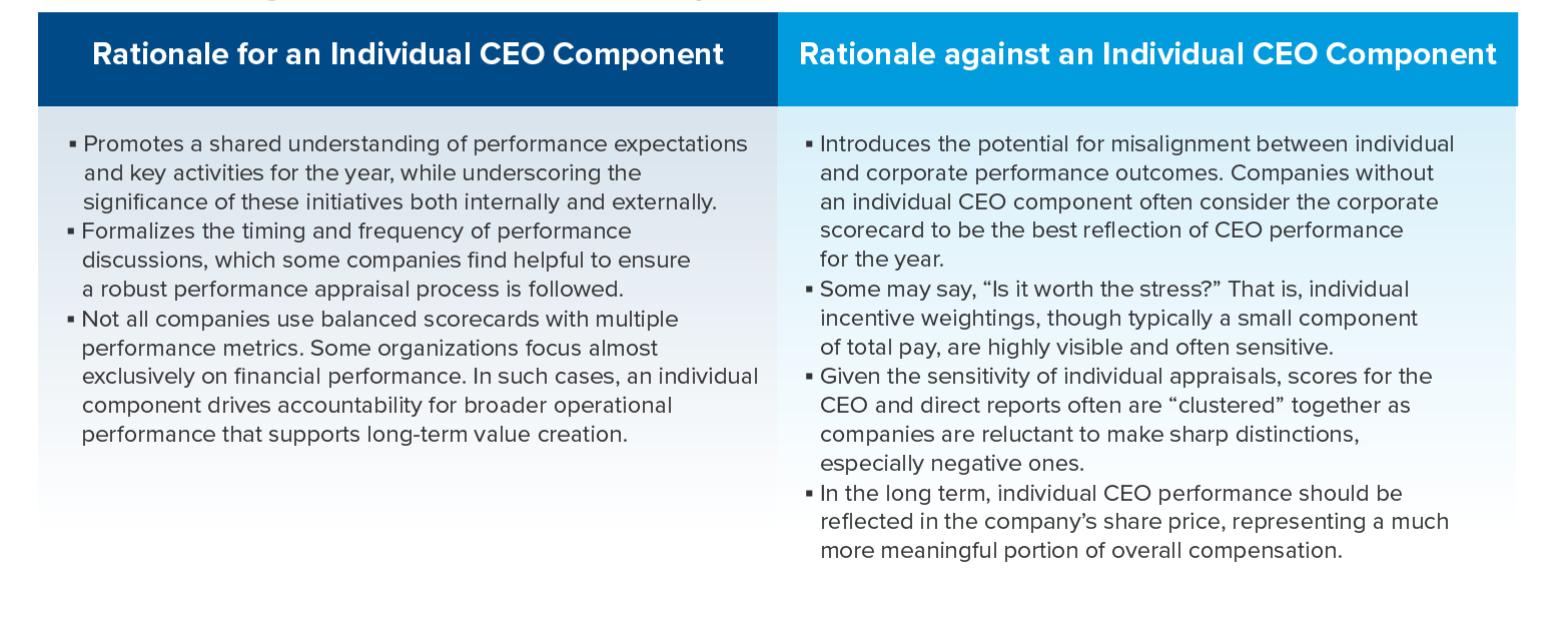

Although the use of individual components in annual incentive plans for CEOs is evenly split in North America, high-performing organizations typically possess well-defined CEO performance appraisal processes, fostering a shared understanding of performance expectations and outcomes.

Whether such CEO performance appraisals should be formalized in the annual bonus depends on how each company views the cases for and against. The following table provides some pros and cons.

The Importance of Individual Contributions

How should we interpret these results? Are CEOs being over-rewarded or evaluated less strictly than they should? We do not believe this is the case.

We believe the key question is whether a CEO’s personal contributions are accurately reflected in the annual incentive plan. Companies with bonus plans that focus mainly on financial performance and less on other metrics benefit from including an individual component that helps hold CEOs accountable for overall operational performance. In contrast, companies with a more balanced annual scorecard gain less from an individual component.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: