- Greater scope of responsibilities. Compensation committees are expanding their role in human capital management matters, including building and sustaining an inclusive, diverse workforce and strengthening engagement and productivity.

- Beyond executive compensation. WTW analysis finds that compensation committee oversight now includes instituting and maintaining global HCM concerns.

- Addressing company culture. Another growing area of responsibility among compensation committees is culture, relations and engagement. There was a 26% jump between 2019 and 2022 in compensation committees adding these responsibilities, attesting to the growing need to address changes in a post-pandemic workforce.

- Recognizing employee value. Companies are realizing that their people are their best asset and the key to attaining goals as they work to positively influence society, create value and improve long-term business performance.

Human capital management (HCM) turns the traditional administrative tasks, such as recruitment, training, performance management and compensation, into opportunities to boost productivity, employee engagement and business value. To stay on top of HCM matters, compensation committees are increasingly broadening their scope to address:

- Building and sustaining an inclusive and diverse workforce.

- Focusing on leadership succession, preparing for transitions beyond just top-level executives.

- Executing business strategy by acquiring and keeping key talent.

- Strengthening workforce engagement and productivity.

- Establishing a strong and healthy corporate culture.

Recent world events — including the COVID-19 pandemic, investor focus on environmental, social and governance issues (ESG), and the great resignation — have intensified the demands and responsibilities of boards and committees, leading more compensation committees to add or take on even greater HCM roles.

WTW research on S&P 500 companies corroborate these anecdotal observations and provide further insights into HCM developments at the board and committee level since we first reviewed this issue in 2019.

In 2022, we can confirm the continuing changes both in name and responsibility of traditional board compensation committees. These changes reflect the current ESG climate with an HCM focus both in and out of the boardroom. The most recent study of S&P 500 companies’ charters and committee names conducted by WTW’s Global Executive Compensation Analysis Team revealed some noteworthy results.

Within S&P 500 compensation committee names:

- Nearly 50% of the S&P 500 (242 companies) now refer to the committee responsible for executive compensation oversight as something beyond just the compensation committee. This is a 10-percentage-point increase from our 2019 study findings.

- Companies are changing compensation committee names to reflect broader responsibilities at a faster clip. Fifty-four companies changed the name of their compensation committee to reflect broader duties, compared to the 45 changes over the previous decade observed during our 2019 review.

- Of the 54 companies that changed the name of their compensation committee between 2022 and 2021, 44% (24 companies) added “human capital.”

Within S&P 100 compensation committee charter reviews:

- Only seven committees’ charters do not name any HCM oversight responsibilities.

- Over 75% of the companies require committees to maintain oversight of broad-based compensation programs and benefits.

- In addition to overseeing broad-based compensation, nearly half (44%) of companies are responsible for broad-based recruitment, promotion, retention and turnover.

- 62% of companies have given the committee diversity and inclusion program oversight.

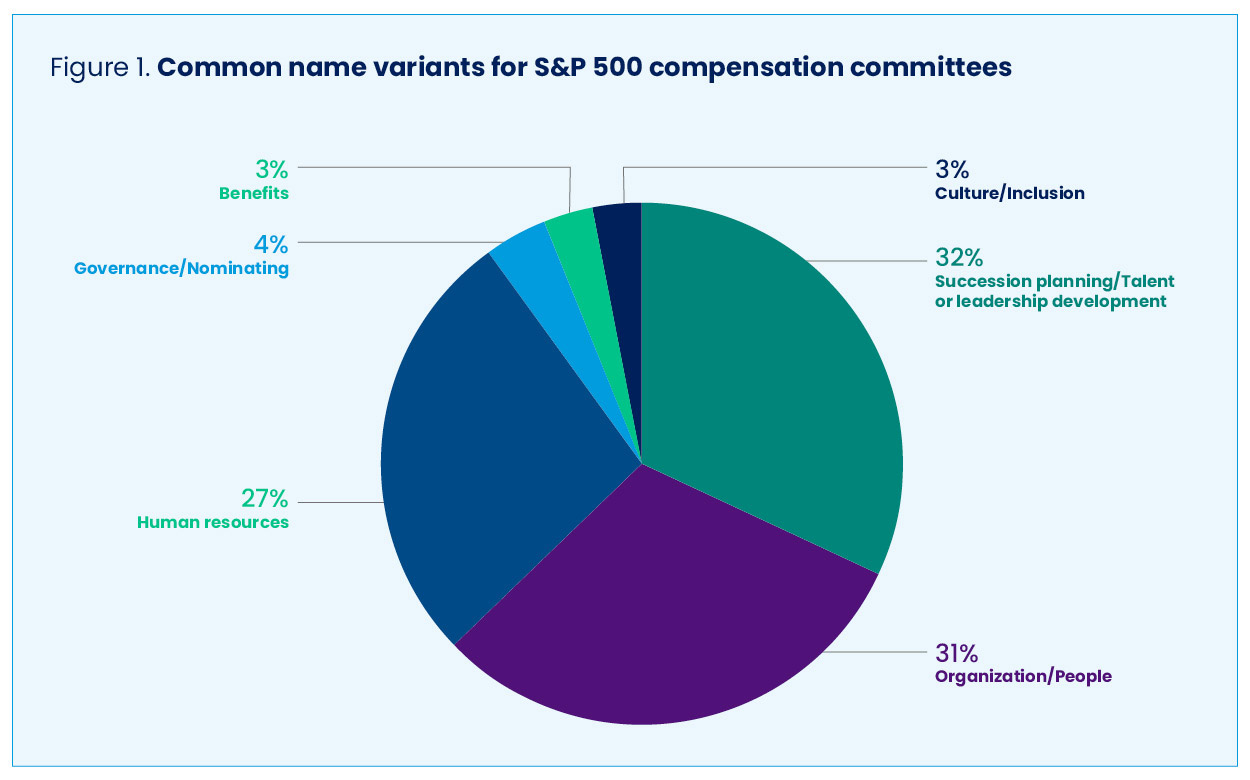

Increasingly, compensation committee oversight includes not only establishing and managing executive compensation matters but also instituting and maintaining global HCM concerns. Figure 1 provides a breakdown of the common compensation committee name variants used by S&P 500 companies.

Notes: Statistics are based on 242 S&P 500 companies with committee names other than “compensation committee” or “executive compensation committee.” Some boards do not have distinct compensation and governance committees. These boards typically combine compensation with governance/nominating, making “governance/nominating” a common name variant.

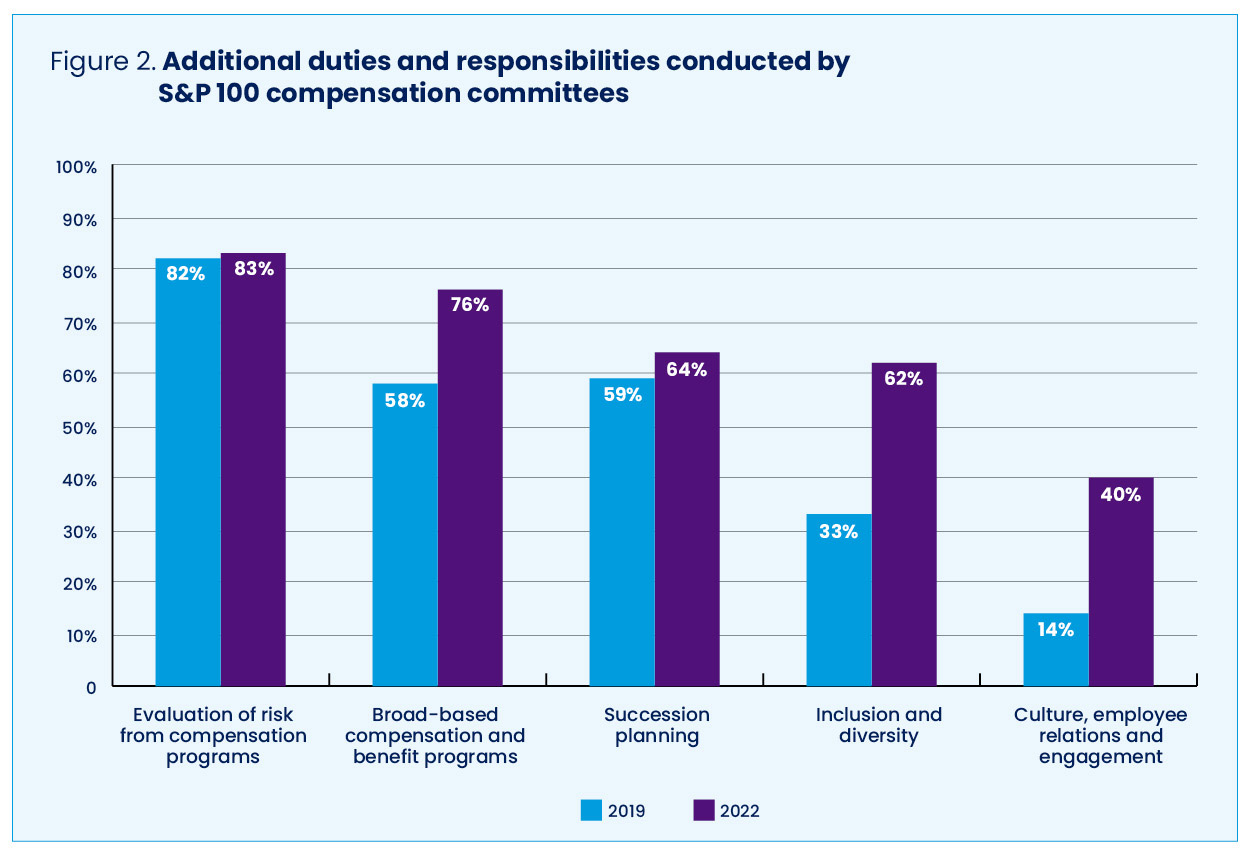

To determine whether these broader oversight responsibilities went beyond just committee names, WTW reviewed the current compensation committee charters of the 100 largest S&P 500 companies. Comparing 2019 with 2022, WTW found an increase in every topic we categorized in the first study, as shown in Figure 2.

Note: Statistics are based on a review of committee charters among the largest 100 S&P 500 companies as determined by revenue.

The Role of the Compensation Committee in Human Capital Governance

News-making events over the past four years have raised awareness of disparities across race/ethnicity, gender, class and other important social markers, leading companies to step up their efforts to combat these inequalities.

WTW analysis found that inclusion and diversity (I&D) remains topical; there was a 29-percentage-point increase (62% in 2022 vs. 33% in 2019) increase between 2019 and 2022 in compensation committees adding “inclusion and diversity” to their list of responsibilities.

Committees are not only reviewing programs and practices related to workforce I&D but also ensuring the equitable administration of compensation programs. Currently, 76% of companies include oversight of broad-based compensation and benefit programs compared with 58% in 2019.

Another growing area of responsibility among compensation committees is “culture, employee relations and engagement” (Figure 2). There was a 26% jump between 2019 and 2022 in compensation committees adding these responsibilities, attesting to the growing need to address changes in a post-pandemic workforce.

The sharp rise in employees working remotely may be COVID-19's most evident effect within the executive suite as well as among broad-based employees, leading to key questions like:

- How do we maintain the company’s culture or is there a need to modify it?

- Without day-to-day in-person interaction, how do we keep employees engaged?

- What’s the best way to create, manage and maintain a positive connection between management and the workforce?

More HCM-Related Issues

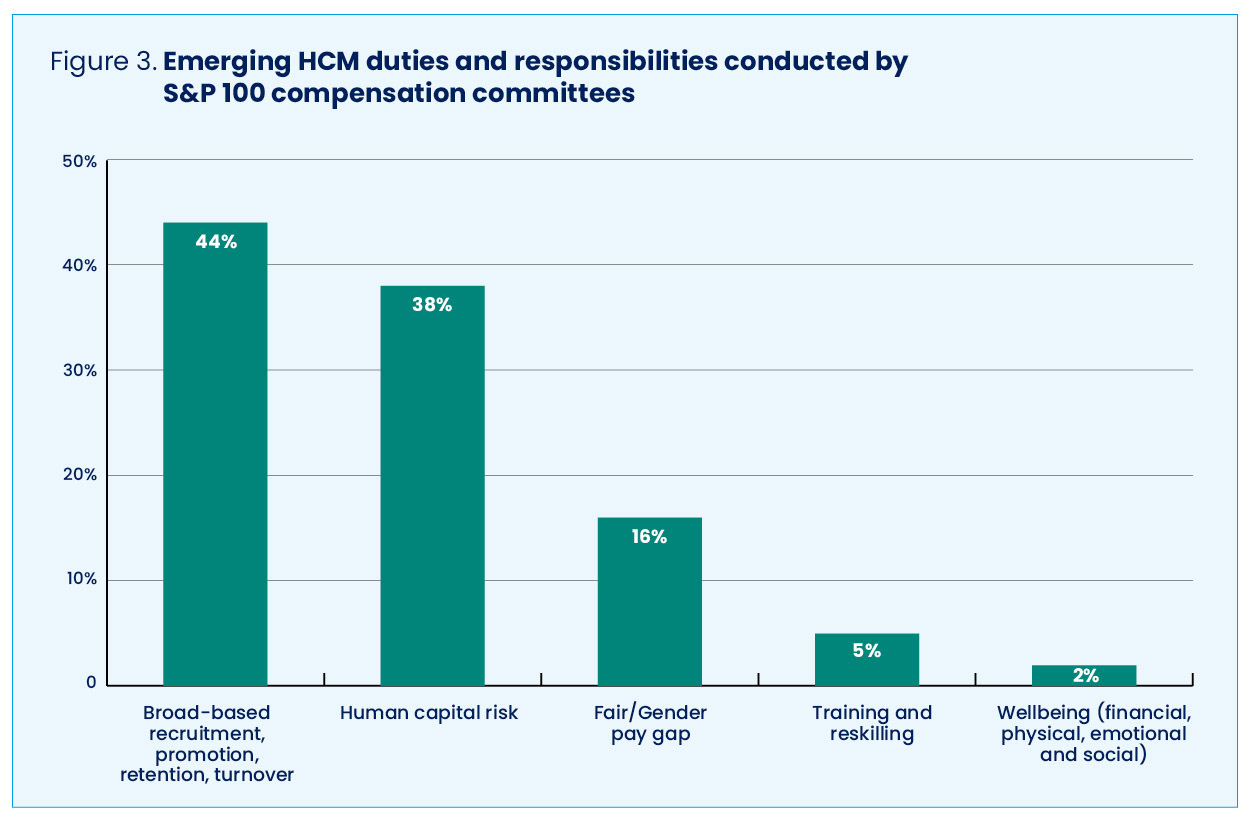

Compensation committees continue to oversee traditional matters of executive succession and evaluation of risk from compensation programs. But I&D and culture, employee relations and engagement matters have made their way into committees’ expanded scope of responsibilities. In WTW’s review, we noted new and more focused areas are being added to the committees’ oversight (Figure 3).

Note: Statistics are based on a review of committee charters among the largest 100 S&P 500 companies as determined by revenue.

Note: Statistics are based on a review of committee charters among the largest 100 S&P 500 companies as determined by revenue.

Although compensation committees’ incorporation of these matters is still relatively low, advocacy and questions from investors, employees, customers and regulators may be contributing factors that lead more compensation committees to include them.

Expanding outside HCM specifically and looking at ESG responsibilities more broadly, our 2022 review found that 14% of S&P 500 governance committee names included some aspect of ESG issues relating to corporate social responsibility, sustainability and the environment. In addition, 90 companies established at least one or more additional committees beyond the standard audit, compensation and governance committees to tackle the same ESG concerns.

Companies are realizing that their people are the best asset and are the key to attaining goals as they work to positively influence society, create value and improve long-term business performance.

As pressure from a variety of stakeholders continues to center on ESG issues, the functions and responsibilities of the board and its committees are deepening to include more aspects of human capital considerations.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: