- The environmental, social and governance (ESG) landscape is evolving. Amid increased political attention and polarization, companies can reevaluate ESG components in their incentive plans.

- Many companies are not moving away from ESG goals in incentive plans. Despite some external pressure, companies reinforce ESG goals that are key to business strategy.

- Recent trends show two paths for addressing ESG incentive measure concerns. For companies updating 2024 incentive plan designs, trends include updating measures or restructuring plan designs using scorecards.

- Transparent communication remains critical. Consider how company decisions will be viewed by stakeholders and communicate your rationale clearly and consistently.

In recent years, environmental, social and governance (ESG) policies have become politicized and polarizing, causing companies to reconsider how they are used. For example, the Supreme Court (SCOTUS) ruling against affirmative action in college admissions has prompted companies to re-evaluate how diversity, equity and inclusion (DEI) programs tie to their strategy and how they communicate about them.

Most companies — 61%, according to The Conference Board— expect an ESG backlash to intensify over the next two years. Even so, companies generally are not stepping back from ESG priorities. In fact, almost three-quarters of S&P 500 companies have included ESG metrics in their compensation plans, according to Semler Brossy’s 2023 ESG and Incentives Report.

In this environment, companies can assess their progress on a spectrum of metrics (including broader sustainability and human capital measures) and determine whether to adjust their incentive plans in response – and, if so, how. One option: While DEI and environmental metrics currently are considered on their own, companies can consider combining them with other non-financial measures.

Blueprint for Deciding on ESG Incentive Plan Components

Today it is especially important to verify that ESG metrics remain material to company strategy. Discussions on FY2024 incentive plans provide an excellent opportunity to do this and to pinpoint the measures that will most effectively promote business and cultural objectives. These decisions have become part of the broader communications effort regarding how sustainability efforts fit in with the company’s purpose and values.

For companies holding these conversations, two paths are emerging: updating incentive measures or restructuring plan designs. An important note: Few companies are considering changing metrics in current, in-cycle plans; most are contemplating making changes going forward.

Updating Measures

Organizations want to confirm that measurement areas fit with overall company strategy and are material enough to make a difference.

Measurement areas should be evaluated against all strategic and operational priorities to identify the key drivers of targeted business outcomes.

For areas that make the cut, the next step is determining precisely how to measure them. For instance, in the wake of the SCOTUS decision, many companies are pivoting away from quantitative DEI metrics (such as diversity representation) towards efforts that can be objectively measured but that focus on outcomes (such as inclusion and engagement).

Other companies are moving towards more qualitative measurement of milestones and initiatives related to efforts such as culture, leadership development and succession planning, all of which contribute to the DEI agenda.

For environmental metrics, companies are revising objectives as they advance their understanding of science-based targets and increase their collaboration with key stakeholders. Advancements in measurement eliminate some previous concerns with these metrics and provide a clearer direction for formal implementation.

Restructuring Using Scorecards

Scorecards can help integrate non-financial metrics (such as ESG, operational and other strategic priorities) into a single weighted component within the bonus plan. This allows companies to establish objective goals and measure them retrospectively, taking into consideration the context of the progress made.

Scorecard structures give committees a tool for holistically measuring non-financial achievements. Given the evolution of corporate responsibility discussions, scorecards offer more flexibility to adjust metrics year-over-year without fundamentally altering a company’s plan design.

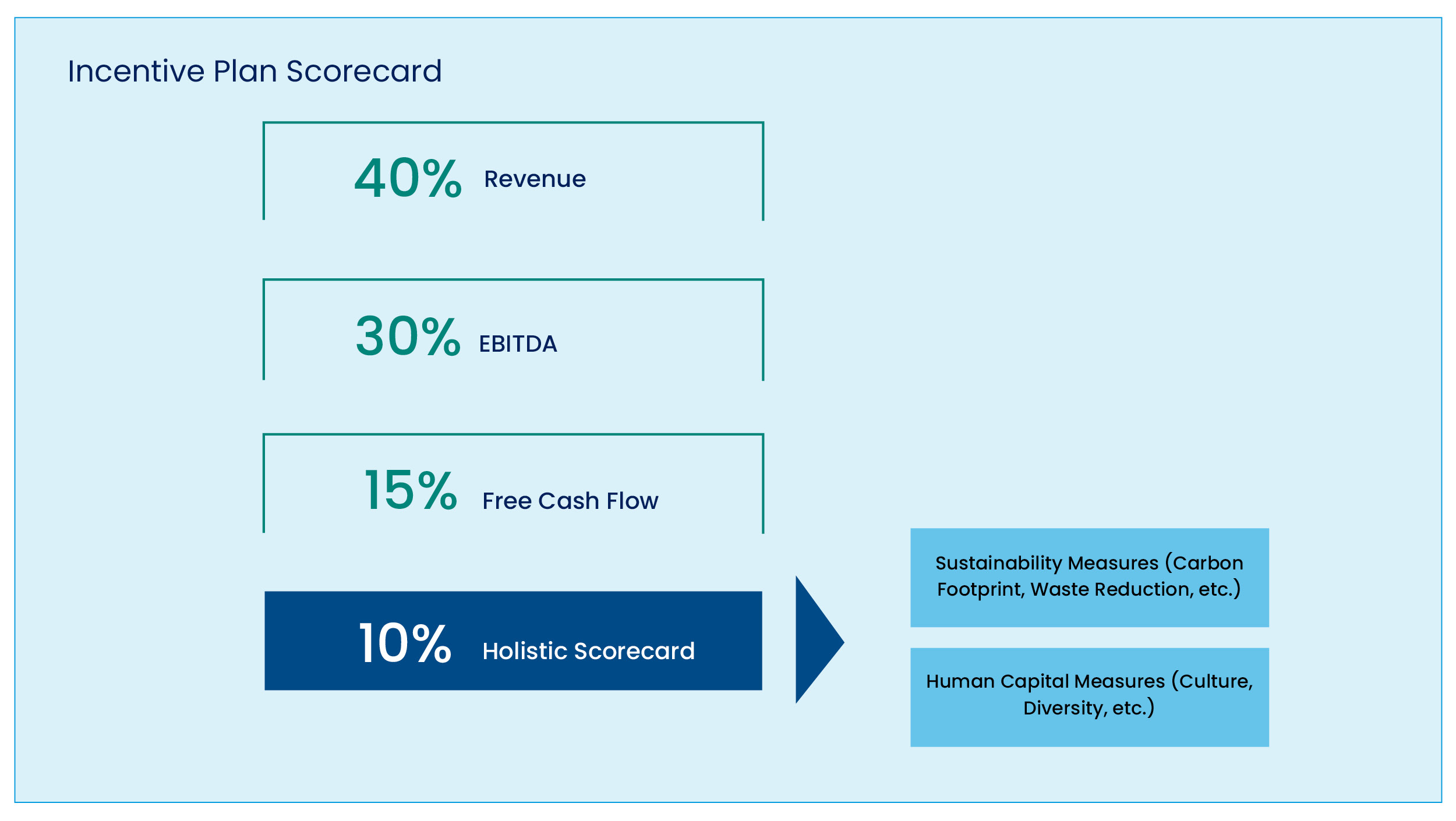

Scorecards also allow pre-established ESG incentive plan metrics to be combined with other priorities. For example, a company with a discrete ESG metric that is a weighted component within the bonus plan could combine that measure with other non-financial goals in a scorecard that then is weighted.

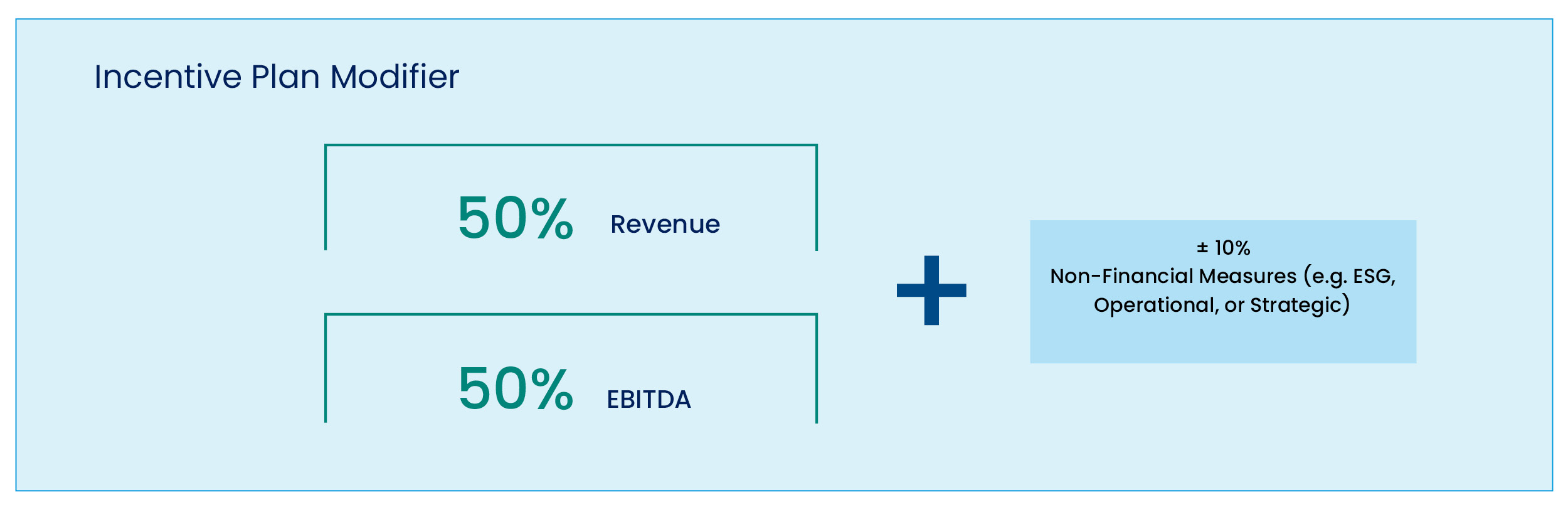

Alternatively, companies could introduce a non-financial modifier based on strategic, operational or ESG related measures. Traditionally, modifiers adjust pay depending on performance and are a good way to impact total payouts that are primarily influenced by weighted financial metrics.

Below are two examples. The first shows how to use non-financial metrics, such as ESG, as a specific percentage of a broader incentive plan scorecard. The second shows how to use a non-financial modifier, which can include featuring ESG goals, in a predominate financially weighted incentive plan payout. Actual metrics and weightings vary by company.

The Importance of Transparent Communication

When companies modify ESG incentives questions may arise among various stakeholders, including investors, employees and consumers. New metrics and design approaches present an opportunity to communicate how ESG changes reinforce business priorities. Internally, boards and senior leaders can send strong messages that cascade through the organization; externally, transparent and consistent messages can be sent to various stakeholders.

While we expect many companies to reposition and reprioritize their metrics, some may drop ESG metrics from incentive plans altogether. When metrics are eliminated, clear communication about the reasons for the decision becomes even more crucial.

Importantly, ESG priorities can be recognized in other ways — by, for example, promoting individuals who build diverse and inclusive teams or evaluating employee’s performance related to building a strong culture.

Finding Direction and Refocusing ESG for Greater Impact

ESG in pay programs continues to evolve, and in ways that may not be immediately evident. For example, decisions made today on FY24 pay programs will not be publicly disclosed until 2025 proxy statements are released.

It is clear that companies are figuring out what is important and incorporating metrics more holistically to establish the best place to make an impact. Companies can consider accompanying any incentive plan adjustments with transparent communications to explain how these ESG metrics align with business strategy and how they fit in compensation plans in the context of the evolving social and political ecosystem.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: