For WorldatWork Members

- 2025-2026 Salary Budget Survey, research

- Bonus Programs & Practices, research

- A Step-by-Step Guide to Employing Modular, Hyper-Personalized Comp, Workspan Daily Plus+ article

- Handling Pushback: How Comp Pros Can Address Management Objections, Workspan Magazine article

- Compensation: KPIs and Business Formulas, tool

For Everyone

- Are ‘Modular’ and ‘Hyper-Personalized’ the Future of Compensation? Workspan Daily article

- Employees Seek More Personalized Total Rewards Packages, Workspan Daily article

- With a Multigenerational Workforce, Personalized Rewards Are Key, Workspan Daily article

- Essentials of Compensation Management, course

- Total Rewards ’25 On-Demand Highlights, virtual conference

Total rewards professionals might pick up a few unexpected tips from their local movie theater to help balance the motivations of employees and business units that provide consistent, reliable value with those that strive for innovation and risk-taking.

When Hollywood studios plan their calendar- or fiscal-year film slate, they typically consider “blockbusters” that provide generally reliable returns with “indies” that bring risk but also innovation and the potential for outsized returns.

Much like film studios, successful organizations all have a unique blend of “indie” employees who drive innovation, such as those generally found in research and development (R&D) functions, and the “blockbuster” employees who produce more consistent outcomes, like those frequently found in operations and finance functions.

Designing pay programs for both types of employees can be a challenge. However, understanding and motivating your organization’s “blockbusters” and “indies,” and adjusting compensation components within the total rewards strategy accordingly, can increase the likelihood of long-term “box office” (i.e., shareholder) success.

Going back to the movie analogy, a mature studio like Warner Bros. may release some blockbusters with reliable audiences (e.g., “Minecraft,” “Superman”) and some indies (e.g., “Mickey 17,” “Sinners”). Similarly, mature organizations can afford to fund innovation while maintaining strong performance through more mature business units. In contrast, a newer studio, like A24, might focus first on more creative, risky films (e.g., “Everything Everywhere All at Once,” “Materialists”) before growing the capital and audience familiarity necessary to fund their own blockbusters — much like earlier-stage organizations or high-growth business units.

Reading the Scripts — Evaluating Your Talent Mix

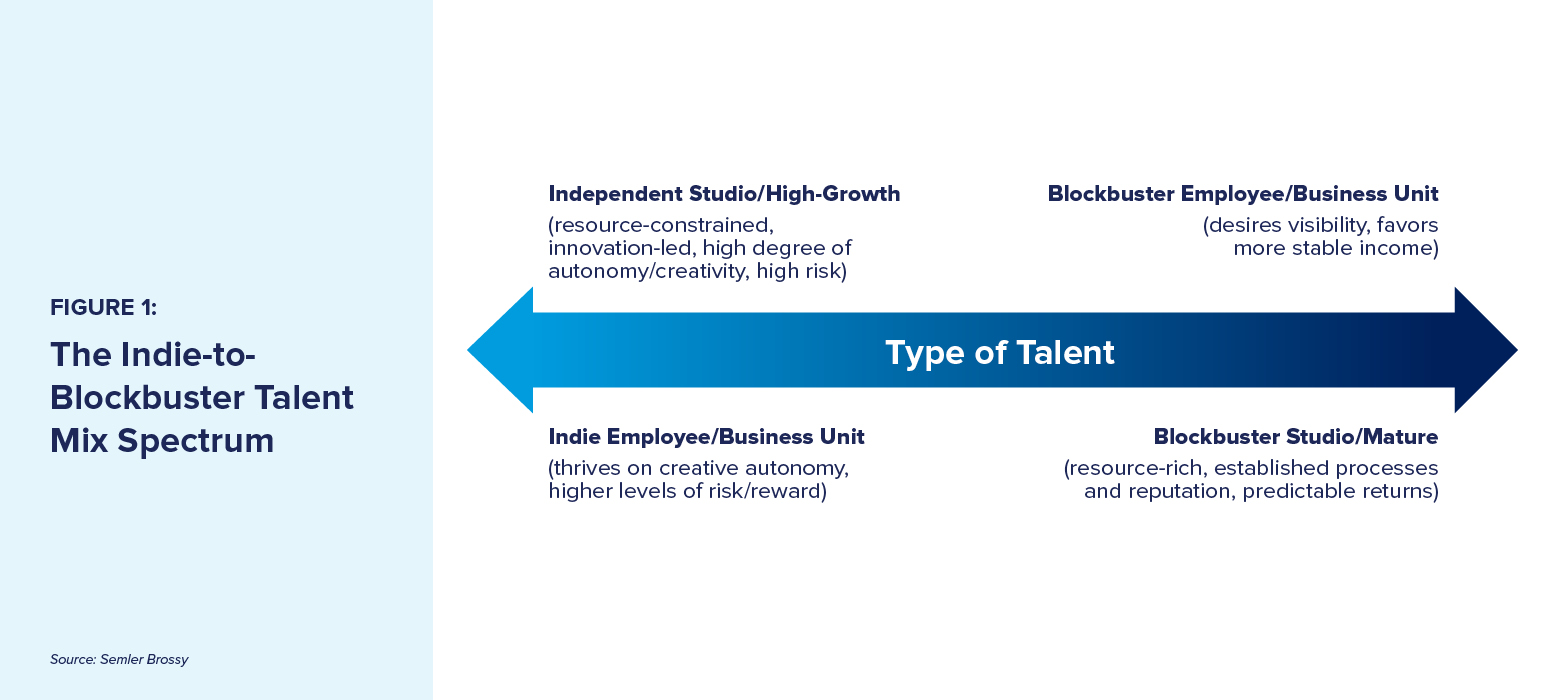

The first step toward designing and differentiating compensation programs is understanding what types of talent you want to incentivize and where they are situated (see figure below). Otherwise said: Which areas of the business house your reliable “blockbusters” and which house your adventurous “indies?”

Organizations rarely fit into one category and likely have individual business units, and representative employee groups, across the spectrum. To make sense of where their unique talent needs lie, compensation committees may first ask:

- Is the prevailing culture more “indie” or “blockbuster?” For example, a newly public organization may have more “indie” employees left over from their high-risk, high-reward startup days.

- Is a new talent culture necessary to reach long-term corporate goals? If the long-term objective is to develop a new product or move into a new market, it may be time to seek out indie talent. Conversely, a maturing organization may start to bring in steadier hands that provide more structure.

- Are there talent attraction or attrition issues that may stem from a mismatch between motivation and compensation? For example, an organization with a carried interest program may struggle to retain reliable, blockbuster employees, since the pay is very much at risk.

- Which business units prioritize stability, and which crave creative leeway? One-size-fits-all approaches may not bring out the best in everyone. Consider an e-commerce company that needs engineering and retail talent. Engineers, especially those from the tech sector, often expect heavier equity compensation than, say, those from the retail world.

Different Talent Types May Desire Different Pay Structures

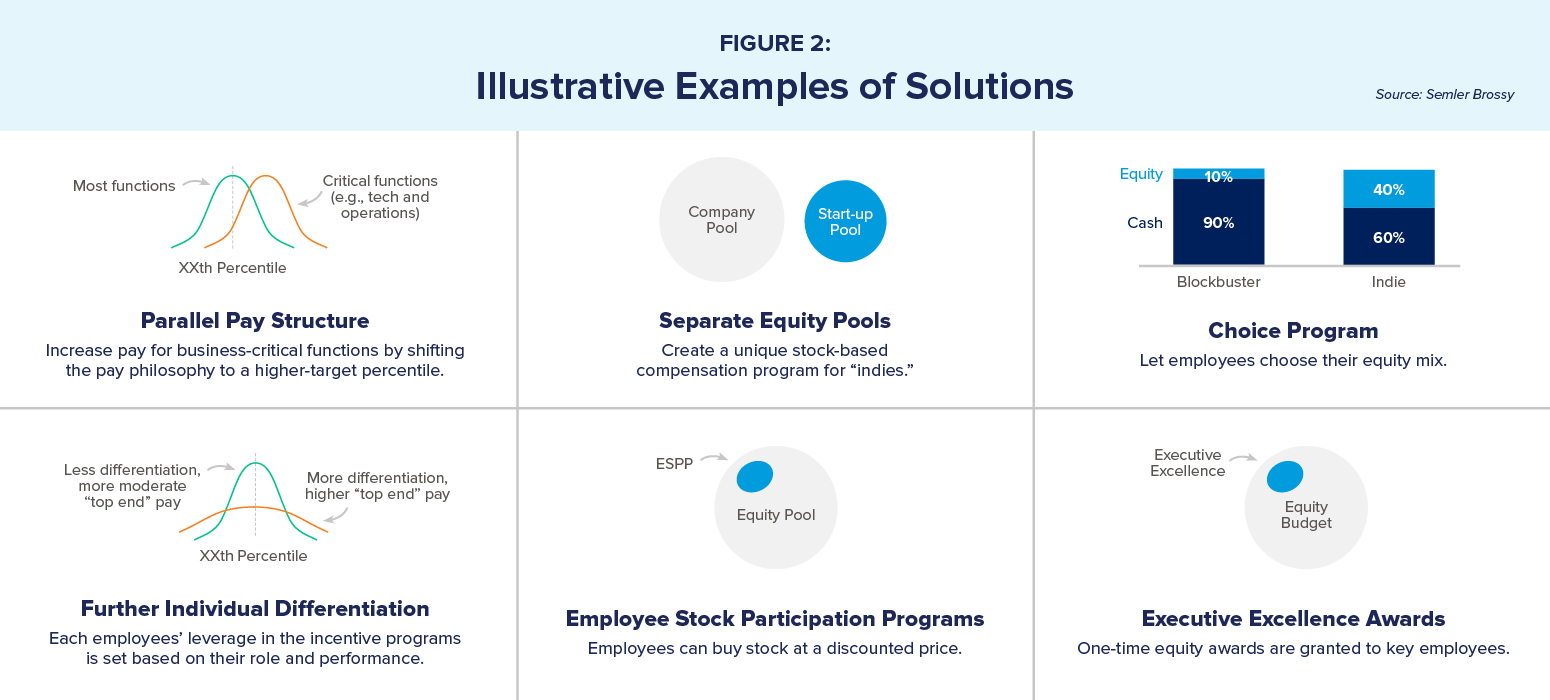

Total rewards teams use various tools, including direct and indirect solutions, to attract, motivate and retain both types of employees (see figure below).

Direct Solutions

Direct solutions are typically used in more urgent, acute situations (i.e., high attrition, recruiting challenges) and are viewed as more temporary in nature.

|

Direct Solution |

Set-Up / Function |

Purposes and Considerations |

Example |

|

Parallel Pay Increasing pay for business-critical functions by shifting the pay philosophy to a higher-target percentile |

Identify groups (“blockbusters”) where premium pay positioning philosophies for cash compensation levels are critical. |

|

A high-growth tech company competes in a “hot” talent market. It adopts parallel pay structures to provide greater upside for key target roles without changing the pay structure for the broader organization. |

|

Separate Equity Pools Creating a unique stock-based compensation program for “indies” |

Carve out a portion of a mature business that functions, and is rewarded, more like a startup to attract the “indies.” |

|

A legacy tech company operates a high-growth, proof-of-concept business unit. To attract the necessary talent, the compensation programs align with smaller, startup peers. |

|

Choice Program Letting employees choose the equity mix |

By allowing bespoke cash-to-equity mixes, plans may be tailored to both “blockbusters” and “indies.” |

|

Netflix, a tech company at the intersection of multiple industries, allowed employees to choose their cash-to-equity mix, catering to both entertainment and tech backgrounds. |

Indirect Solutions

Indirect solutions are more sustainable but offer limited differentiation, which can reduce motivation for individuals at the more extreme ends of the risk/reward spectrum.

|

Indirect Solution |

Set-Up / Function |

Purposes and Considerations |

Example |

|

Employee Stock Participation Program (ESPP) Employees can buy stock at a discounted price |

Gives “indies” the opportunity to invest in the potential upside while enabling “blockbusters” to retain cash. |

|

Large organizations with a wide range of talent profiles (e.g., a global banking company) offer some level of risk/reward autonomy while retaining a more simplified overall compensation plan. |

|

Further Individual Differentiation Each employee’s leverage in the incentive program(s) is set based on their role and performance |

Allows for greater flexibility to retain top and critical talent across both “indies” and “blockbusters.” |

|

A small fintech company that wants to compete with top-tier tech companies for key talent provides top-of-market equity grants. |

|

Executive Excellence Awards One-time equity awards granted to key employees |

Equity is pulled from a pre-determined pool at the beginning of the fiscal year (<5% of the equity budget); it can be used to reward either “indies” or “blockbusters.” |

|

After a company achieved a key strategic milestone, it rewarded key individuals. |

Rolling Out the Red Carpet

In Hollywood, the dichotomy between “blockbuster” and “indie” films is not quite as clear-cut as stated, and employees will not typically be boxed into one category, either. Organizations must first diagnose their talent, then apply appropriate compensation levers to incentivize the respective risk/reward profiles. This can help to determine if the appropriate talent is available to help “write” the organization’s success story.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics:

#1 Total Rewards & Comp Newsletter

Subscribe to Workspan Weekly and always get the latest news on compensation and Total Rewards delivered directly to you. Never miss another update on the newest regulations, court decisions, state laws and trends in the field.