For WorldatWork Members

- A New Way to Evaluate Performance-Compensation Strategy, Journal of Total Rewards article

- Setting a Strategy, Workspan Magazine article

- Reimagining Rewards Strategies in the New Landscape of Work, Journal of Total Rewards article

- Compensation Philosophy Guide, tool

For Everyone

- A Framework for Fair and Consistent Pay Decisions, Workspan Daily article

- The Five Goals of a Strong Compensation Structure, Workspan Daily article

- An Argument Against Pure Market-Based Pay Structures, Workspan Daily article

- 2025-2026 Salary Budget Survey, research

- Essentials of Compensation Management, course

- Pay with Purpose: Driving Employee Engagement Through Compensation, webinar

Imagine if you walk into your CHRO’s office and they tell you the CFO is bearish for the next two calendar years. In fact, the CFO believes the company will face headwinds in the foreseeable future. The CHRO turns to you, saying they want to retain the organization’s critical workforce by using all possible levers, without irreparably damaging the overall workforce and balancing the uniqueness of each of your operating units. What would be your short-term, medium-term and long-term actions to satisfy this request?

To help address that premise, Deloitte Consulting and Empsight partnered to conduct a survey across 249 organizations to understand how compensation strategy aligns with overall business objectives during different economic and labor market conditions. The survey explored various aspects of compensation strategy, including how compensation strategies are adjusted in response to different economic conditions, the role of employee feedback in shaping it, and its impact on employee motivation and engagement.

Understanding Business Cycles from Economic Conditions

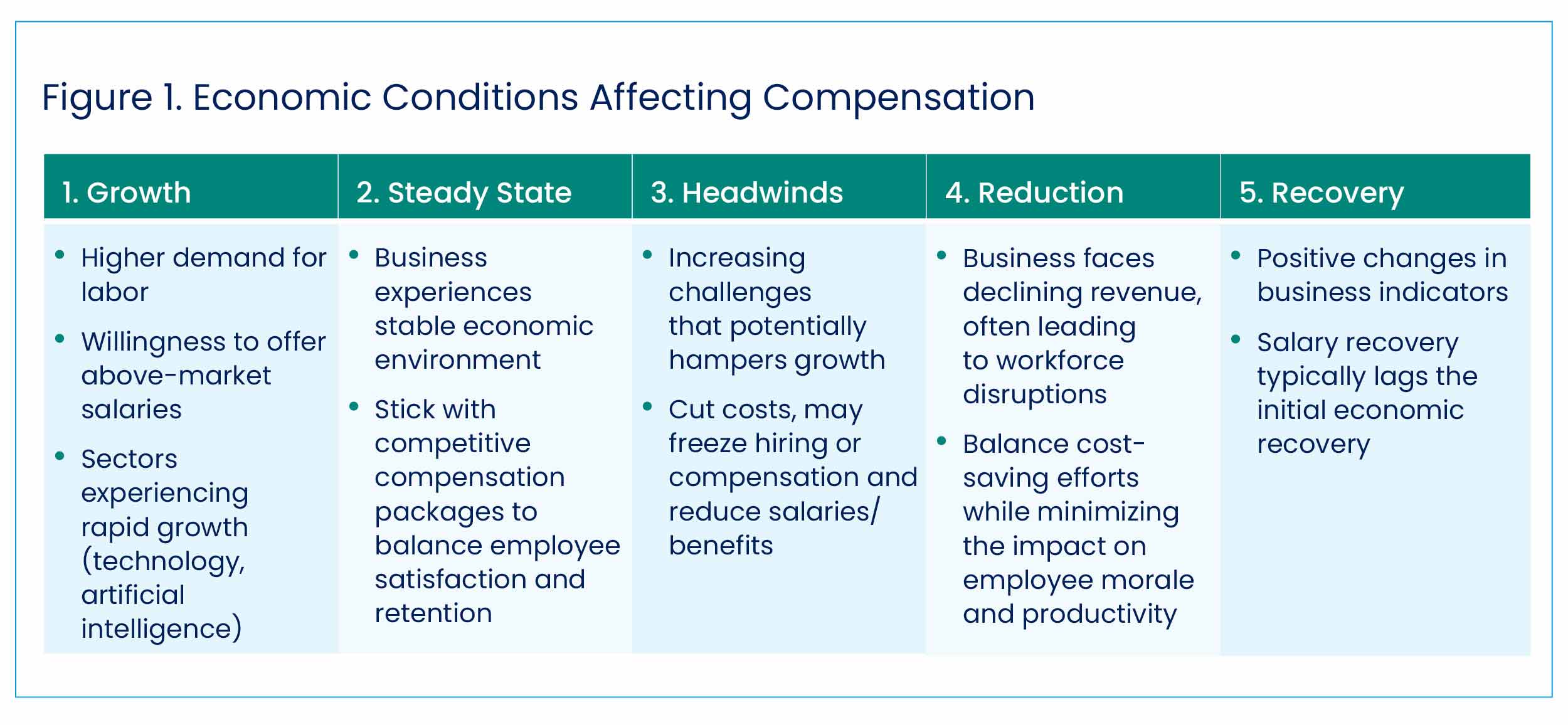

To begin answering your CHRO’s question, you remind them that business cycles resulting from varying economic conditions are broken down into five phases: growth, steady state, headwinds, contraction and recovery. These can be attributed to factors such as labor market demand, gross domestic product (GDP) growth, interest rates and consumer spending.

Comprehending the different phases of economic conditions is likely crucial for organizations to best adapt their compensation programs. Deloitte and Empsight explored the five economic conditions affecting compensation (as seen below in Figure 1). ln reviewing the survey results, it became increasingly apparent that different business units of the same organization may occupy different economic phases.

In terms of economic conditions, nearly 50% of the organizations reported experiencing steady state, followed by 25% experiencing a growth phase. The largest industry represented in the study was insurance (11%), closely followed by manufacturing (10%).

Impact of Economic Conditions on Compensation Strategies

Your CHRO gently reminds you they are aware of business cycles, and that they wanted to understand your opinion of how the business cycles should impact your compensation strategy.

The Deloitte-Empsight research illustrated that total rewards should be the primary focus across business cycles, not just compensation. For example, organizations across economic conditions are either implementing or contemplating the integration of traditional monetary awards with non-monetary benefits to reinforce their balanced total rewards strategies. The emerging trends indicate a shift toward compensation strategies that prioritize long-term sustainability and employee development over short-term financial incentives. This could be a response to the changing expectations of the workforce and a recognition of the importance of resilience in organizational success.

Key survey findings on this perspective include:

- An emphasis on above-market salaries. Currently, offering above-market salaries is most prevalent among organizations during the growth phase (43%) but less so during reduction (18%). The emerging trend shows a notable decrease in the emphasis on above-market salaries during recovery, suggesting organizations might be considering a recalibration of salary strategies post-challenge. This could possibly be due to financial constraints or a shift in focus toward more sustainable compensation practices.

- Increased merit and promotions. There’s a significant current emphasis on increased merit and promotions during growth (40%), which is expected to decrease across all phases, according to emerging trends. This could reflect a more cautious approach to compensation strategies, possibly in anticipation of economic uncertainties or as a lesson learned from navigating past challenges.

- Bonus opportunities. The current use of bonus opportunities (27%) and equity awards (19%) are highest during the growth phase. However, emerging trends suggest decreased reliance on these variable compensation elements and a complete halt during reduction. This may indicate a strategic shift toward more predictable, stable compensation methods in uncertain times.

- Non-monetary benefits. The current emphasis on non-monetary benefits, particularly strong in growth (49%) and recovery (50%), correlates with emerging trends that continue to highlight their importance across all phases, albeit at a slightly lower overall future projection (10%). This suggests that while non-monetary benefits remain a key element of compensation strategies, organizations might be recalibrating the extent to which they rely on these benefits in the future.

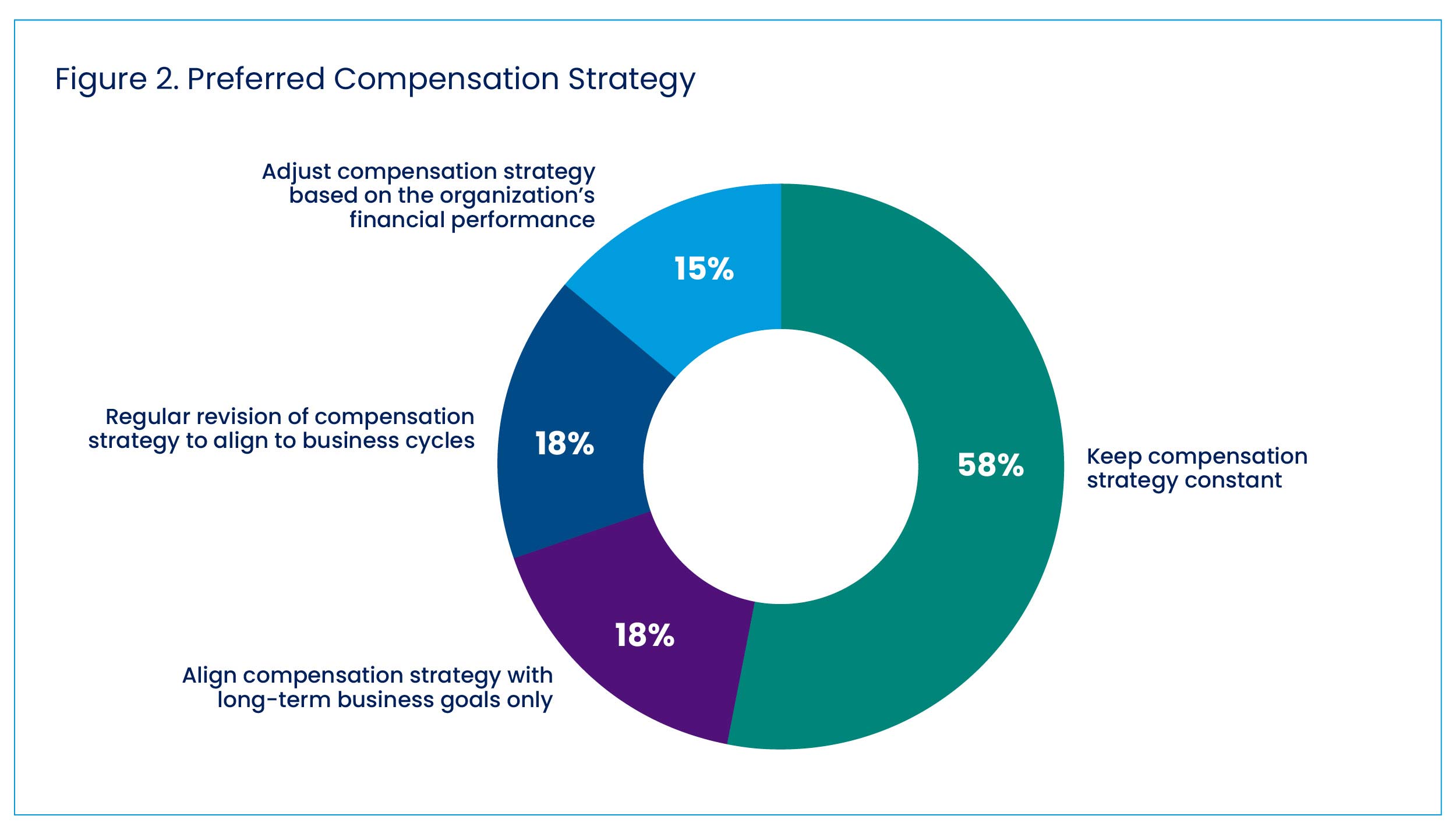

- Keeping compensation strategy constant. Overall, organizations are leaning toward a “stable” compensation strategy (see Figure 2). The study found 58% of organizations are keeping their compensation strategy constant, followed by 18% of organizations that are revising their strategy to align to business cycle or aligning their strategy with long-term business goals. However, organizations indicated the reduction and recovery phases helped refocus their compensation strategies with long-term business goals and organizational financial performance.

Note: Percentages in figure do not total 100% since multiple responses were allowed.

Labor Market Impact: Tight vs. Cooling Labor Market

Before you can move on, the CFO walks into the office where you and the CHRO are meeting, exclaiming this tight labor market is causing them to pay higher than budget for the new VP of treasury. Your CHRO turns to you and asks how you have factored the labor market conditions into your recommendation. You proceed to remind the CHRO and CFO that it’s important to understand the difference between a tight labor market and one that is cooling. These terms encapsulate the fluctuating supply-and-demand dynamics for labor, which in turn influence the total rewards strategy and overall employee value proposition.

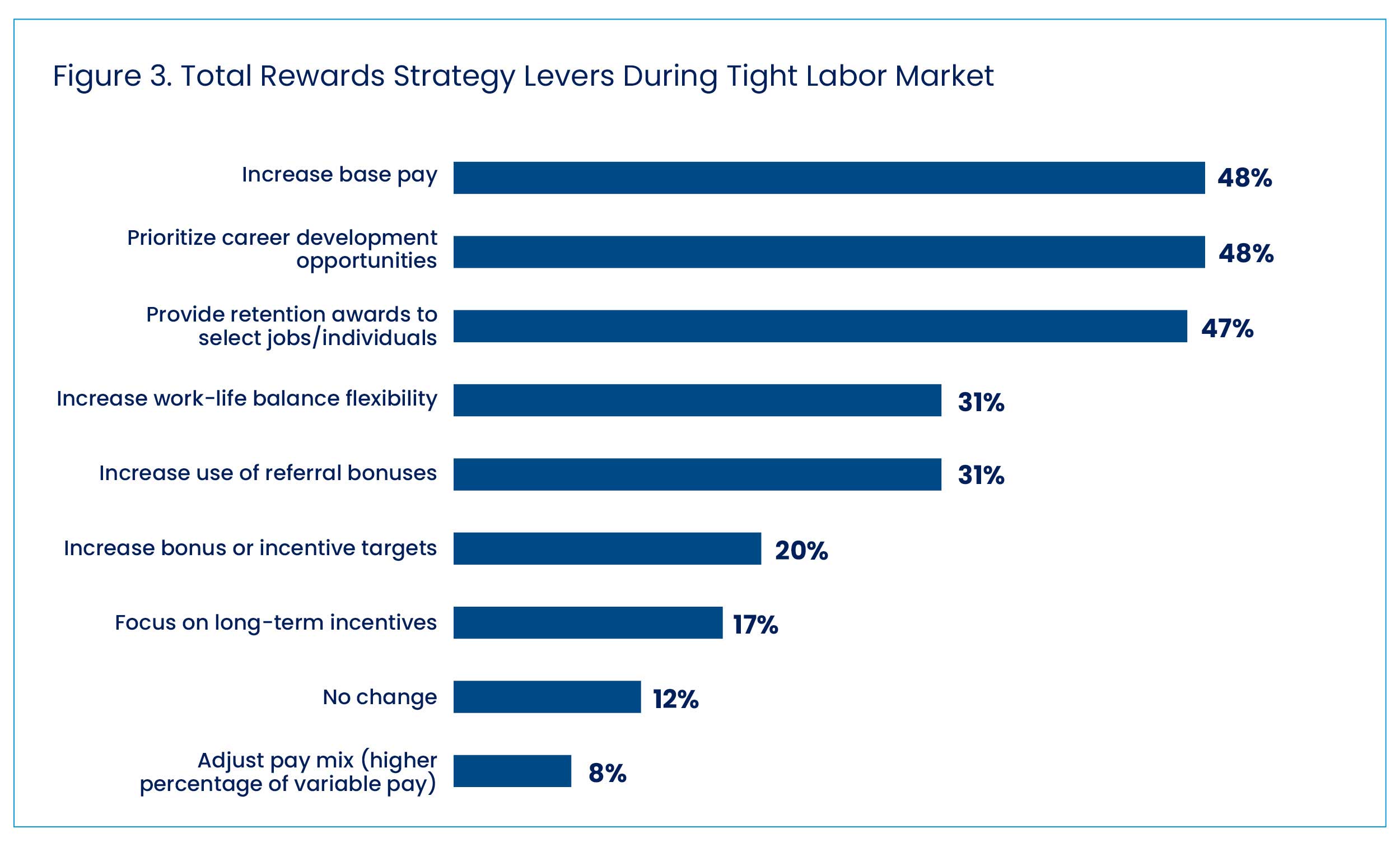

A tight labor market refers to a situation when the economy is performing well and businesses are expanding — hence, leading to a low unemployment rate coupled with a high demand for labor that exceeds the available supply. In such economic conditions, employers often face challenges in attracting and retaining talent due to the competitive environment. Employees have more leverage as compared to employers, leading to upward pressure on wages and benefits. Organizations that are in a tight labor market generally shift toward a balanced total rewards strategy (see Figure 3). Across all phases, prioritizing career development opportunities and increasing base pay are consistent strategies.

Conversely, a cooling labor market is generally marked by a shift toward a higher unemployment rate and a decrease in demand for labor relative to its supply. This scenario often arises from economic downturns, technological changes or consumer behavior shifts. In a cooling labor market, the power balance shifts toward employers, as the pool of available talent expands and competition for talent increases.

Organizations in recovery (86%) increasingly utilize career development opportunities as part of their total rewards strategy. This suggests that irrespective of the business cycle, organizations are investing in employee growth and development is a critical lever for attraction and retention — especially critical in post-reduction, where organizations aim to rebuild and drive growth. The strategy to increase base pay is most favored by organizations during steady state (55%) and recovery (50%) phases, but a decrease in preference is seen during headwinds and reduction. This indicates that while competitive base pay is crucial, its feasibility as a strategy likely varies with the organization’s financial health and market conditions.

The use of retention awards for select jobs or individuals is notably high among organizations during recovery (64%), potentially indicating a strategic focus on retaining critical talent essential for recovery and growth. This targeted approach might allow organizations to maintain key competencies and skills crucial for navigating out of challenging periods.

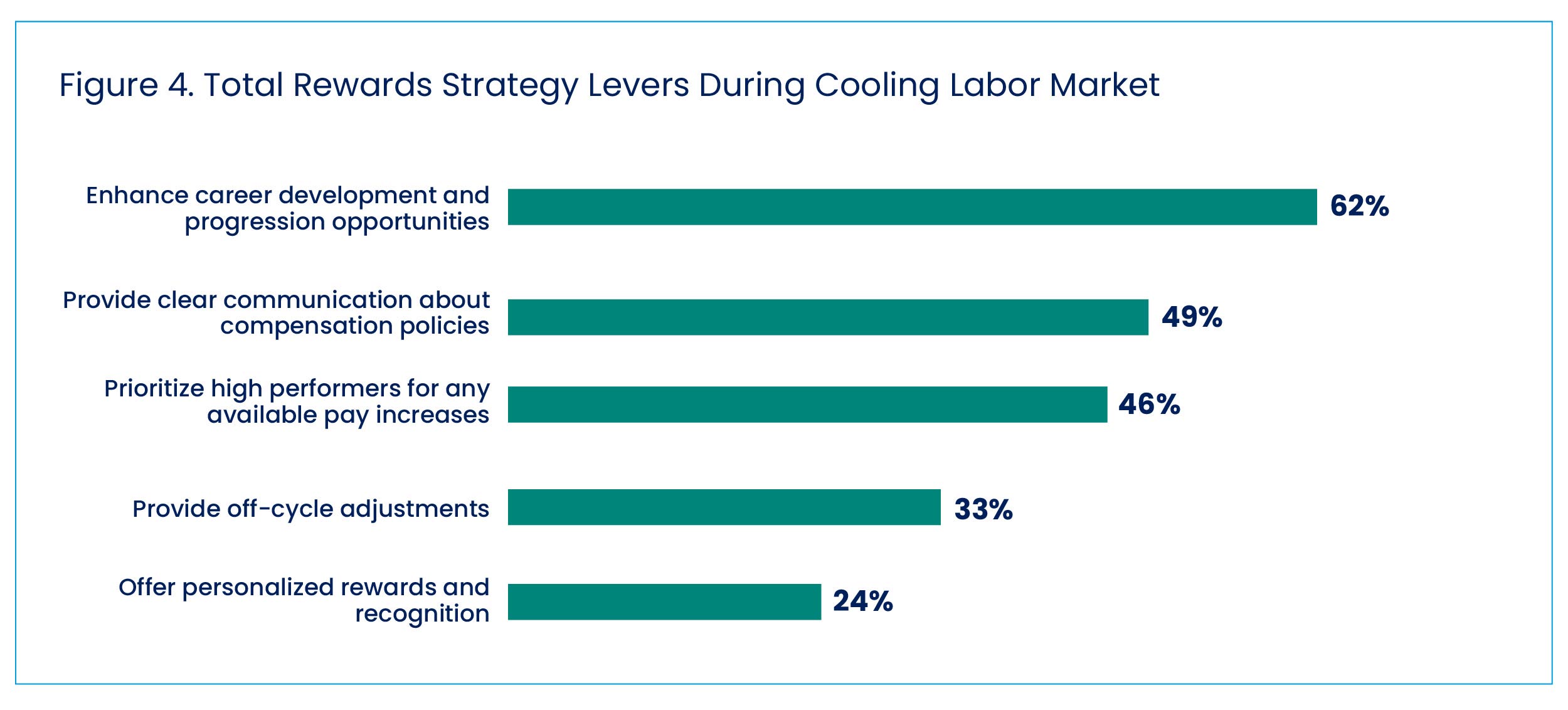

Organizations indicated career development and progression opportunities are critical levers to engage high performers during a cooling labor market (see Figure 4). Additionally, providing clear communication about compensation policies is seen as a significant strategy, especially during headwinds (57%) and recovery (64%). This may allude to the notion that transparency and managing expectations become even more crucial during periods of uncertainty or when the organization is navigating back to stability and growth. Finally, prioritizing high performers for any available pay increases is a common strategy across organizations, albeit with moderate variation across phases. This approach might underscore the importance of recognizing and rewarding top talent, even in a cooling labor market, to retain key contributors to organizational success.

Staffing Practices

As for current-state staffing practices, most surveyed organizations focused on strategic hiring for key positions and diversity, equity and inclusion (DEI) initiatives. Strategic hiring for key positions is consistently prioritized across all phases, with its importance peaking during reduction (82%) and recovery (86%). This suggests that even in challenging times, organizations focus on securing critical talent necessary for immediate needs and future growth.

DEI initiatives remain a high priority across all business cycles, with a notable emphasis during growth (77%). This indicates organizations recognize the value of a diverse and inclusive workforce as a driver of resilience and innovation, regardless of economic conditions.

Enhancing Your Employee Value Proposition

To better optimize compensation through business cycles, survey results indicated organizations should consider enhancing their employee value proposition to attract, motivate, engage and retain top talent, particularly in dynamic labor markets. By aligning compensation strategies with economic and market conditions, organizations might incentivize performance, maintain employee engagement and achieve their business objectives.

Finally, a common thread across all phases indicated organizations may consider staying true to a long-term compensation strategy, while maintaining flexibility to adapt to unforeseen market dynamics.

Keeping focused on the organization’s rewards philosophy and talent strategy, while incorporating innovation in their programs, may help prepare organizations for economic fluctuations and the future of work.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: