- Disclosures stay the course. The overall trends in pay vs. performance (PVP) disclosures were comparable to those in the first year of PVP in 2023.

- What gets measured gets managed. Most organizations continued to use profit or income metrics for their company-selected measure.

- Revisions and changes were common. Nearly 1 in 3 organizations disclosed revisions or made changes to their PVP disclosure for Year 2. Alterations to disclosed pay or performance values were more common than revisions of PVP disclosure decisions.

In August 2022, the U.S. Securities and Exchange Commission (SEC) adopted final rules implementing the pay vs. performance (PVP) requirement in the Dodd-Frank Act. These rules require registrants to disclose, in both tabular and narrative format, how their executive compensation is paid in relation to their financial performance.

WTW is among the organizations that have kept a close eye on PVP disclosure trends, providing insight on early trends as well as broad consensus on disclosure practices among first-year filers. In addition, WTW tracks the SEC’s Compliance and Disclosure Interpretations (C&DIs) that accompanied the final rules, most recently in November 2023 (see SEC issues November 2023 guidance on pay versus performance).

PVP Year 2 Disclosures Show Consistency with Year 1

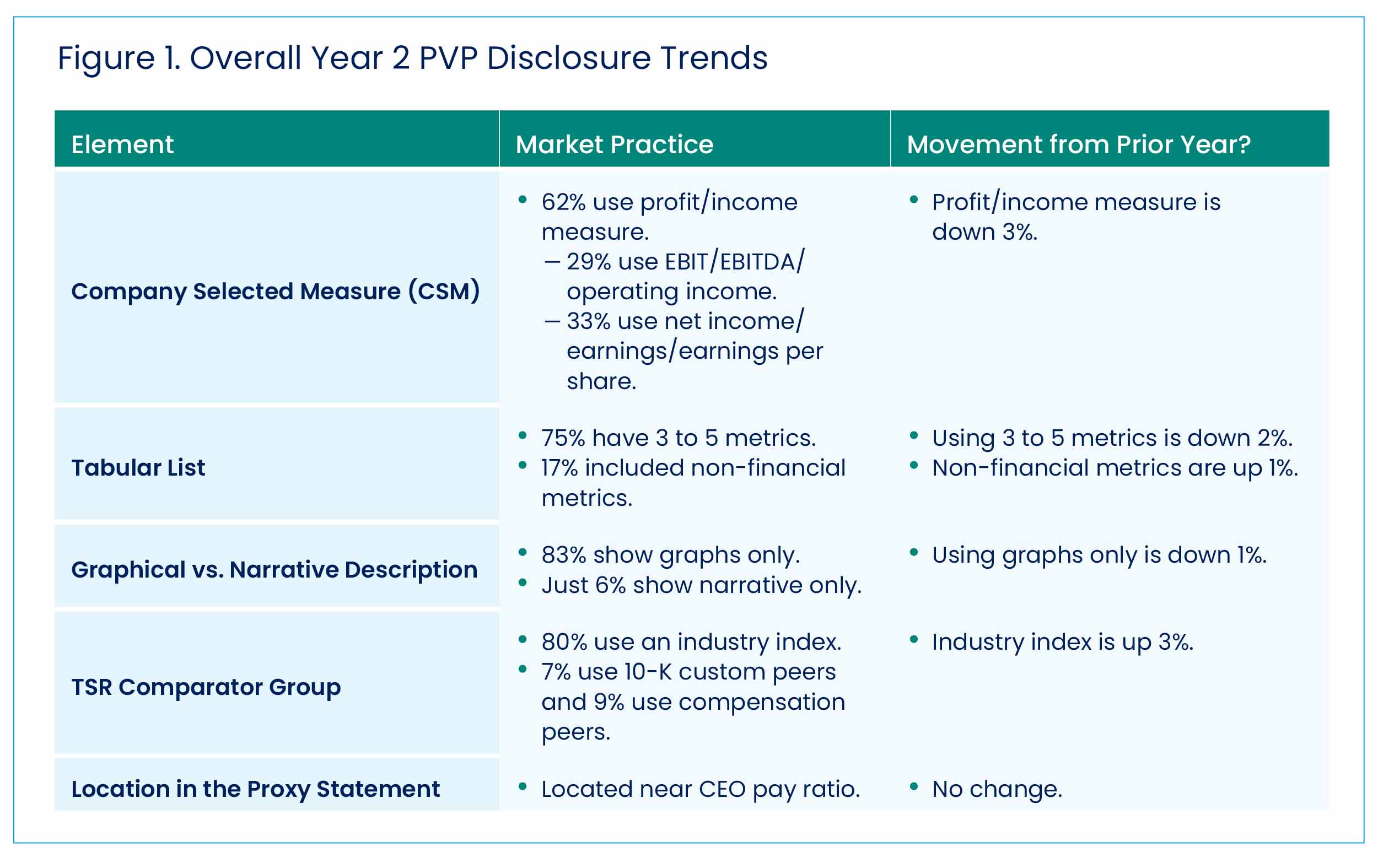

WTW research found that the overall trends in PVP disclosures were comparable to those in the first year of PVP in 2023 (see Figure 1). Most organizations continued to use profit or income metrics for their company-selected measure. This comes as no surprise, as a short list for determining the company-selected measure was to review those used in company executive incentive plans, which tend to rely heavily on profit or income, especially in annual incentive plans.

In terms of the total shareholder return (TSR) comparator group, the market pointed to the use of an industry index, with 80% of organizations opting for that route. The locations of the PVP disclosure continue to be near the CEO pay ratio, and graphical descriptions of PVP were heavily favored over narrative descriptions.

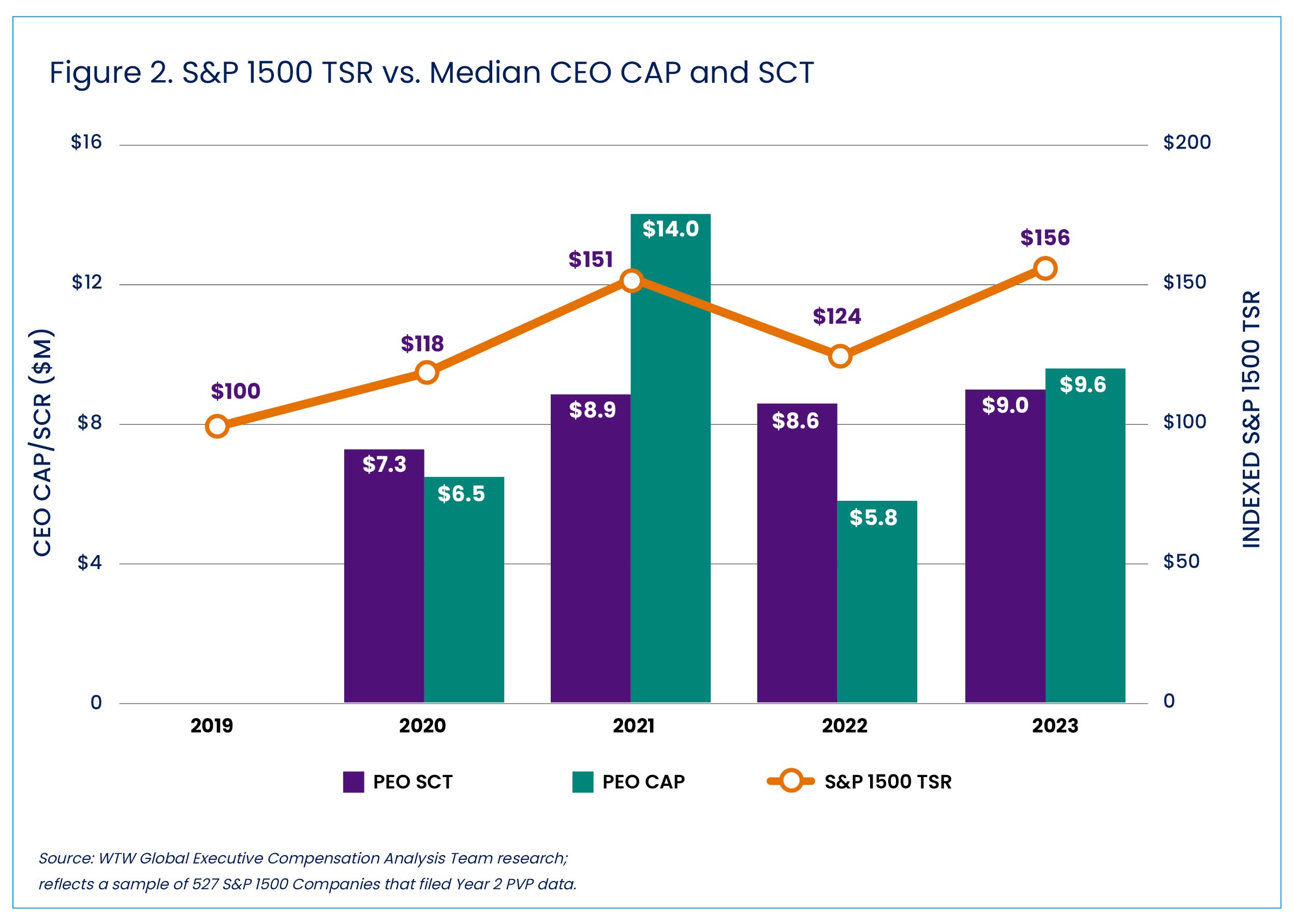

The form of the graphical description of PVP tended to be a dual y-axis chart that compared company and peer TSR performance with compensation actually paid (CAP). WTW collected the CAP values disclosed by companies in Year 2 to compare S&P 1500 TSR to median CAP and summary compensation table (SCT) pay for CEOs (also reflected in Figure 2 as principal executive officers, or PEO). The figure below mirrors the graphical disclosure form chosen by many organizations.

As expected, compensation actually paid tends to track with TSR. Equity is generally valued under CAP by the change in fair value from prior fiscal year end to either vesting date or current fiscal year end, so it is not surprising that it increases and decreases with annual fluctuations in stock price.

Year 2 PVP Disclosure Changes

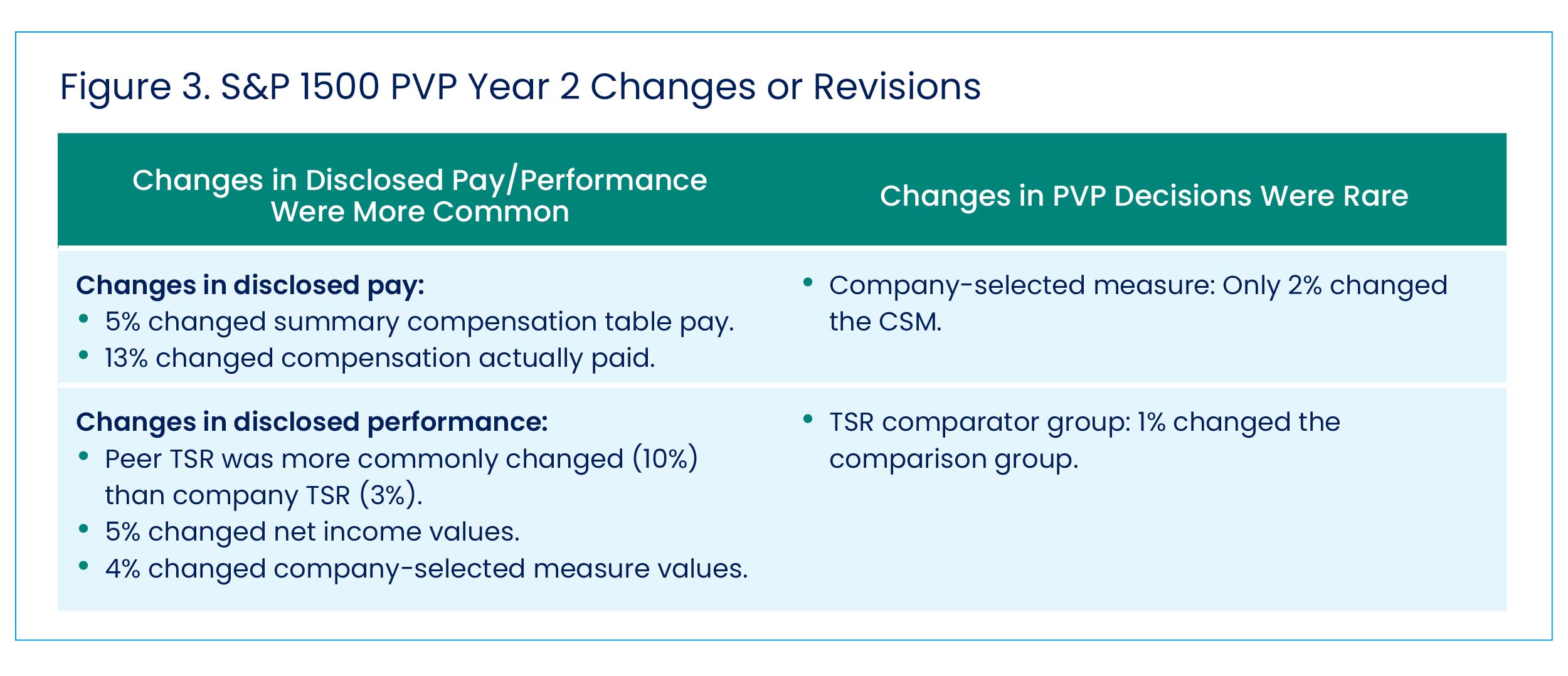

Along with the collection of overall trends in Year 2, WTW also analyzed the disclosures of individual companies to determine any differences between the first and second year (see Figure 3). If your organization made changes to its PVP disclosure for Year 2, you are not alone: 31% of organizations disclosed revisions or made changes to their PVP disclosure for Year 2. Of the types of revisions and changes WTW examined, alterations to disclosed pay or performance values were more common than revisions of PVP disclosure decisions. PVP disclosure decisions include determining the company-selected measure or TSR comparator group.

WTW found only 1% to 2% of organizations changed either of those decisions for Year 2. Changes in disclosed pay or performance were more common.

CAP to SCT Reconciliation Footnotes

While it was clear in PVP Year 1 that the footnote reconciling CAP to Summary Compensation Table (SCT) needed to include multiple years (three years for most companies), for PVP Year 2, WTW tracked whether companies were opting to include just the incremental year or all years with each subsequent disclosure. Companies tended to reproduce prior year reconciliations in the second PVP year, with only 8% of organizations disclosing just a single year in the CAP-to-SCT reconciliation footnote.

Looking Ahead

As companies continue to plan for their annual PVP disclosures, it is safe to say the disclosure trends reaffirmed in Year 2 will remain, absent further C&DIs from the SEC steering companies in a materially different direction. Companies should likely continue to make PVP disclosure decisions grounded to their core incentive plan structure and design to avoid changing the company-selected measure or TSR comparator group annually to produce a comparison that might appear aligned for any single year. Those with a program rooted in paying for performance will tend to show alignment over time.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: