- SEC announces a new comment period for Dodd-Frank. The pay-for-performance proposed rule from 2015 is being reopened for comments.

- Reassessing details of pay programs in CD&A. The SEC is considering additional disclosures that would cause companies to reassess how they present the details of their pay programs in their CD&A.

- Five most important measures. Among the additional requirements companies would have to include is a list of the five most important performance measures in determining executive compensation.

- Prepare for 2023 proxy season. The expectation is that companies will have to prepare these additional pay-for-performance details in their 2023 proxy statements.

Editor’s Note: Workspan

Daily will be publishing a monthly executive compensation column from Willis

Towers Watson for the benefit of our readers and to encourage further discourse on topics

vital to compensation professionals. New to WorldatWork? Please feel free to

join the discussion in our new online community, Engage, or send your thoughts to workspan@worldatwork.org.

The latest surprise from the Gary Gensler chaired Securities and Exchange Commission (SEC) may cause companies to recraft their Compensation Discussion and Analysis (CD&A) for the 2023 proxy.

Last month, the SEC issued a release announcing that the comment period for the Dodd-Frank pay-for-performance proposed rule is being reopened. The release explained that the SEC is considering additional disclosures that would greatly expand what companies would include in their Dodd-Frank pay versus performance disclosure, including an extensive disclosure of the compensation measures that are most important to companies.

From a legal standpoint, requiring disclosure of pay measures will cause companies to reassess how they present the details of their pay programs in their CD&A, which are governed under a “principles-based approach,” in that companies may decide that a more extensive discussion is warranted. As part of this reassessment, companies will need to determine how and whether to revamp their existing pay-for-performance disclosures, which may be viewed as less relevant to shareholders when they can review a more uniform, required table common to all companies.

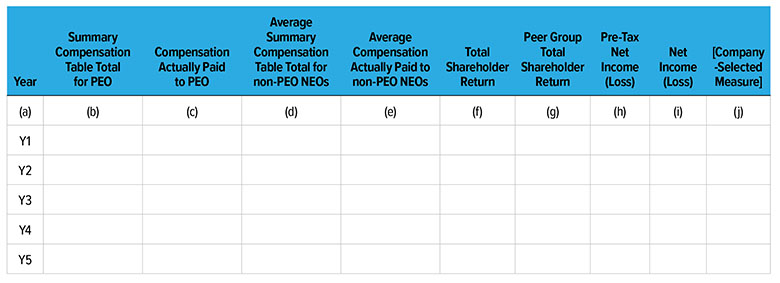

Technically, the SEC has reopened the comment period for the pay-versus-performance disclosures first proposed back in 2015. Not only will public companies need to provide a tabular disclosure of “compensation actually paid” to their CEOs/executive officers compared to absolute and relative total shareholder return, they also would be required to compare it to the Generally Accepted Accounting Principles (GAAP) metrics of “pre-tax net income” and “net income,” plus a “Company-Selected Measure” that represents the “most important performance measure used by the registrant to link compensation actually paid during the fiscal year to company performance.”

Further, the SEC is considering requiring a tabular disclosure listing the five most important performance measures that drove “compensation actually paid” as being useful to investors “related to the consideration of the registrant’s corporate performance and individual performance in the design of NEO compensation required in the CD&A.”

Comments on this proposal are due within 30 days of when the proposal is published in the Federal Register, which signals the SEC has this proposal on a similarly fast track as the Rule 10b5-1 proposal issued at the end of 2021, with the strong possibility being that calendar-year companies will need to include this disclosure on their 2023 proxy. This means companies will have a lot of work ahead of them to revisit their current pay-for-performance disclosures to sort through precisely how much information they will present to shareholder in their proxies.

More Details on How to Complete the Table

Willis Towers Watson synopsized the proposed rule, plus the additional items that the SEC has requested comments on, underneath the table. There are extensive descriptions in the 2015 proposal of how the mechanics of each of these calculations will work. We expect the final regulations to provide even more guidance.

- Compensation actually paid would continue to be defined as SCT compensation, excluding changes in pension value, but with the value of equity awards at vesting rather than when granted.

- CEO and the average of other NEO compensation would appear with both SCT values (columns (b) and (d)) and compensation actually paid values (columns (c) and (e)).

- Performance measures to be disclosed in, what we will call the “Pay vs. Performance Table,” would be the company TSR (column (f)); the TSR of the company’s peer group, as chosen by the company (column (g)); pre-tax net income (loss) (column (h)); net income (loss) (column (i)); and a company-selected measure (column (j)).

- Five years of history would be required to be disclosed on the table. Small reporting companies must show only three years. Exempt from the disclosures would be foreign private issuers, registered investment companies, and Emerging Growth Companies (EGCs).

- The five most important performance measures that drove compensation actually paid, in a separate tabular disclosure entitled the “Five Most Important Company Performance Measures for Determining NEO compensation.” We call this the “Top-Five Table.”

A Sea Change or Just an Adjustment to Executive Compensation Disclosure?

The SEC’s proposal would ask companies to provide tabular disclosures with very different information than required under current rules, although we’ve noted that most companies already have vibrant pay-for-performance disclosures in the CD&As, either in prose or via tables and diagrams. This is because the CD&A instructions specify, as the SEC points out, that examples of material information may include how executive compensation relates to company performance and what items of corporate performance affect compensation decisions and plan design.

We would assume that the SEC wants this information disclosed because it believes that existing disclosures are not sufficiently transparent for shareholders to compare pay for performance analyses across companies. The new Pay vs. Performance table, if mandated, will present both tactical and strategic considerations for companies.

Immediate Action Steps

Our view is the SEC seems eager to get this disclosure finalized, and would anticipate this disclosure will be required for, at least calendar year companies in their 2023 proxy. It is not unheard of for the SEC to move even sooner for fiscal year companies, wherein they establish an effective date for the disclosure for proxies issued after a date certain. We wouldn’t venture a guess on what that date might be. The upshot is that companies should start planning for the disclosure now.

Here is a quick reference on what to do now:

1. Model the Pay vs. Performance Table for 2021 based on the proposal: This will prove a useful exercise, both in understanding how the rules will work and in anticipating how to determine the “most important” measure. It may be too early to discuss with the compensation committee what they might think is the proper measure to use in the table for 2023, if required, so consider modeling the table with those measures that might be in play. This model should include the five-year history, as well.

2. Create a Top-Five Table: Similar exercise as for one to list the five most important company performance measures for determining NEO compensation. The rules will seek a cross reference to where those measures are discussed elsewhere, so charting those appearances may be useful.

3. Start thinking about existing Pay for Performance depictions: There will be myriad challenges in assimilating existing pay for performance disclosures along with this new Pay vs. Performance tabular disclosure. This will be an important issue to start thinking about this year to determine how these new tables may move to the start of the CD&A and whether your company will continue to use prior disclosures of how you may have measured pay for performance.