- New guidance from the SEC. The SEC released additional guidance on its new pay versus performance rules in the form of compliance and disclosure interpretations that provide needed clarification on the various requirements for companies in upcoming proxy filings.

- Peer group measure clarified. The SEC said the peer group in the pay-versus-performance (PVP) Table could include any peer group from the compensation disclosure and analysis (CD&A), not just a peer group used for benchmarking. For example, some companies may use a relative total shareholder return (rTSR) measure to drive long-term incentive payouts. The SEC said this kind of “performance” peer group could be used in the PVP Table.

- Company selected measure. The company selected measure requirement may now include relative TSR, earnings per share (EPS) and other measures derived from net income and TSR, which are already included in the table. However, it may not include stock price unless stock price itself is used as an incentive metric to drive outcomes.

- Guidance on CAP is lacking. Analysts note that the SEC guidance lacked some specifics that were needed to calculate compensation actually paid (CAP) as well as the footnote disclosure that must accompany the reconciliation.

- Late on guidance. The SEC’s guidance, while quite helpful for certain companies, comes a bit too late for others, as proxy season is already underway. Those in the throes of the work, pressing up against their respective filing deadlines will need to act quickly to ensure this new guidance is incorporated.

The Securities and Exchange Commission (SEC) released additional guidance on Feb. 10 to the new pay-versus-performance disclosure rules, which sheds additional light on how organizations should proceed with the executive compensation reporting requirements.

The new guidance provides some much-needed points of clarification for companies, analysts note, but falls short in spelling out how to address the nuances of the most arduous part of the disclosure — computing compensation actually paid (CAP).

Read: The Road Ahead: Preparing to Disclose

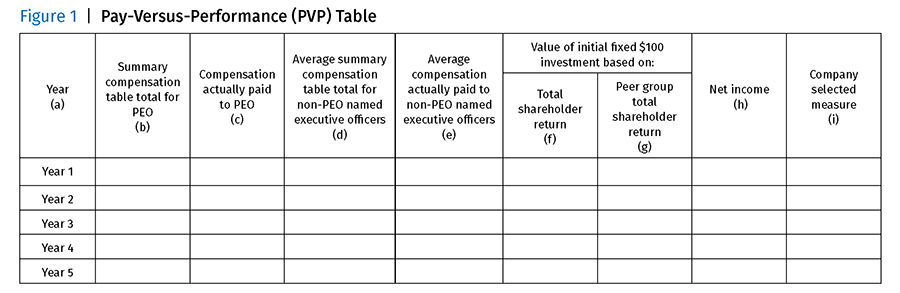

For background, under the new rules, U.S. public companies must provide a new table in their annual proxy filings that contains executive compensation and financial performance measures covering a period of up to five years. Companies must file the new pay-versus-performance information for fiscal years 2020 through 2022 beginning this year.

Under the new rules, companies must provide, in proxy or information statements in which executive compensation disclosure is required. Those statements must be included in a new pay-versus-performance (PVP) table disclosing specified compensation and financial performance measures for the named executive officers (NEOs).

The PVP table must include the total compensation as presented in the Summary Compensation Table (SCT) and compensation actually paid for the principal executive officer (PEO) — and, as an average, for the other non-PEO NEOs.

Deborah Lifshey, managing director at executive compensation consultancy Pearl Meyer, outlined the key areas where the SEC provided clarification:

- Peer groups. The peer group in the PVP Table could include any peer group from the compensation disclosure and analysis (CD&A), not just a peer group used for benchmarking. For example, some companies may use a relative total shareholder return (rTSR) measure to drive long-term incentive (LTI) payouts. The SEC said this kind of “performance” peer group could be used in the PVP Table.

- Company selected measure. The company-selected measure (CSM) requirement may now include rTSR, earnings per share (EPS), and other measures derived from net income and TSR, which are already included in the table. However, it may not include stock price unless stock price itself is used as an incentive metric to drive outcomes.

- Most important measure from prior year. The company-selected measure must be the most important measure used in the immediate prior year. It cannot be a multi-year measure. This has raised complications for many companies that rely on multi-year metrics to drive a large portion of their pay package for executives.

- Aggregation is allowed. Compensation of multiple CEOs in one year may be aggregated for purposes of the graphical or narrative relationship disclosure.

- Accounting for awards granted. Awards granted to senior leaders before they became NEOs must be counted when computing fair value.

Executive compensation consultancy FW Cook noted that an area of uncertainty for companies has been how to detail compensation actually paid (CAP), including the extent to which footnotes in the PVP table should be utilized and how.

“The compliance and disclosure interpretations (CDI) by the SEC indicates that the footnote disclosure to the PVP table must be done on an item-by-item basis, tracking to the regulatory language, and not the aggregate,” FW Cook’s blog details. “Companies will need to show up to six categories of equity adjustments (fair value at end of year of awards granted during year, change in fair value of awards granted before the year that are outstanding and unvested at end of year, etc.).”

Lifshey said calculating CAP has been the most arduous part of the disclosure in year one. She thinks the recent guidance failed to adequately address this critical component.

“Unfortunately, the SEC guidance lacked some specifics that were needed to do these valuations as well as the footnote disclosure that must accompany the reconciliation,” Lifshey said. “For example, clarification was needed as to how to account for dividends as well as awards that accelerate upon retirement.”

To the latter point, Lifshey said that while the guidance suggested that aggregating reconciliation was not permissible, it remains unclear how granular the reconciliation from the summary compensation table to compensation actually paid must be.

Thus, she said, the question remains as to whether this should be broken down by awards, tranches or other factors.

FW Cook found the multi-year restriction on the CSM to be surprising, noting that it could lead to some unexpected results in cases where the CSM is a metric in LTI plans.

“For many companies, the LTI plan metric tied to the greatest proportion of total direct compensation in any given year and from our experience to date, LTI metrics are significant contenders for the CSM,” it said in the blog. “Further, it is very common, and considered to be a strong pay practice, to measure performance over three years for purposes of LTI awards.”

The SEC’s guidance, which can be quite helpful for certain companies, comes a bit too late for others, as proxy season is already underway. Organizations in the throes of the work, pressing up against their respective filing deadlines, will need to act quickly to ensure this new guidance is incorporated into their proxy statement.

“The timing of this guidance at the beginning of proxy season presents a challenge as companies have had to forge ahead in the past few months and already made decisions with respect to the form and content of their PVP disclosures,” FW Cook said. “These decisions will now need to be revisited in many cases.”

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: