- What is double crediting? If only one seller is involved, the ownership of sales credit is awarded without question to the seller. But if multiple parties are involved in the persuasion process, multiple parties earn sales credit.

- Vertical versus horizontal crediting. Vertical sales crediting is the sales credit awarded to the supervisor of the sellers. Horizontal sales crediting is when two or more sellers are awarded credit for a sale.

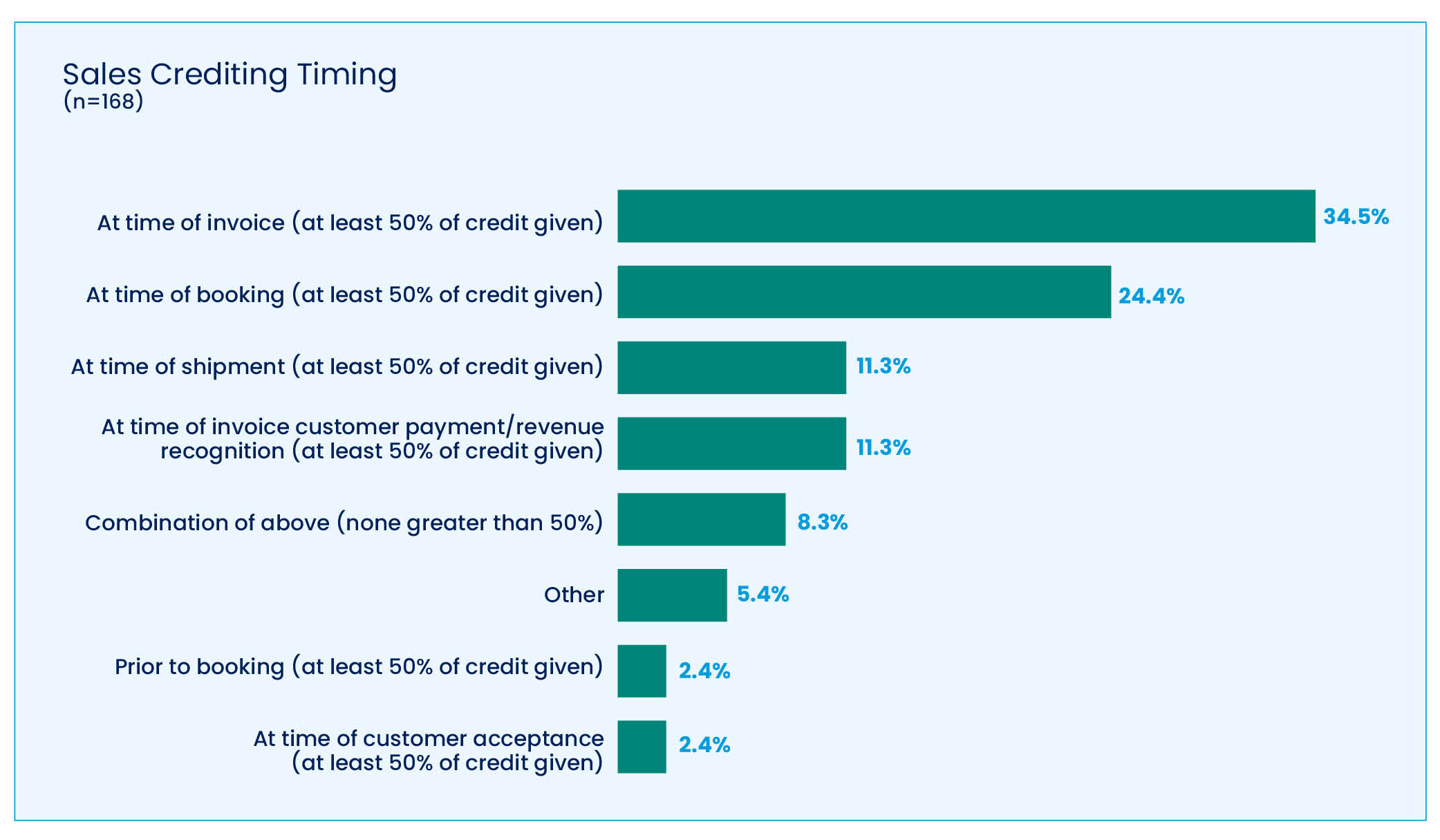

- When sales are credited. When a seller is credited with a sale various across organizations, as it can occur at the time of the booking, when a customer approves a purchase via invoice and shipping, when a final payment is received, or once the revenue is recognized by the organization.

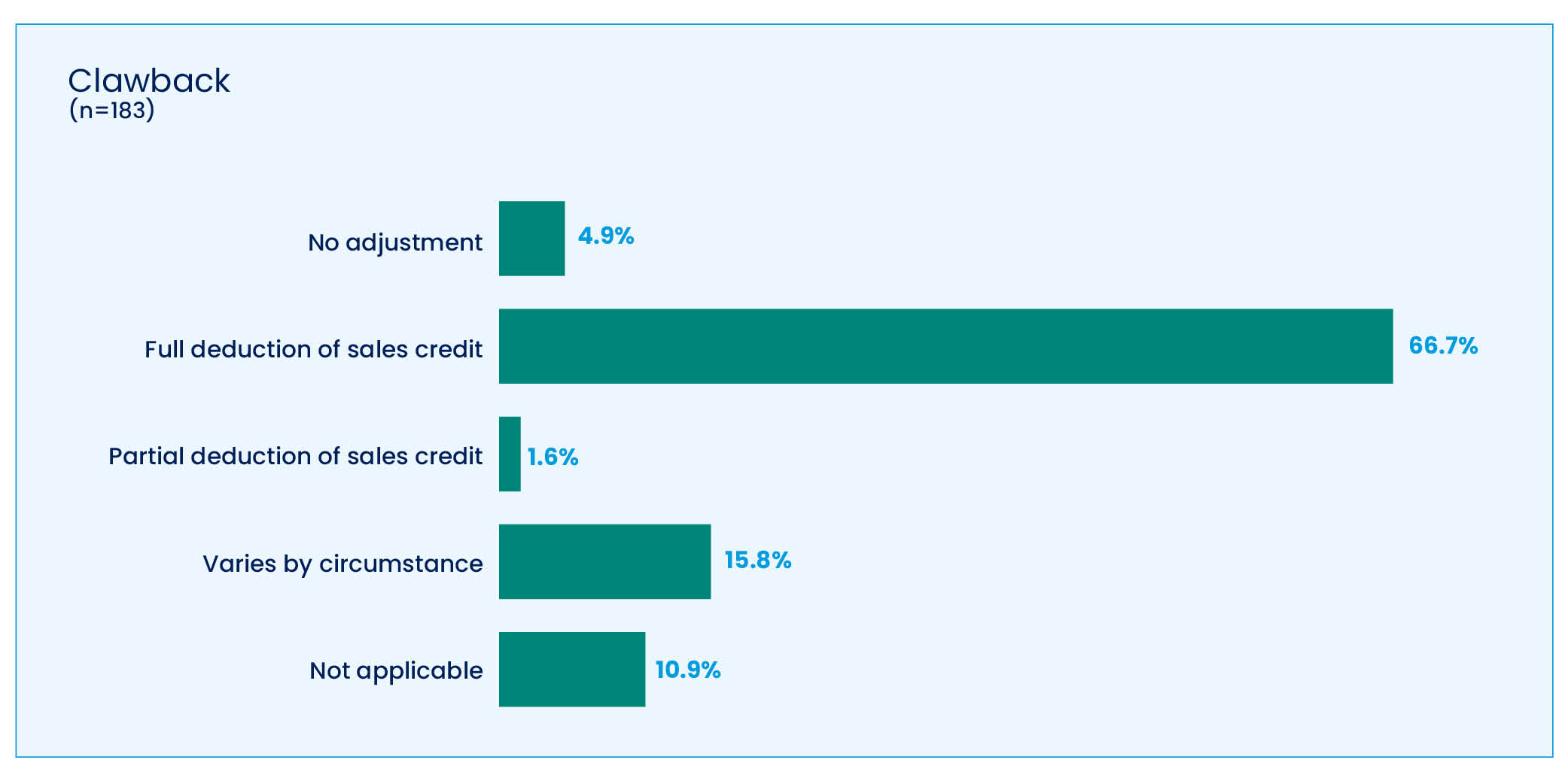

- Clawbacks do occur. Two-thirds of the companies (67%) in an Alexander Group survey apply a full clawback of incentive payments made on non-payment and canceled orders. Less than 5% allow the seller to keep the incentive payments.

On the surface, double sales crediting seems ill-advised and ill-conceived. However, sales crediting is the gateway to sales compensation payments. Sales personnel are keen to ensure that they get credit for a sale.

Once the seller receives sales credit designation for a sales transaction, then the compensation program will make a scheduled incentive payment. No wonder sales credits are carefully monitored transactions. Both sellers and the company want to get it right.

Double crediting, split credits, clawbacks and credit timing are practices affecting sales incentive pay calculations. Let’s take a look at all things related to sales crediting, including definitions, good practices and advisory notes.

Breaking Down Sales Crediting

Sales crediting can be split into two topics: who and when. The “who” topic identifies the responsible party or parties who earned sales credit for a customer purchase. The “when” topic determines the transaction event (order, invoice or payment) when the seller (or sellers) earn sales credit for a sale. Once the “who and when” criteria are met, sellers will get paid at the next scheduled payout cycle.

In its simplest application, sellers earn sales credit when the seller helps the customer make a purchase. Seller persuasion includes providing education, decision guidance and overcoming objections. Sellers receive sales credit on the initial purchase but also earn sales credit if they encourage subsequent purchases, such as contract renewals or new product purchases.

If only one seller is involved, the ownership of sales credit is awarded without question to the seller. But what if multiple parties are involved in the persuasion process? In such cases, multiple parties earn sales credit. This is double crediting. But when would this occur?

National account selling is a good example of when double crediting is appropriate. A national account seller has a unique responsibility to win “approved vendor” status from corporate purchasing authorities. However, actual purchases are made at local facilities.

Account managers or territory sales personnel pursue these local opportunities. A successful sale depends on both sellers: the national account manager gaining approved vendor status and the local salesperson getting a signed order. The transaction could not have proceeded without the successful persuasion efforts of both the national account manager and the local seller. In a quota-based pay system, both the national account manager and the local salesperson carry sales quota for the identified account.

The national account manager receives sales credit when any local seller wins an order from a local facility. Local sellers would earn sales credit and quota recognition for the local sales outcomes. Both would earn an incentive based on a successful sales outcome.

Vertical Versus Horizontal Crediting

Another crediting distinction is vertical versus horizontal sales crediting. Vertical sales crediting is the sales credit awarded to the supervisor of the sellers. Vertical sales crediting moves up the ladder all the way to the vice president of sales — the summation of all sales results. This type of crediting is not considered double crediting. However, horizontal sales crediting is when two or more sellers are awarded credit for a sale.

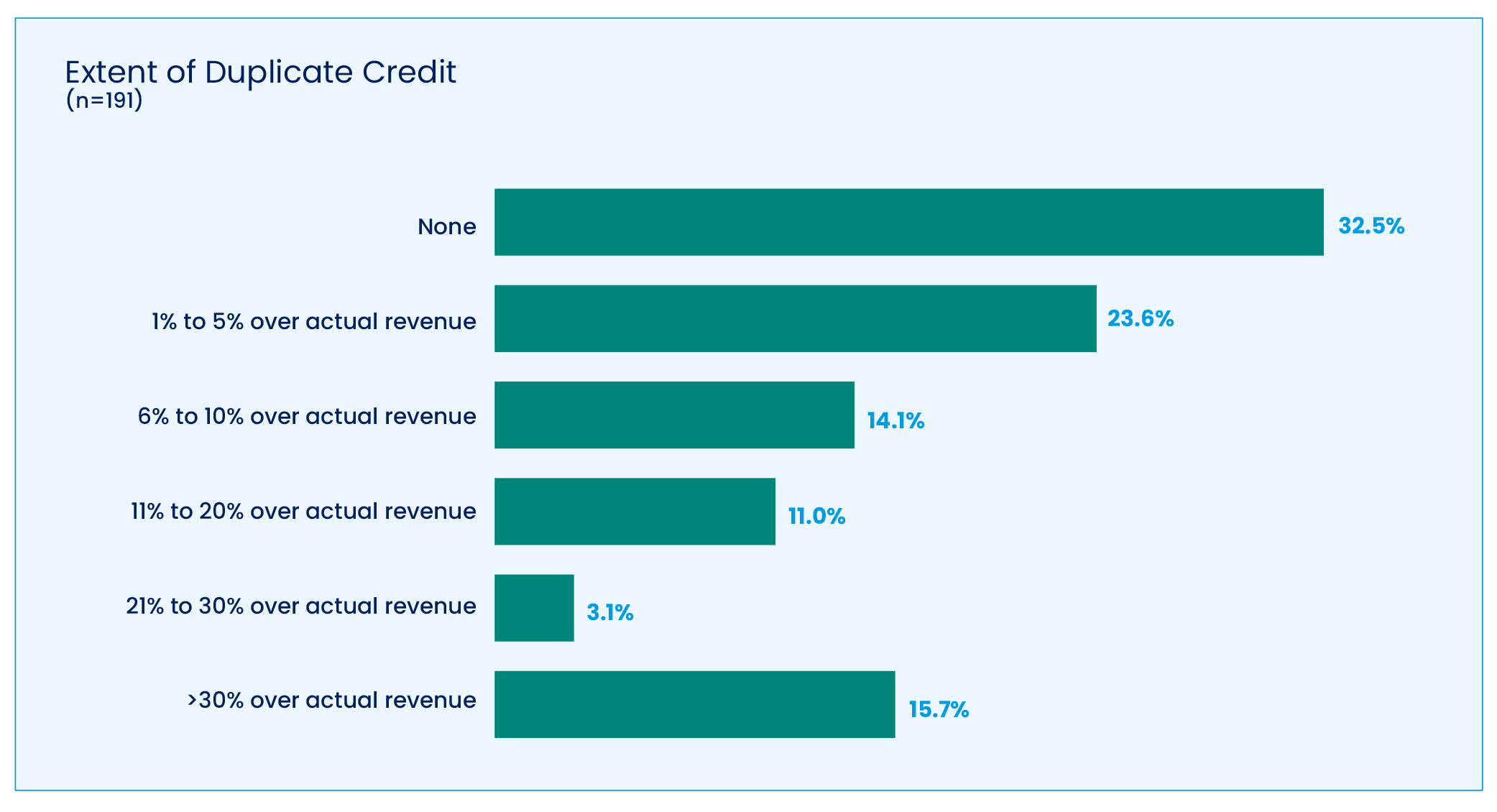

Consider the extent of duplicate crediting. Alexander Group’s survey results reveal that more than 68% provide some level of duplicate crediting; 33% do not. Further investigation would help explain why 16% provide more than 30% duplicate crediting. In these cases, while real revenue equals 100%, the incentive plan paid on 130% (or more) of actual revenue.

Examples of warranted double sales crediting would be between national account managers and local sales personnel, sales representatives and overlay specialists, and joint sales teams of premise and telephone sellers.

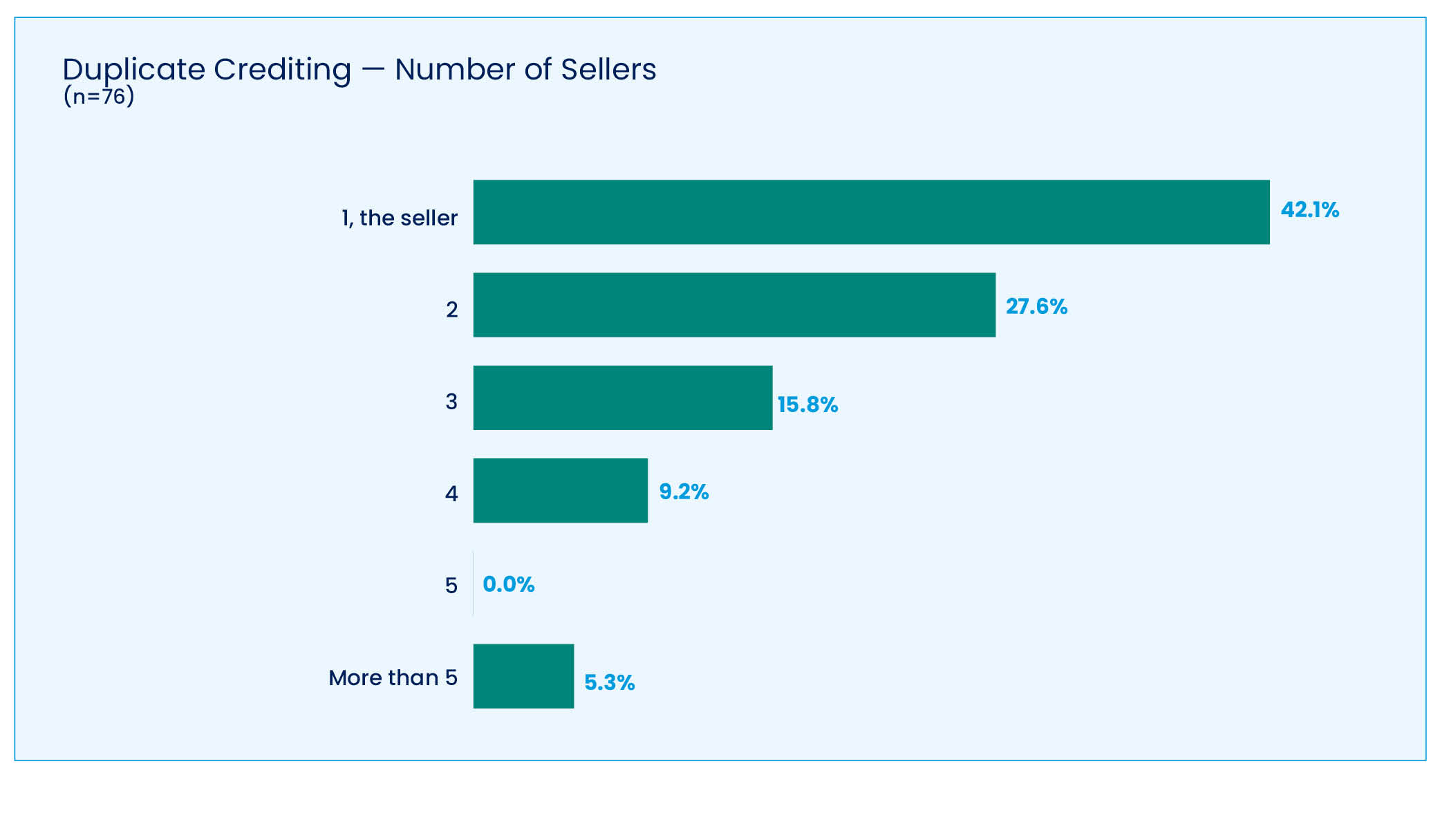

Another test to review double sales crediting practices is to examine the number of sellers getting sales credit on a typical transaction. The following Alexander Group survey findings suggest that 42% only credit one seller, whereas 58% reward two or more sellers. Again, further investigation would need to help explain why 5% of the companies are crediting five or more sellers for the same sale.

Payout Formula

Payout Formula

The two payout formula types — bonus and commission — often treat double crediting differently. A bonus formula measures sales success as a percent of quota achievement. Payouts are tied to quota success. Most bonus formula programs follow the practice known as “double quota/double credit.”

Double quota means both parties — national account manager and the local salesperson — are carrying the quota for the national account. The national account manager’s quota is the total sales for the account regardless of location. The local salesperson only has the quota assignment for the local facilities present in their assigned account base. Both receive credit for a local sale.

On the other hand, a commission formula ties payouts to actual performance, such as revenue, profit dollars or units sold. A commission formula pays a percent of actual performance. The payout does not use percent of quota achievement to calculate the payout. Commission formulas often split the sales credit. For example, the actual sales revenue outcome might split the credit as follows: 25% for the national account manager and 75% for the local salesperson.

The company might even give a premium for engaged sales collaboration by providing a 150% sales credit split: 75% for the national account manager and 75% for the local salesperson.

When Is a Sales Credit Awarded

The second key question is when sales credit should be awarded. Sales credit timing can vary substantially. The following are potential sales crediting timing events.

- Booking. A booking is a signed purchase order/agreement from a customer. The actual purchase has not occurred yet. Perhaps certain delivery and terms must be met before final purchase.

- Invoice and shipment. When a customer approves the purchase, the company sends an invoice. This officially recognizes the purchase by the customer. If the purchase includes materials, the company issues the invoice at the same time as shipment.

- Payment. A final timing point is payment. Payment is when the customer has met all the terms of the purchase agreement and has made final payment for the product or service. For companies with continuing revenue, such as monthly payments, the payment is the most recent and current one by the customer.

- Recognized revenue. Recognized revenue is a less common but still used credit timing. It’s an accounting term. The definition of recognized by revenue varies substantially. Often specified by a company’s contracts, policies and regulatory accounting standards, recognized revenue is when finance accepts the order as a revenue source. A key point: Sales credit and recognized revenue do not need to occur at the same time. Sales credit recognition for sales compensation purposes can occur when it serves the company’s sales strategy objectives. It may or may not match the company’s definition of recognized revenue.

Each company determines when it awards sales credit to sellers. It might be booking, invoice or payment. Sometimes, the sales credit is split, for example, 50% at booking and 50% at invoice/shipment. Alexander Group survey results suggest that time of invoice (34.5%) is the most prevalent time to award sales credit. However, time of booking (24.4%) is also popular.

There are numerous other sales events that can trigger a sales credit. Design wins and qualified sales leads are examples of alternative sales credit milestones.

- Design win. Surprisingly, while often compensated, a design win is not actually a sale. At least, not yet. Hard goods manufacturers, including technology companies, will include sub-components from suppliers (e.g., a motor, a semi-conductor chip or a power modulator). Design win selling occurs during the product design cycle prior to the actual manufacture and purchase by the original equipment manufacturer (OEM) customer. A “design win” would mean that the customer has selected your product if (and when) it goes into production.

- Qualified sales lead. Many sales teams today rely on pre-sales efforts of sales development representatives (SDR). These virtual, telephone, digital contact and social media talent reps develop qualified leads for sales personnel. The key persuasion role is to have a prospect (qualified lead) accept a meeting or demo with a salesperson. Many companies reward SDRs for sales leads that matriculate into orders.

Clawbacks

Clawbacks are recapturing previously paid sales incentives when a customer fails to fulfill the payment terms of the purchase agreement. In such cases, the view is, “We, the company did not get paid, therefore we will not pay an incentive for a no-deal transaction.” Normally, the clawback occurs by subtracting the clawback amount from a future incentive check.

Two-thirds of the companies (67%) in an Alexander Group survey apply a full clawback of incentive payments made on non-payment and canceled orders. Less than 5% (4.9%) allow the seller to keep the incentive payments.

Moving Forward

The Alexander Group has two guiding principles for sales crediting:

- Pay for persuasion

- Credit when the seller is no longer accountable.

Additional advisory notes regarding sales crediting include:

- Double crediting. Carefully audit double crediting to avoid excessive payments. While some double crediting is necessary, investigate when double crediting creates compensable revenue in excess of 112% of actual revenue.

- Team awards. Instead of using double crediting to reward team efforts, create a team incentive and provide payouts based on team results.

- Ransom payments. Don’t use double crediting to buy the cooperation of sellers. For example, duplicate crediting of the inside sales team with the outside sellers may not be necessary.

- Field allocations. While often considered a reasonable idea, allowing field managers to negotiate sales credit among sales functions often leads to misapplication of practices. It’s best to have established, non-variance sales credit practices that prescribe sales credit splits.

Sales crediting practices play an integral part in successful sales compensation plans. And, yes, sometimes double sales credits are the right solution to recognize the contribution of two or more sellers.

Editor’s Note: Additional Content

For more information and resources related to this article see the pages below, which offer quick access to all WorldatWork content on these topics: