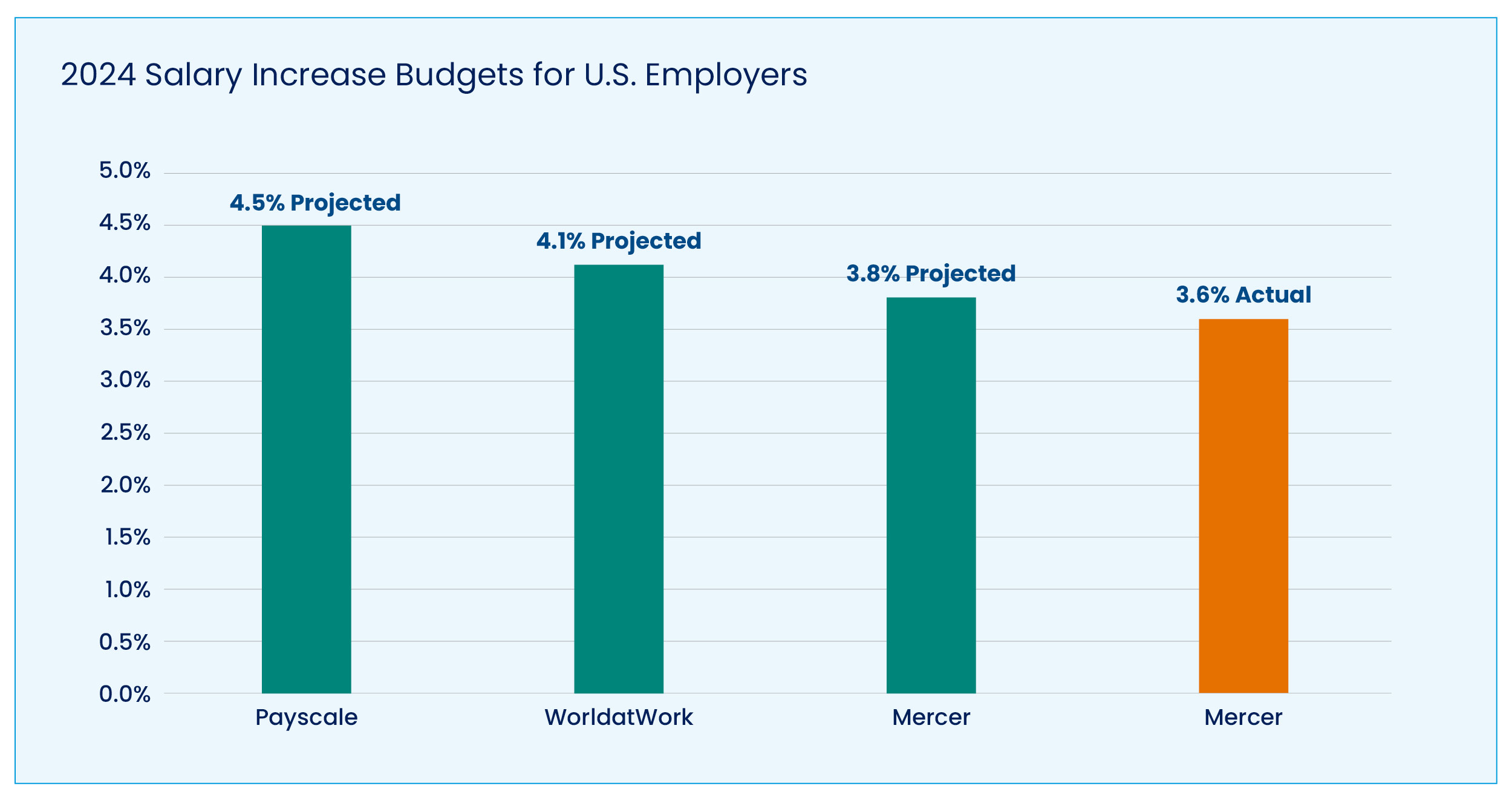

- Projections are down. U.S. employers in a recent Mercer survey reported 2024 annual merit increase and total salary increase budgets were lower than projected. The findings were also lower than earlier projections made in WorldatWork’s Salary Budget Survey and a Payscale report.

- Pay trends influencing the results. Pay transparency and the aftereffects of minimum wage increases in several states may explain the observed pay increase results.

- Focus on the total rewards package. Compensation is just one of many elements that make up a company’s total rewards package. Employers should also review and respond to health and retirement benefits, career paths and development, and flexibility and well-being.

As employers approach the halfway mark of 2024, many of them are finding their budgets for annual merit increases and actual workforce salary increases are lower than they projected.

Mercer’s 2024 QuickPulse U.S. Compensation Planning Survey of more than 1,000 U.S. employers found annual merit increase budgets increased by 3.3%, on average, while total salary increase budgets went up by 3.6%. Those numbers are down from Mercer’s November 2023 projections of 3.5% and 3.8%, respectively.

Salary Budget Survey 2024-2025: Participation Closes May 15

Mercer’s latest survey findings fell below WorldatWork’s 2023-24 Salary Budget Survey of 2,146 participating U.S. organizations, which in July 2023 projected 4.1% pay increase budgets in 2024. Payscale’s 2024 Compensation Best Practices Report, released in March, predicted a higher average base pay increase of 4.5% in 2024.

For historical perspective, Mercer projected 2023 annual merit increases of 3.9% and total salary increases of 4.3%, then provided revised figures of 3.8% and 4.1%, respectively, in April 2023.

“While the labor market remains competitive, there are signs it is cooling or at least moderating,” said Sue Holloway, a compensation content director at WorldatWork. “There remain variations in the market, as illustrated by reported and meaningful differences in merit increase budgets across industries.”

For example, Mercer’s survey found:

- Industries such as transportation equipment (3.9%), services (non-financial) (3.6%), mining and metals (3.6%), consumer goods (3.6%) and chemicals (3.6%) are providing merit increase budgets above the 3.3% national average.

- Healthcare service and the retail and wholesale industries (each at 2.9%) and high tech (3.0%) lag the national average. A significant proportion of the workforce in healthcare and the retail and wholesale industries are paid hourly, for whom employers continue to struggle with hiring and retention.

“These trends, combined, suggest that while the labor market may be stabilizing after a period of increased turnover, it remains strong,” said Michael Citron, a principal and compensation and rewards consultant at Mercer. “Employers are still focused on their pay positioning and are using increases as a way to enhance retention in the face of continued pay movement in the market.”

Contributing Factors

While many trends could explain the observed merit and total pay increase results, Citron said one factor may include organizations’ responses to pay transparency legislation and trends.

Tool: Pay Equity Laws by State — Are You in Compliance?

“While different states have different laws or regulations around pay transparency, we see nearly half (46%) of organizations are either already sharing pay ranges in a standardized way or are exploring implementing a standardized approach beyond what is legally required,” he said. “In short, pay transparency is becoming more prevalent, and employers are often right-sizing their compensation levels to prepare for sharing with employees.”

Another key factor is the rise of minimum wage increases, according to Citron. “In California alone, we’ve seen minimum wage increases this year for the fast-food industry and upcoming for the healthcare industry,” he said. “Many organizations are not just bringing those below-minimum levels to the new minimum but are employing a nuanced pay increase strategy to mitigate compression.”

Off-Cycle Increases

Citron noted that many organizations are turning to off-cycle pay adjustments to enhance compensation. The survey data shows such adjustments are becoming more prevalent, with 62% of organizations reporting they have or will provide off-cycle increases for 2024, compared to 52% last year. Top reasons for administering these increases include market adjustments (81%), retention concerns (78%) and countering competitor offers (63%).

Among organizations utilizing off-cycle increases, Citron said the frequency is as follows:

- Monthly (2%)

- Quarterly (14%)

- Twice a year (27%)

- Once a year (51%)

- Other (6%)

Preparing for 2025

While budgeted merit and annual increase rates are decelerating, it is important for companies to remain proactive in their compensation strategies, Citron said.

“Factors such as pay transparency and minimum wage increases are expected to continue, driving the need for organizations to stay ahead of the curve,” he said.

Learn: Total Rewards Management

It’s also important to recognize compensation is just one of many elements that make up a company’s total rewards package. Health and retirement benefits, career paths and development, flexibility and well-being, and the ability to do meaningful and purposeful work are all additional pieces of the pie, said Citron.

“Not every organization will be — nor can be — top of the market when it comes to compensation, and that is acceptable,” he said. “The key is to optimize your total rewards strategy and offerings by listening to your employees’ needs, understanding the market landscape and responding with an intentionally crafted investment strategy. This may involve reallocating resources to establish a more compelling total rewards portfolio for critical talent without necessarily increasing costs.”

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: