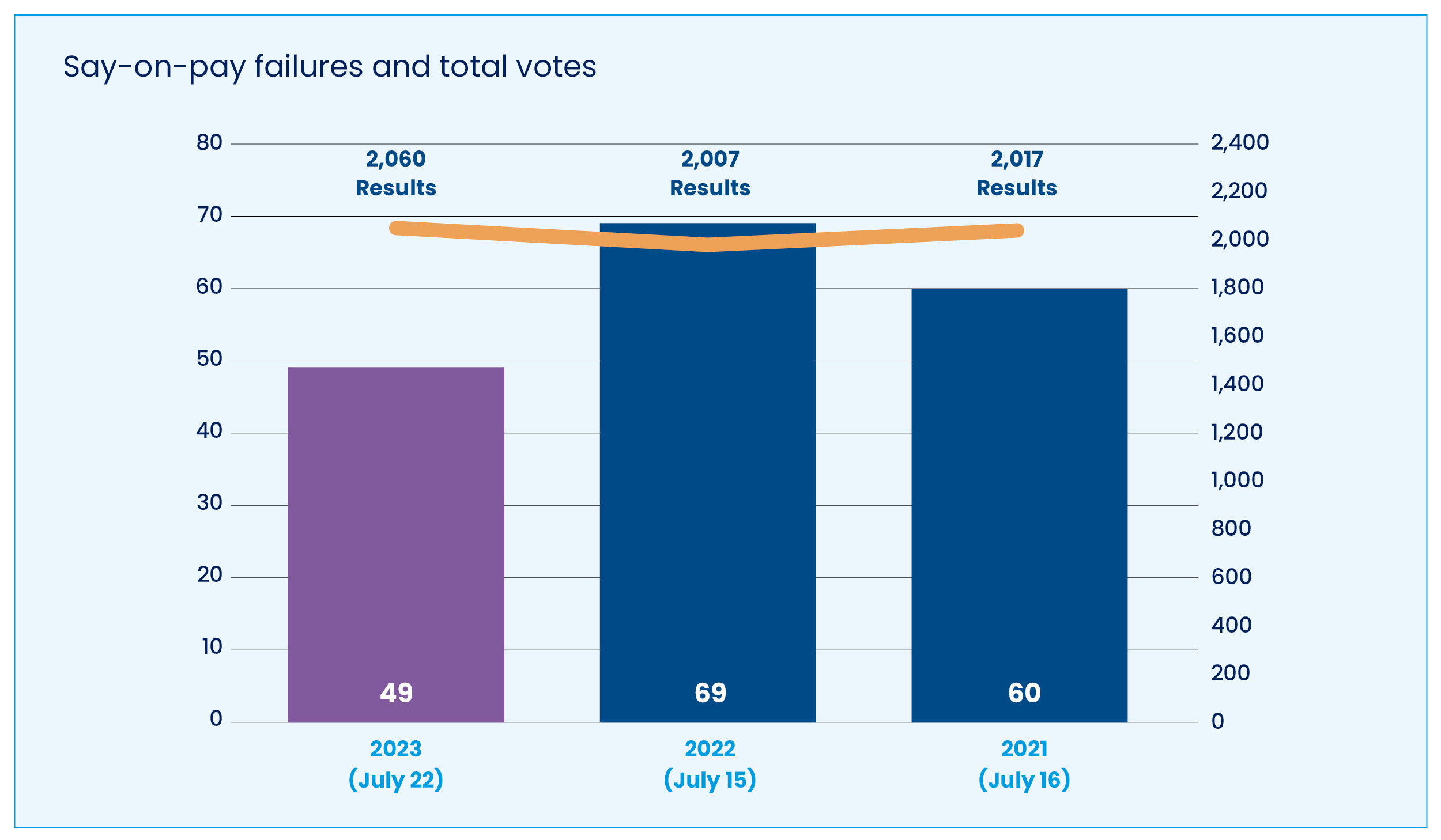

- Lower say-on-pay failures. There were 49 say-on-pay failures through mid-July, which is the lowest total at that time of year in the past three years.

- Proxy advisor concerns. Lack of performance attributes, poor disclosure and rigor of plan metrics are the key issues at companies with a negative recommendation and a high pay-for-performance concern.

- Looking ahead. Overall, the results of the 2023 SoP proxy season show that companies were met with enhanced scrutiny from investors, beyond even what the proxy advisers recommended. Moving into 2024, we expect that this trend might continue as share prices face ongoing uncertainty and volatility.

With the 2023 proxy season now in the rearview mirror, WTW’s post-season say-on-pay (SoP) research within the Russell 3000 indicates a shift from the recent norm.

Though shareholder support remained generally stable at 90% (compared to 89% in 2022 and 91% in 2021 at this time), results have improved in comparison to the past two years when it comes to failures and opposition. A summary of our main findings are below.

Say-on-Pay Failures

We observed 49 SoP failures during the proxy season through mid-July, which is the lowest total at this time for the past three years (69 failures in 2022 and 60 failures in 2021).

Proportionally, we have more repeat failures at this time, as only 63% are currently first-time failures compared to 70% in the last two years. Non-S&P 1500 companies now account for 53% of the total number of failures (33% in 2022 and 25% in 2021, at this time).

Further, we observe a significant decrease in the proportion of mid-cap failures, which are currently at 4%, down from 13% last year and 23% at this time in 2021.

Main Proxy Adviser Concerns

Lack of performance attributes, poor disclosure and rigor of plan metrics are the key issues at companies with a negative recommendation and a high pay-for-performance concern. For those companies that failed, rigor of incentive plan metrics and magnitude of pay are the main concerns. Regarding compensation committee members, lack of responsiveness to prior SoP concerns continues as the main issue for concern driving negative vote recommendations.

Low Opposition

Institutional Shareholder Services (ISS) opposition settled lower at 12% so far (compared to 14% in 2022 and 11% in 2021 at the same time). Shareholder support for negative recommendations is the highest in three years at 66%.

TSR and Pay Levels Correlation

Low total shareholder return (TSR) triggers the most shareholder opposition across all pay levels, as the highest opposition has generally been seen at companies with high pay and low performance. However, strong TSR performance when linked to mid/low pay seems to mitigate the opposition from investors.

Equity Plans

We have observed some headwinds for equity plan share requests. To date, we have observed one failure within the S&P 1500, similar to last year at this time (two failures at this time in 2021). However, ISS opposition is the highest at 17% compared to 13% at this time in 2022 and 2021. Support is currently at 89% compared to 91% at this time in 2022 and 2021.

Say-on-Parachute

Average support within the Russell 3000 is stable at 71% for say-on-parachute (SoG) proposals (compared to 70% in 2022 and 84% in 2021 at this time).

Currently, there are six failures (compared to eight failures in 2022 and four in 2021 at this time). ISS opposition is at 32% (compared to 47% in 2022 and 19% in 2021 at this time). We have recorded the lowest support for SoG with a negative recommendation for the past three years at 32% (compared to 47% in 2022 and 40% in 2021 at this time). The main concerns at SoG failures are: auto-accelerated equity; tax gross ups; performance awards vesting at maximum; and excessive cash payout.

Overall, the results of the 2023 SoP proxy season show that companies were met with enhanced scrutiny from investors, beyond even what the proxy advisers recommended. As we move into 2024, we expect that this trend might continue as share prices face ongoing uncertainty and volatility.

More than ever, shareholder engagement (both proactive and responsive) and clear, compelling and concise compensation, discussion and analysis (CD&A) disclosure will be paramount.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: