For WorldatWork Members

- Compensation Structure Policies and Practices, research

- Compensation Committee Toolkit, tool

- How to Navigate Tariff Uncertainty with a Responsive Sales Comp Strategy, Workspan Magazine article

- Emphasize the Value of Total Rewards During Economic Uncertainty, Workspan Daily Plus+ article

For Everyone

- How CEO Pay Trends Reflect a Changing Performance Landscape, Workspan Daily article

- Should Your CEO Incentive Payouts Follow a Bell-Shaped Curve? Workspan Daily article

- Consider Performance Targets for Setting Executive Incentive Goals, Workspan Daily article

- Executive Pay in the Pressure Cooker: Policy, Politics and Performance Collide, webinar

In recent years, organizations have faced unprecedented challenges (e.g., COVID-19, workplace model changes, talent shortages, emerging technologies). This year, disruption is in the form of U.S. federal policy shifts.

To understand how organizations are responding in real time to American policy shifts, WTW conducted a series of three 48-hour pulse surveys of its North American clients in March and April. The first survey had more than 90 participants, the second had more than 100 and the third had more than 200. The vast majority of responding organizations (90%) were U.S.-based and collectively represented a wide range of industries.

This article shares some salient insights on compensation and talent management from this research.

Economic Impact and Organizations’ Responses

Most surveyed organizations indicated they are preparing for economic impacts because of new tariffs and policy shifts. Seventy-two percent of respondents said they expect at least some negative effects on their financial conditions, including increased operational costs and supply-chain disruptions.

Industries that rely heavily on global trade (e.g., manufacturing, retail, agriculture) are particularly vulnerable to these impacts. Survey participants indicated their organizations are looking for ways to prioritize meeting workforce needs while maintaining a disciplined operational approach in a time of uncertainty.

Compensation Strategies

Organizations are re-evaluating their compensation strategies to navigate economic uncertainty. According to the results:

Executive Compensation

Twenty-one percent of responding organizations already have implemented changes to their executive pay programs, and 25% are considering further modifications. These changes have the potential to reduce payout volatility, including shifting toward more fixed compensation (i.e., derisking the program), widening performance-goal ranges, revising long-term incentive metrics and shortening long-term performance periods.

In-Flight Incentive Plans

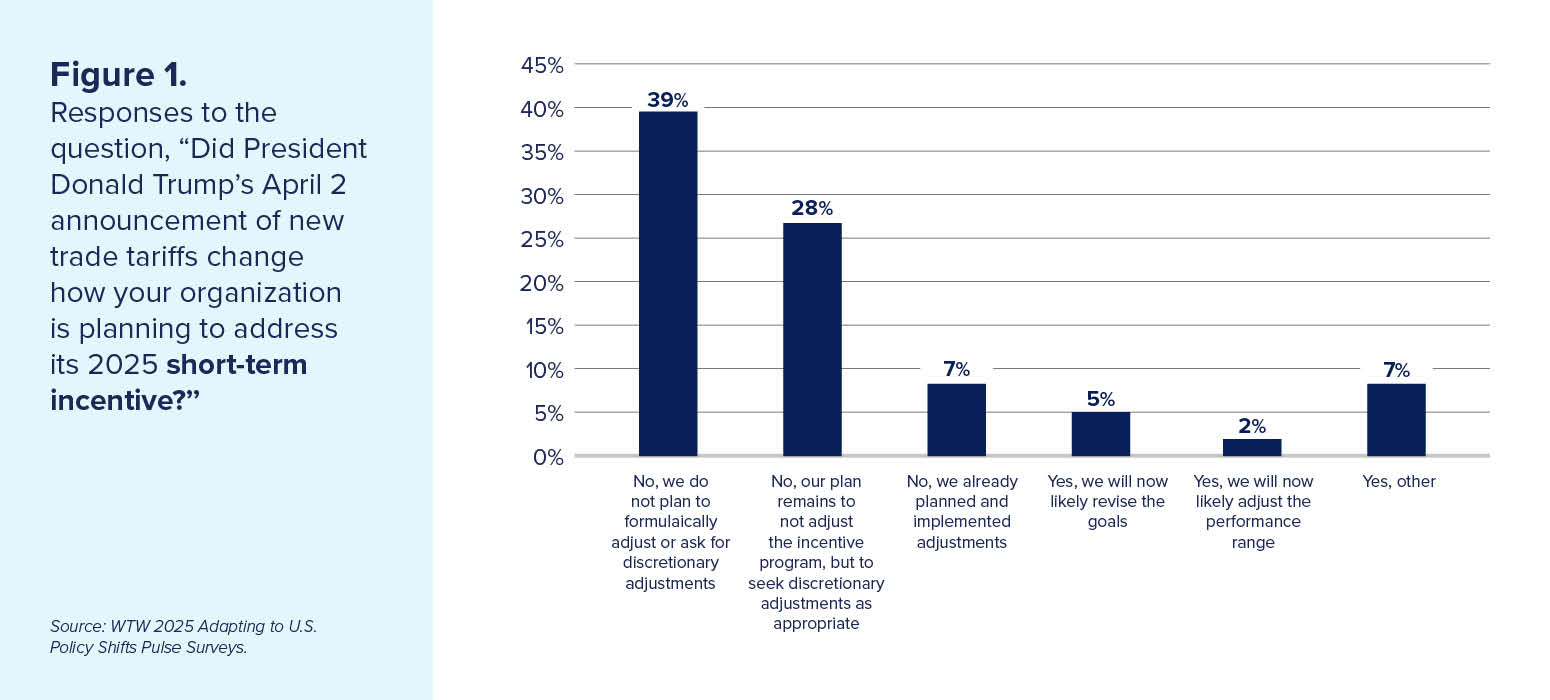

The research provided detailed insights into how tariffs and policy changes are affecting in-flight incentive plans and goalsetting. Most respondents indicated no plans to modify their short-term incentive plans or to seek discretionary adjustments (see Figure 1).

Thirty-five percent of respondents said they are considering discretionary adjustment at the end of the performance period or already have made changes; 14% intend to make changes, such as revising goals or adjusting performance ranges.

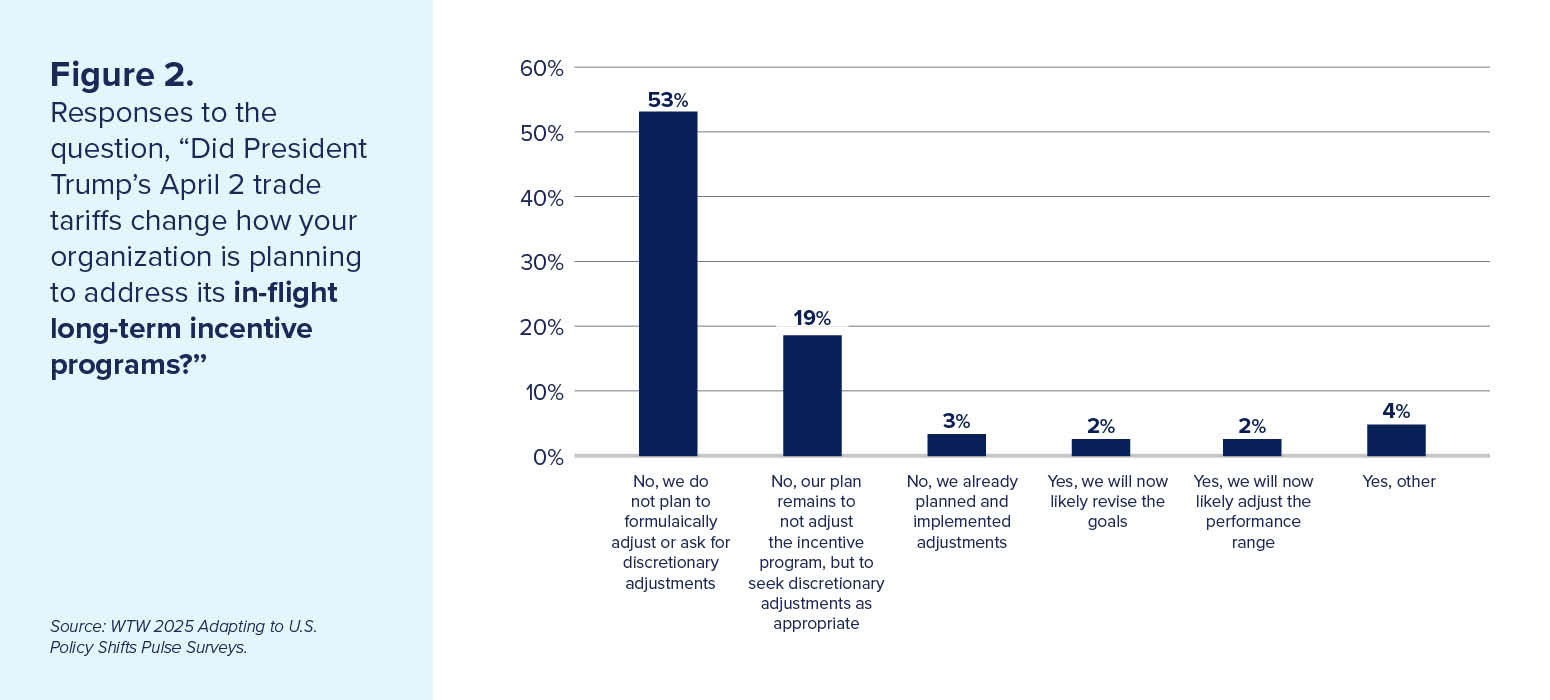

Organizations reported being less likely to modify their long-term incentive (LTI) plans or seek discretionary adjustments (Figure 2). Nineteen percent are considering discretionary adjustments at the end of the performance period.

Talent Management

Organizations are adopting several key strategies to manage their workforce effectively amid policy shifts. Many organizations spent several years after the COVID-19 pandemic managing elevated turnover and challenges in attracting talent. Today, the data suggests organizations are prioritizing investments in their existing workforce. Avenues to further this include the following:

- Upskilling and development. More than half of respondents are focusing on skill building and development as a means for career advancement. Additionally, 57% of employers are prioritizing better defining career paths and development opportunities.

- Use of the existing workforce. Fifty-five percent of respondents are strengthening workforce planning to better leverage existing employees. They also are considering alternative ways of getting work done without additional headcount. Enhancing focus on succession planning is a priority for 43% of organizations.

- Focus on employee well-being. Revising or enhancing well-being programs is a focus for 34% of respondents.

- Total rewards spend. Twenty-eight percent of organizations said they are rebalancing their total rewards spend by eliminating underutilized or underappreciated programs.

- Rewarding top talent. While most organizations are not overhauling their performance management systems, 20% plan to emphasize rewarding top performers more via differentiated incentive payouts. This may reflect that many employers continue to face challenges in retaining top talent, even as rates of voluntary turnover continue to decrease.

Next Steps for Leadership Groups

The research showed significant implications for HR leaders as well as boards and compensation committees. This section lays out some of these outcomes and what these groups can do about it.

HR Leaders

HR leaders should prioritize clear communication with employees about the organization’s financial health as well as any compensation program changes. Clear internal communications likely will help give employees clarity and faith in the business — and help prevent uncertainty-related turnover.

While there is an inclination to assume labor market dynamics could shift, current actions being taken by organizations to invest in and leverage existing staff — plus low indications of planned reductions in force — suggest the competitive labor market is here to stay.

Boards and Compensation Committees

Most organizations are taking a wait-and-see approach rather than making changes to executive compensation — particularly given the general expectation that policy changes and related uncertainty and volatility will continue in the near term. As compensation committees and boards of directors consider the current environment and how to respond, they should consider these guidelines:

- Focus on the business. Now is likely the time to ensure management is proactively managing through the uncertain and fluid environment to remediate underlying issues, ensure organization stability, and mitigate business and people risk.

- Understand the impact. In the second half of 2025, compensation committees should look to management to provide transparency on impacts to bonuses from policy changes and economic conditions.

- Determine the adjustment, if any. With visibility into the entirety of the performance cycle, in late 2025 and early 2026, compensation committees should approve incentive-plan payouts and any discretionary adjustments.

- Be planful for 2026. Review and thoughtfully consider 2026 incentive-plan design — including pay mix, metrics, targets and performance ranges — and adjust based on the current environment and what you’re learning in 2025. For example, should potential adjustments for tariffs be incorporated into the 2026 plan design?

The overall results of these pulse surveys reflect that compensation and talent challenges will persist. When organizations navigated a global pandemic, there likely was hope that a period of respite was coming. However, a highly competitive labor market, changes to the way organizations work and changing employee expectations continue to present challenges for employers.

Today, organizations face the ripple effects of tariffs and policy changes. Through all of this, one thing remains clear: Compensation and HR leaders likely need to stay on top of the latest design trends and insights to remain competitive employers and pursue business success.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: