- Potential recession lowers pay expectations for sellers. An Alexander Group survey found that sales departments are allocating a traditional and modest 3% increase for on-target-earning budgets in 2023.

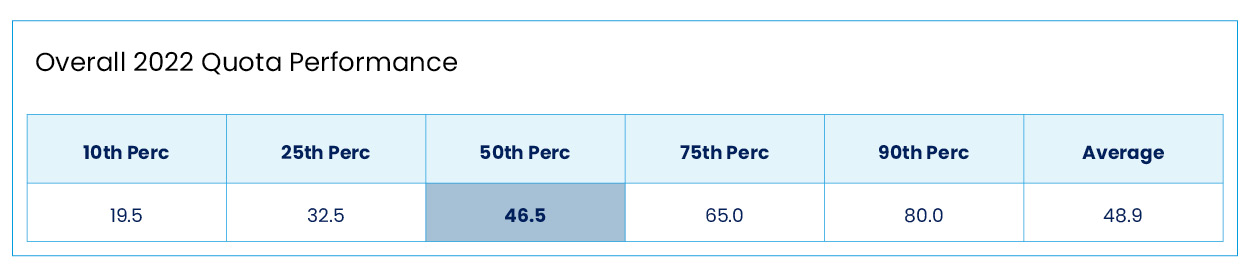

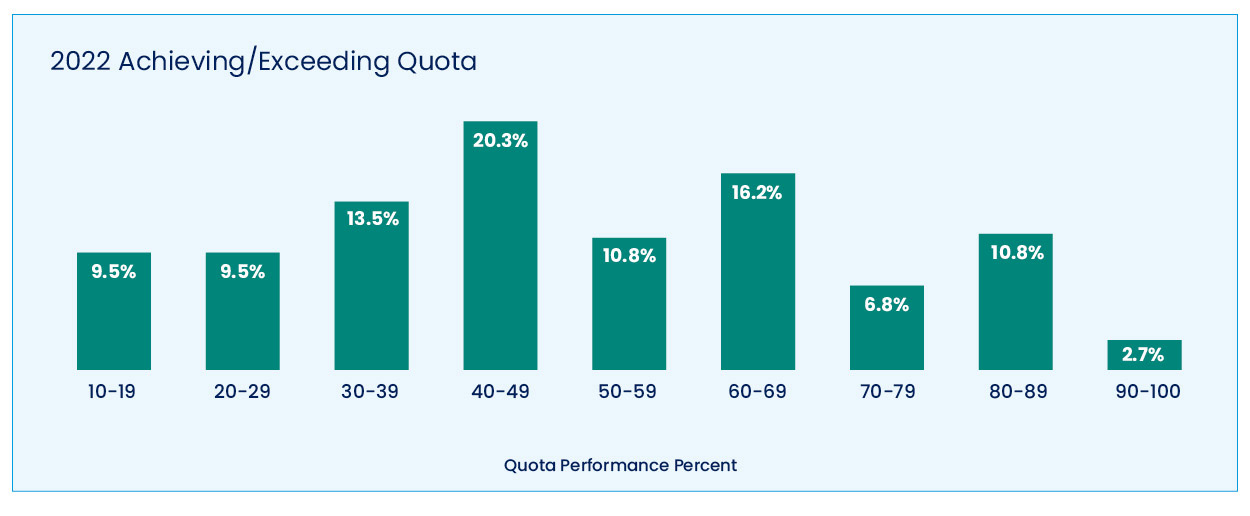

- Sales struggles in 2022. The survey revealed that while companies performed well in 2022, more than half (52.5%) of sellers failed to achieve target performance.

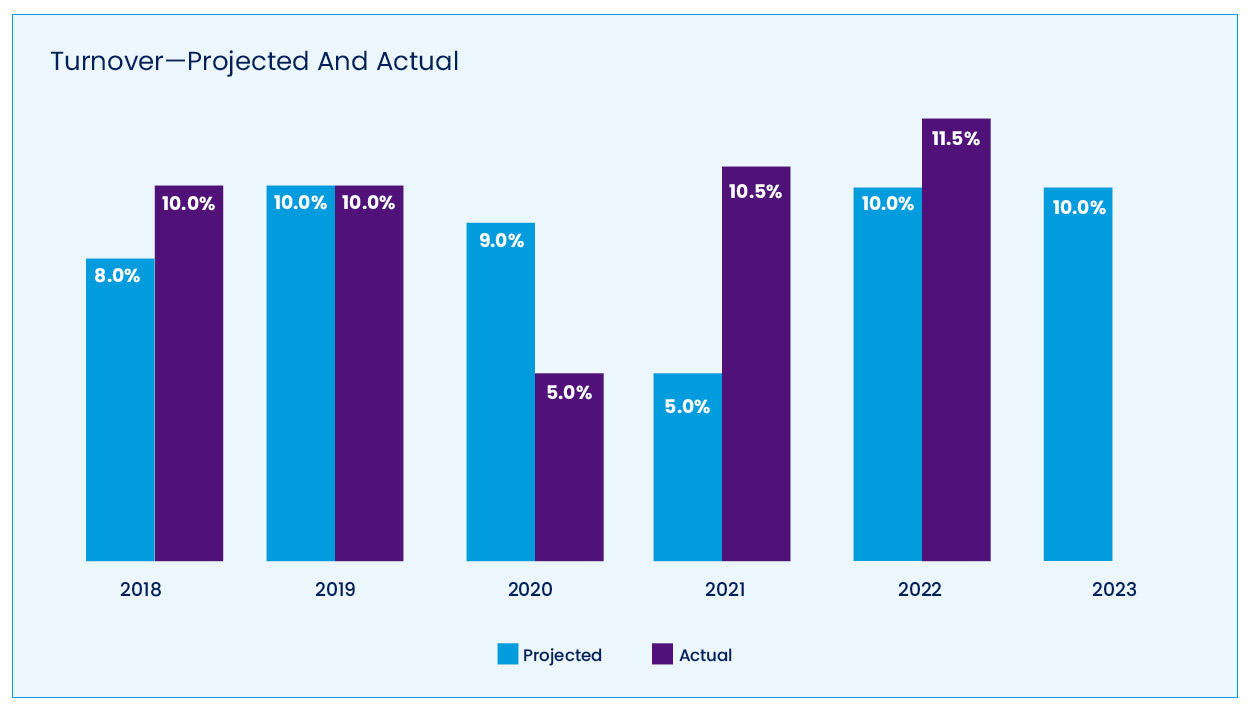

- Increase in turnover. While companies made progress in reducing open positions, turnover was 11.5% — a rate higher than the historic 10% turnover rate. Companies expect a 10% turnover rate in 2023.

- Revenue growth expected in 2023. While survey participants expect a mild recession in 2023, they still expect 8% revenue growth.

Concerns over a potential recession are likely to negatively impact sellers in 2023.

This was a main finding from The Alexander Group’s "2023 Sales Compensation Trends Survey," which notes that emerging recessionary forces at the end of 2022 are now keeping sellers’ pay subdued for 2023.

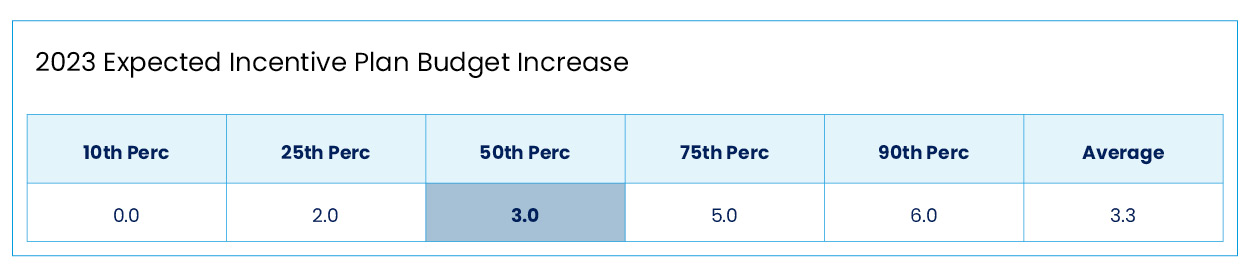

The survey results indicate sales departments are allocating a traditional and modest 3% increase for on-target-earning budgets in 2023. More than 85 companies reported revenue performance, turnover rates and change in compensation costs, including incentive and total compensation increases.

Participants reported on 2022 performance and expected 2023 practices. While companies performed well in 2022, sellers struggled to reach quota with only 46.5% achieving their target performance.

Survey Highlights

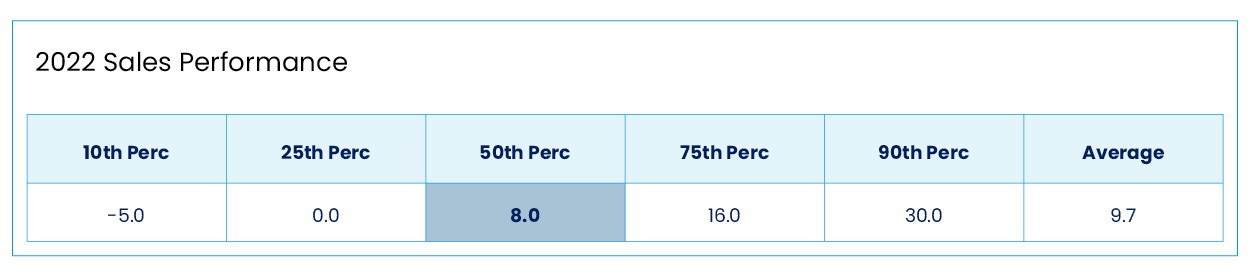

Sales departments did well in 2022, achieving an 8% median increase in sales.

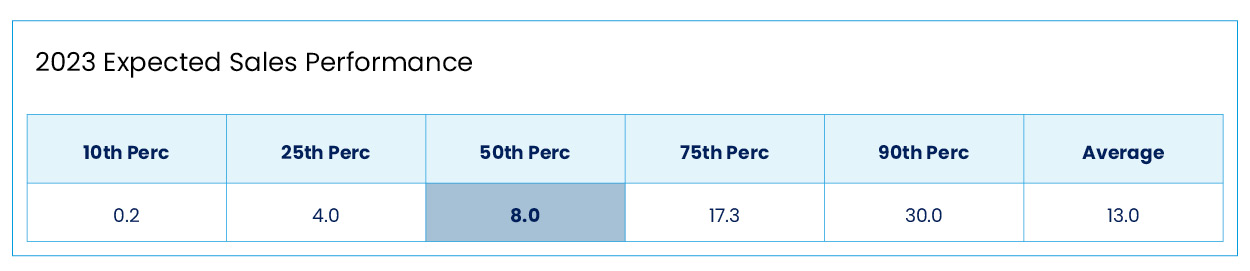

Surprisingly, sales departments expect a similar sales performance for 2023: an 8% median growth projection. Some are expecting a more robust year, skewing the projected average revenue growth performance to 13%.

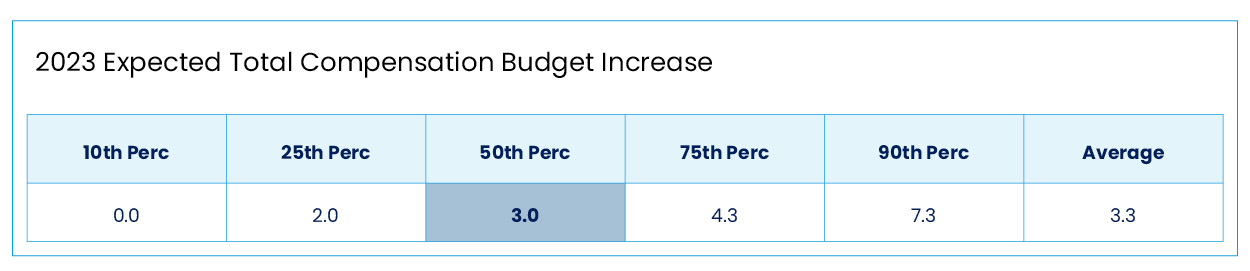

The 2022 incentive cost increase remained muted at 2%. Companies plan a 3% increase in base pay and an overall increase of 3% in target total compensation costs in 2023.

While companies made progress in reducing open positions, turnover was 11.5% — a rate higher than the historic 10% turnover rate. Companies expect a 10% turnover rate in 2023.

Overall, sellers did not fare as well. Only 46.5% of all sellers reached quota in 2022. The median average quota performance was 93%.

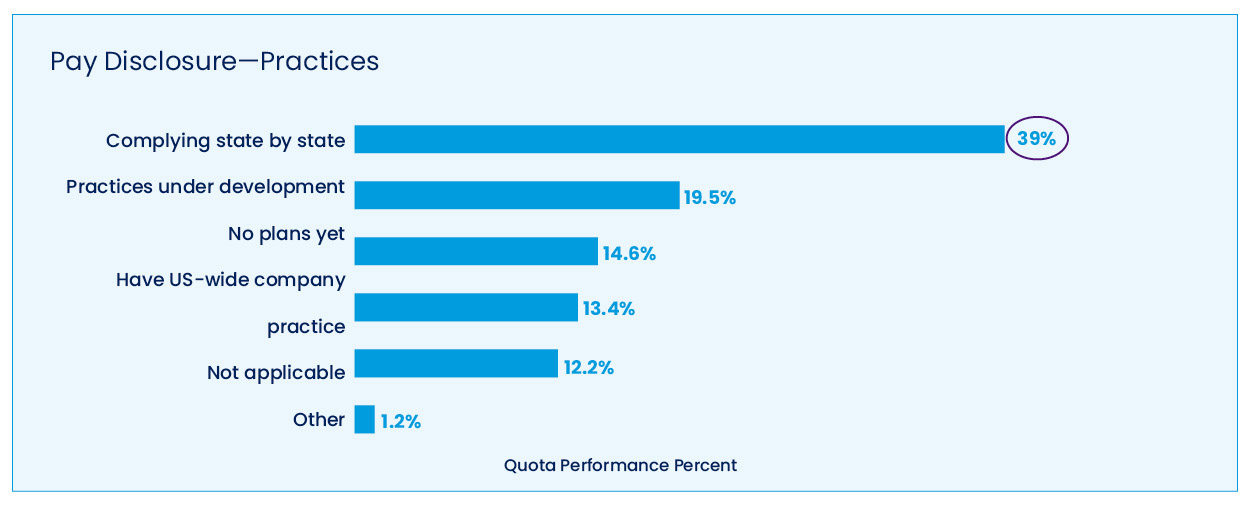

Pay Disclosure Practices

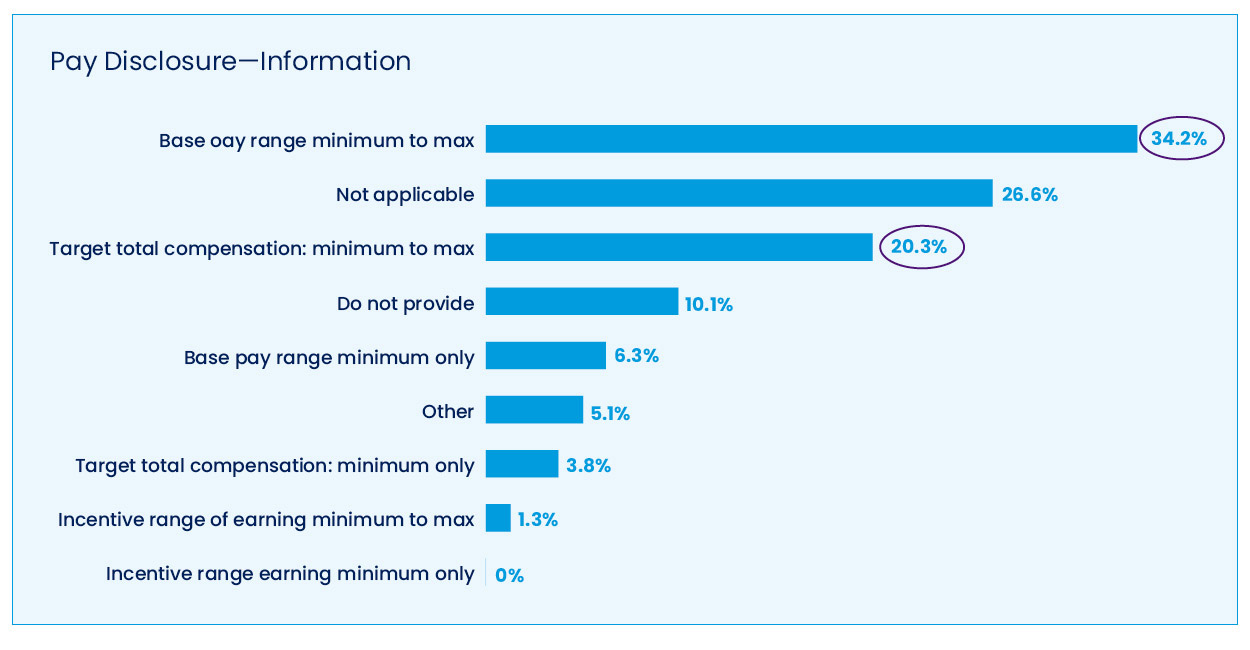

Several states now require pay disclosure (pay ranges) to be posted with job openings and provided to requesting applicants. The survey participants reported on their practices, with 39% complying on a state-by-state basis.

And what are they disclosing? Mostly, base pay ranges (34.2%), followed by target total compensation ranges (20.3%).

The Bottom Line

While survey participants expect a mild recession in 2023, they still expect 8% revenue growth. Organizations projected sales turnover will be about 10% and wage increases will remain close to 3%.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: