- Moderation is the trend. WorldatWork’s latest Salary Budget Survey shows 2024 increase budgets are lower than last year’s in almost every country, and 2025 budgets are expected to be the same or slightly lower in almost all countries.

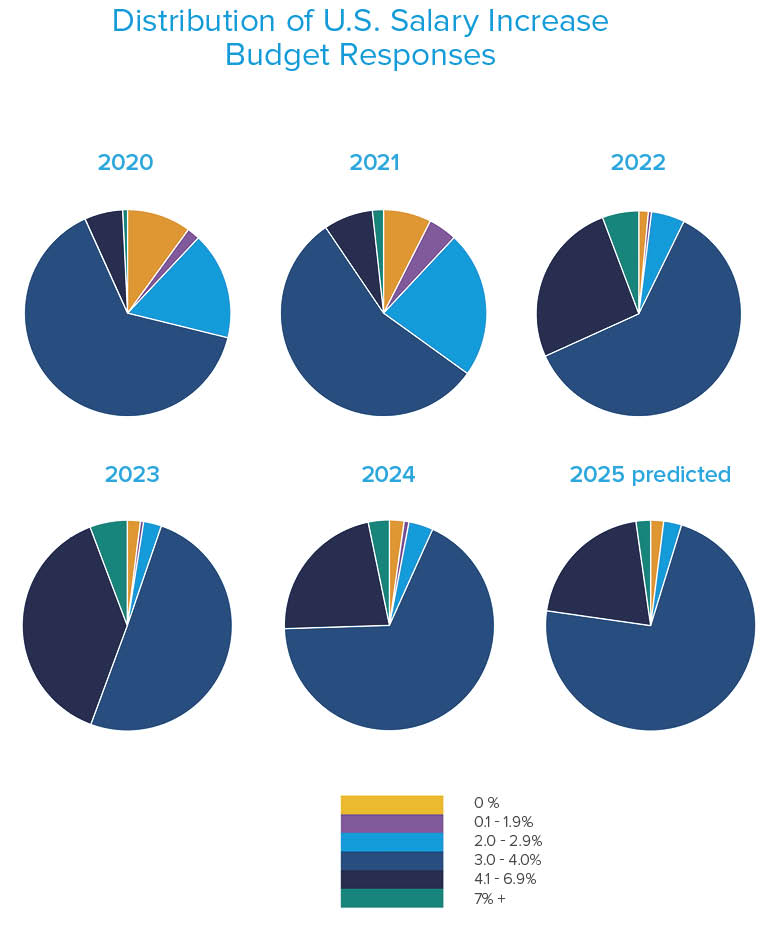

- Salary increase budgets are consolidating. In addition to a contracting salary increase budget, fewer organizations are reporting extremely high or extremely low budgets.

- Organizations budgeting for pay equity. Most organizations anticipate budgeting to allow for pay equity adjustments in 2025. Such adjustments may include maintaining internal equity and correcting unwarranted differences between different groups of workers.

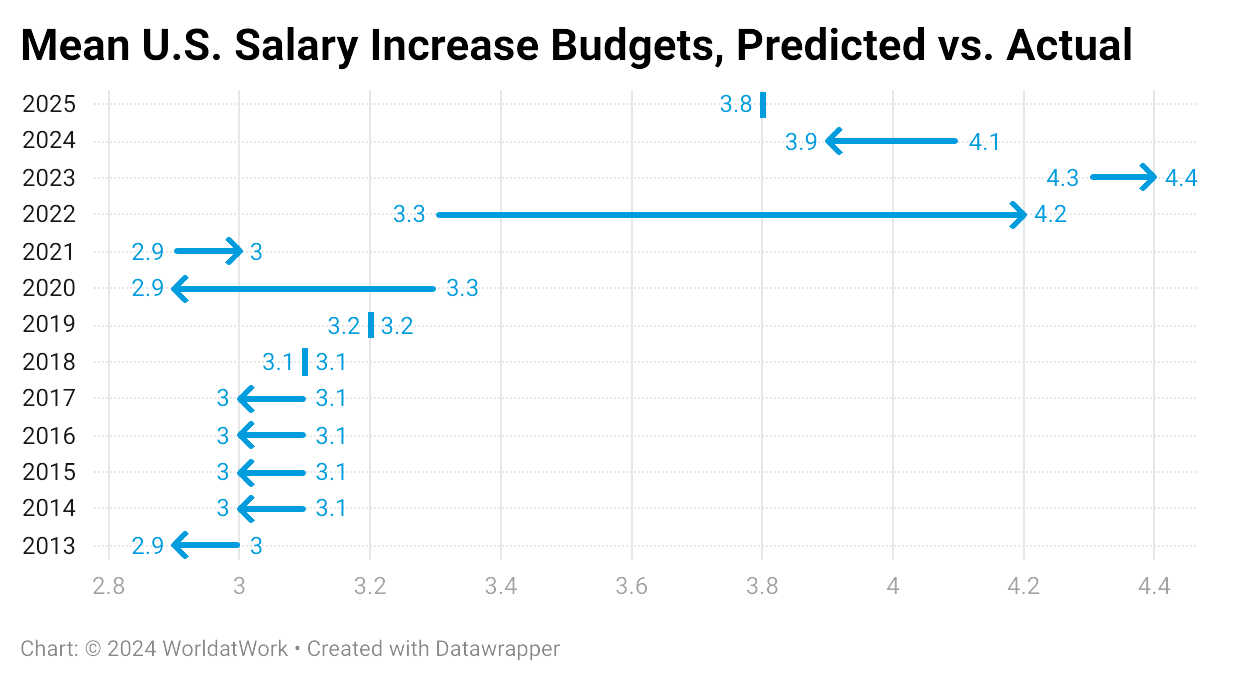

U.S. organizations are projecting mean salary increase budgets of 3.8% in 2025 to stay competitive in the labor market — a slight decrease over projections from the past two years and actual figures since 2022 and a trend that generally reflects what is occurring on a global scale. That’s according to WorldatWork’s 2024-2025 Salary Budget Survey of 2,249 participating organizations.

The new research also revealed 2024 actual mean salary increase budgets in the U.S. averaged 3.9%, a bit under the 4.1% increases employers projected for 2024 in the previous year’s survey.

Click here to access top-level results from WorldatWork’s 2024-2025 report. In addition, the full report — covering base salary increases and merit budgets for 22 countries and in-depth salary budget insights for the U.S., Canada, India and the United Kingdom — is available for purchase. Report purchase also provides access to the U.S./Canada Online Reporting Tool to build customized reports based on industry, organization size and/or geographic area.

Absent major disruptions, predicted and actual mean percentages in the U.S. tend to track closely over time, as seen in the figure below.

Turning Foresight into Strategy

Sue Holloway, a compensation content director at WorldatWork, said the U.S. results reflect a broader trend.

“As viewed through our research, most countries indeed saw a drop in 2024 salary increase budgets, often even greater than forecast,” she said. “Projections for 2025 suggest a continuing contraction of salary increase budgets is expected in 2025.”

Webinar: Dive into the Future: Salary Budget Planning for the Year Ahead

Holloway also stated that, even with variances between forecasts and actuals, survey participants displayed a keen awareness of the compensation landscape.

“This study revealed compensation professionals have a nuanced grasp of the factors impacting salary budgets,” she said. “They were able to foresee the decline in salary increase budgets that we’ve observed this year.”

She added survey feedback shows total rewards professionals are leveraging data and thinking strategically to formulate 2025 compensation budget recommendations and negotiate with their chief financial officers.

Taking a Wider View at Trends

WorldatWork’s 2025 U.S. salary increase budget projection displayed similar vantage points to projections released recently by WTW and Payscale. These findings suggest salary increase budgets are beginning to moderate. WorldatWork’s study found that, in addition to a lower overall mean, reported budgets are beginning to converge, with fewer organizations reporting extremely high or low values.

Moderating overall salary increase budgets and budget data clustering (see U.S. data in the figure below) are a global phenomenon in this study, although the overall increase budget levels vary between countries.

Globally, WorldatWork research found mean salary increase budgets for the senior-most leaders in organizations tended to be slightly smaller than those for other organizational employees.

“The complexity of executive compensation puts less focus on base salary and more on variable or incentive compensation, and salary increase budgets for executives tend to be a bit lower,” said Liz Supinski, director of research and insights at WorldatWork.

Additional global snapshots and storylines from the survey include:

- Country representation increased. The report includes data covering 22 countries. New in this year’s report are the Gulf Cooperation Council countries (Bahrain, Kuwait, Qatar, Oman, Saudi Arabia and the United Arab Emirates), South Africa, South Korea and Vietnam.

- Canadian projection is slightly lower. After correctly predicting 2024 salary increase budgets in Canada would average 3.8%, Canadian HR professionals anticipated a slight decline in 2025 to 3.7%.

- India shows continued strength. India organizations projected the largest 2025 average salary increase budget in the survey – 9.5%. This figure is a slight decrease from the 2024 projection and actual average of 9.6%.

- U.K. stays steady. Survey participants from the U.K. projected 4.2% average salary increase budgets for 2025, nearly in line with the 4.3% projection and actual figures for 2024.

- Japan projects biggest rise. Japanese HR pros projected a 3.8% average increase in 2025, vs. a 3.2% actual for 2024. The six-tenths of a percentage point positive difference was the largest between those figures among the represented countries.

- South Africa projects biggest decrease. South African respondents projected a 5.3% average increase in 2025, vs. a 6.1% actual for 2024. The eight-tenths of a percentage point negative difference was the largest between those figures among the represented countries.

How Organizations Are Approaching Promotional Increases

WorldatWork’s survey reported 56% of organizations budget for promotional pay increases, while 44% do not.

Of the organizations that do budget for promotional increases, the survey found 39% have separate promotional increase budgets, while 32% include them as part of their “other” increase budget, 24% have them as part of their merit increase budget and 5% allot them as part of their general increase/cost-of-living adjustment (COLA) budget.

Of the organizations that do not include promotional increases in their salary increase budgets, 50% fund the promotional pay increases via vacancy, salary or other savings; 21% pull it out of the merit increase budget; 17% pull it out of the “other” increase budget; and 6% take it out of the general increase/COLA budget (the remainder utilized additional options).

A Focus on Pay Equity

Across the U.S. — as well as in Canada, the U.K. and India — most surveyed organizations anticipate making salary adjustments in 2025 to remediate pay equity issues. These adjustments may include those required to maintain internal equity among employees and those needed to resolve unwarranted differences in pay between different groups of workers.

Underscoring the Importance of Data

The new WorldatWork survey reflected that total rewards professionals, in the U.S. and abroad, have much on their plates and their minds. While complexity is an inherent challenge for total rewards professionals, Supinski noted that the Salary Budget Survey and other data sources can prove helpful in strategy development and deployment.

“It’s critical to understand the complexity that underlies these high-level findings when you’re building your increase budget recommendations,” she said. “Whether it’s understanding regional or industry variations, or the impact of promotional increases on salary increase budgets, digging more deeply into the data will let you build a recommendation that is both competitive in the market and fiscally sound.”

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: