Recent press articles have spotlighted a few marquee tech industry companies exploring a pull-back on their bonus payouts and/or stock-based compensation programs. This has prompted much speculation about whether these actions may be foreshadowing a broader pull-back trend within the tech industry, particularly with regard to stock-based compensation.

However, based on a Q1 survey of 69 tech companies conducted by WTW, the overall tech industry will most likely be holding the line on stock-based compensation in 2023 — both in terms of participation by job level and the dollar value of awards.

No Widespread Stock Pull-Backs in 2023

Although there are certainly some notable tech companies that have reportedly pulled back on their performance-based compensation programs, a review of plans across the wider sample of tech companies in this survey does not suggest a broad tech industry pull-back in 2023.

About half of respondents in the survey also expect 2023 share spend to stay approximately the same in 2023 as 2022. Given the declines in stock prices within the tech sector, and little expected changes to long-term incentive plan (LTI) participation (other than due to layoffs for cancellation of significant new hires) or target LTI dollar values, we might have expected a higher percentage of companies reporting an expected increase in share spend.

However, the survey findings suggest staffing actions taken/planned in 2022-23 have allowed companies to manage the year-over-year change in share spend.

Key Survey Findings

Base Pay

The median total base pay adjustment in 2023 is expected to be 4.75%, only a slight dip from a median of 5% in 2022. Although nearly 40% of companies expect to reduce total base pay budgets to some degree, only 9% expect to pull back “significantly” from 2022. (Note: the total pay budget comprises merit increases, promotional increases and any other base pay adjustments).

More than three out of four (78%) of survey participants reported filling positionsin tech job families to range from “somewhat” to “very” challenging.” This compared to only 42% reporting staffing challenges for non-tech job families.

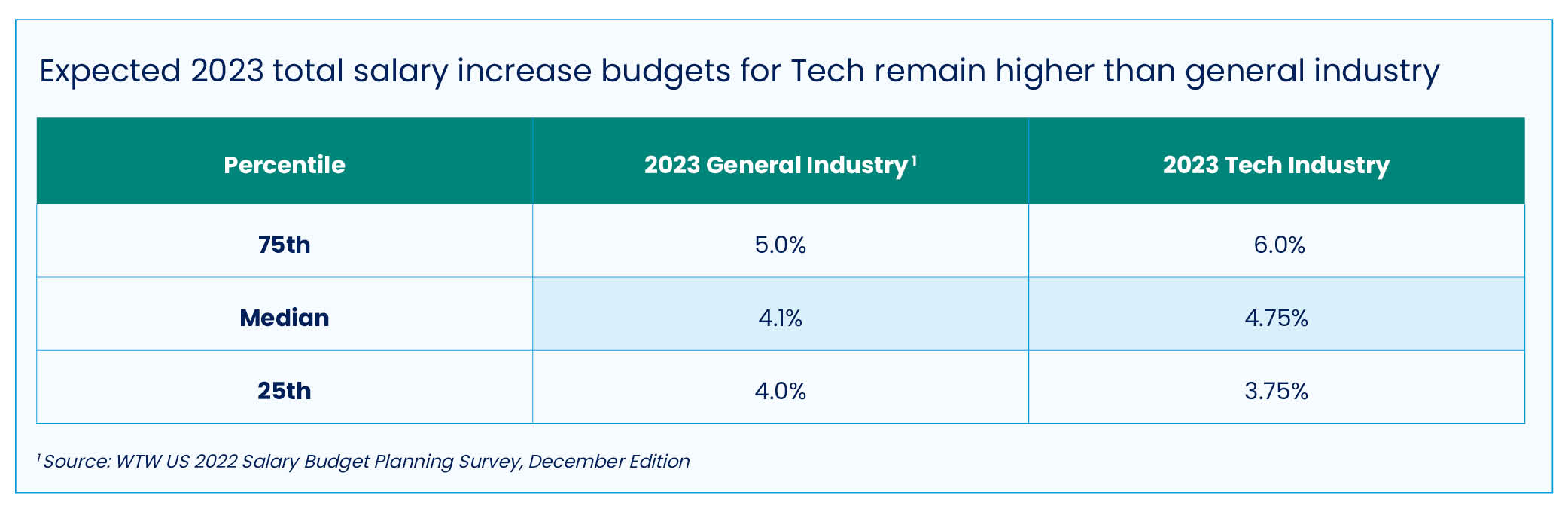

For 2023, expected tech industry total salary increase budgets remain higher than the general industry, and 27% of survey respondents expect a total base pay increase budget over 6%.

2023 Bonuses

Notwithstanding tech sector headwinds, six of 10 companies expect funding for bonus payouts made in 2023 (for 2022 performance) to be at 100% of target or better. Most companies (77%) expect to fund bonus pools at between 75% and 125% of target bonus, and only 8% expected funding lower than 75% of target.

Fewer than one in 10 companies differentiate bonus targets for tech versus non-tech job families.

Stock-Based Compensation

Participation. Most companies report maintaining current LTI participation in 2023 as they balance the need to prudently manage share spend against the need to continually attract, retain and engage talent. Macro-level participation at some companies had dropped due to cancellation of new hire employee ramp-up plans in fiscal year 2022 and fiscal year 2023, and in some cases, layoffs.

Expected participation varies somewhat for tech versus non-tech job families and there are nuances by job level. For example, for tech job families, only 3-5% of companies reported plans to decrease LTI participation for jobs at “Sr. Professional” through “VP and Above” levels, compared to about 10% with plans to pull back on participation for jobs at “Mid-” and “Entry-” level professional levels. For non-tech job families, the LTI pull-back starts at the manager and below levels.

In addition, there are important differences depending upon how companies are choosing to manage their overall share spend/usage. For organizations that plan to decrease their overall share spend in 2023, more than 30% plan to decrease LTI participation at lower job levels for both tech and non-tech job families.

In contrast, for companies expecting share spend to remain “approximately the same” only 4% and 7% plan to reduce LTI participation at lower levels for tech and non-tech job families, respectively.

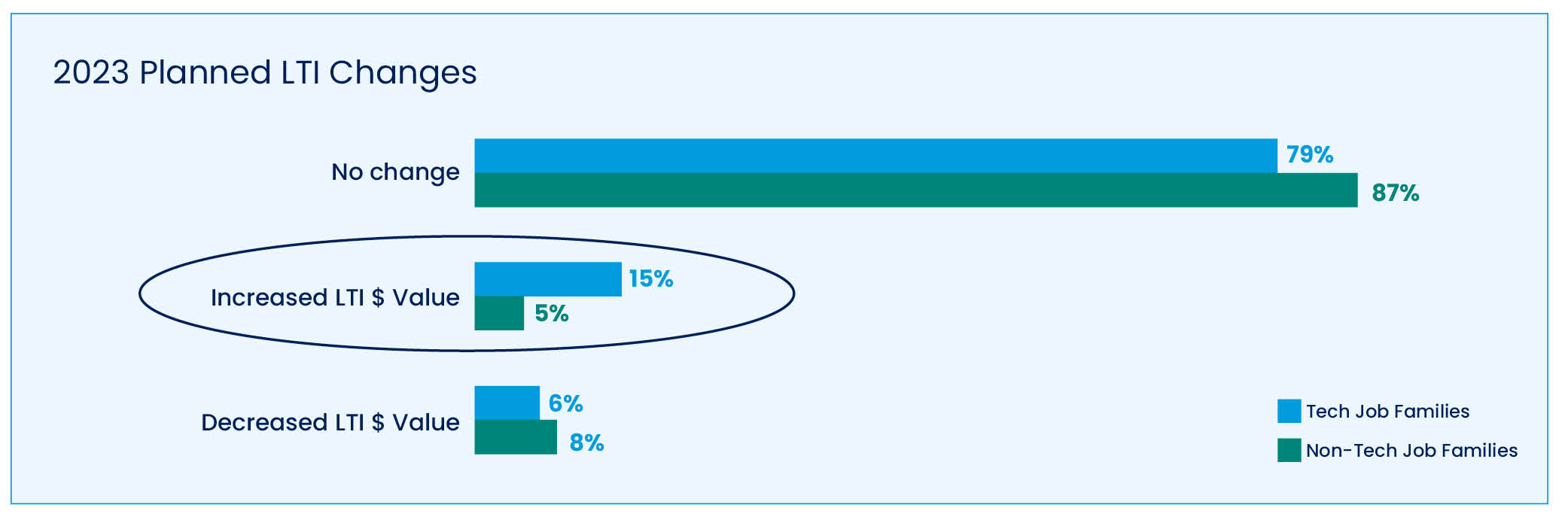

LTI Values. Most companies report holding the line on LTI grant values — a finding that WTW was surprised to hear based on the depressed stock prices at many companies. Although few organizations expect to increase target LTI dollar values in 2023, 15% expect to do so for tech job families.

Generally, for those organizations that plan to decrease their LTI grant values in 2023, target grants will remain at a premium to market (e.g., 65th percentile or greater), whereas those that are increasing grant values are more likely to be targeting the 50th percentile.

Keep A Close Watch Beyond 2023

While the WTW survey does not suggest a broad tech industry pull-back in 2023, this remains a dynamic situation, which warrants ongoing monitoring of changes/variations in pay practices across different tech sectors (and based on size of company), as companies face additional potential economic headwinds in 2023 and into 2024.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: