For WorldatWork members

- Navigate the Executive Compensation Terrain of an Outside CEO Hire, Workspan Magazine article

- Compensation Structure Policies and Practices, research

- Proxy Tables Checklist, tool

For Everyone

- An Innovative, Best-Fit Approach to Design Executive Comp Programs, Workspan Daily article

- Executive Rewards Mastermind, WorldatWork event

- More Executive Compensation content

In an ideal world, organizations would always appoint a permanent CEO after following a well-thought-out succession plan. However, the world is an imperfect place, and circumstances sometimes require quick action and an interim solution. Not having a leader in the current competitive and fast-paced corporate landscape creates ripple effects that may be felt for years.

When organizations find themselves without an immediate CEO successor — whether because a successor was not previously identified or a designated successor is not ready in a sudden emergency — an interim CEO should be appointed. Typically, the interim CEO provides operational stability and expertise while the board conducts due diligence in searching for and selecting a permanent executive who will design and lead the organization’s future.

The role of interim CEO is unique in every organization, and there are important nuances to consider when setting their pay:

- Is the appointed individual from the executive team or board of directors?

- What is the anticipated duration of interim service?

- Which pay elements will be provided?

- Will incentives or stock compensation vesting be aligned with — or differ from — the organization’s standard executive pay program?

Assessing the organization’s unique situation will help set the most appropriate compensation package.

Considerations for Selecting the Interim CEO

Key decisions are required when appointing an interim CEO, and each one helps inform the compensation package:

- Succession management. The process for identifying a temporary CEO and establishing an onboarding process should be set before an unexpected vacancy. This process should include a future-focused CEO success profile, an emergency succession plan and internal candidate readiness assessments.

- Service and duration assessment. Based on WTW research, interim CEOs serve for five months, on average. Understanding the interim CEO’s priorities, responsibilities and anticipated length of service helps guide decisions related to their pay structure.

These factors inform organizations about who will be selected for the interim CEO role and how they will be paid. WTW’s Global Executive Compensation Analysis Team (GECAT) reviewed the public filings of S&P 1500 companies that appointed interim CEOs between 2019-2023. (Note: Proxies filed during any given year reflect compensation and decisions made the previous year. The most current full year of proxy disclosure at the time of this writing was 2023.)

Through this analysis, WTW identified 142 instances of interim CEOs (excluding organization founders who transitioned into the role).

Who Serves as Interim CEO, and How They Are Paid

Unsurprisingly, those chosen to take on the interim CEO role have a specific set of abilities, a track record of success in business and leadership experience. The WTW analysis focuses on interim CEOs who come from the executive team or board of directors rather than outside recruits.

Executive Officers as Interim CEO

When an organization finds itself without a CEO, 55% select a named executive officer (NEO). Prior to being named interim CEO, more than one-third of these NEOs held the position of CFO.

Having been a member of the former CEO’s internal team, an NEO possesses the ability to promptly assume CEO responsibilities temporarily and deal with the organization’s immediate challenges. Compared with the pay of the former CEO, 77% of named interim CEOs earned at median:

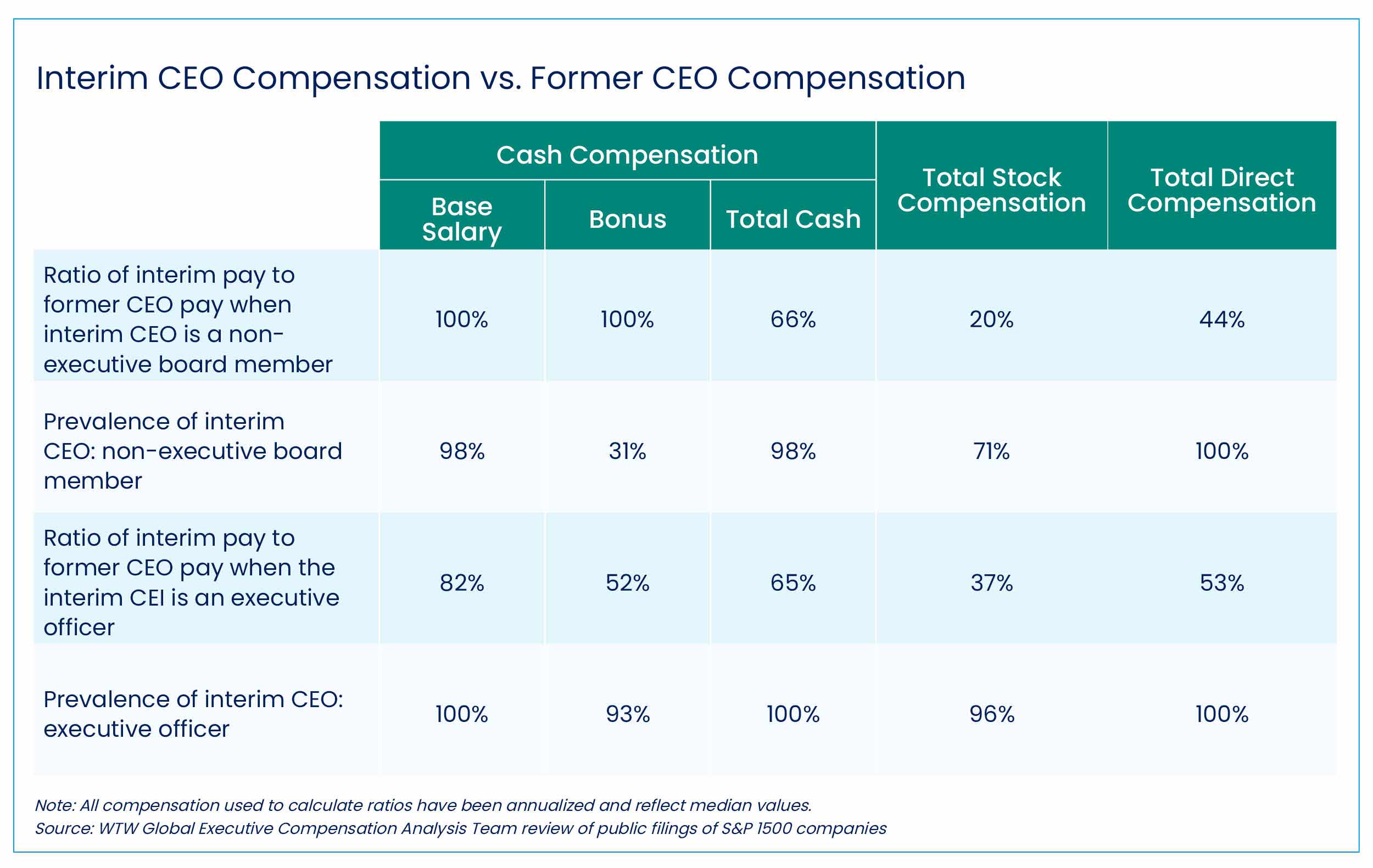

- 53% of the total direct compensation

- 82% of salary

- 37% of long-term incentives (LTIs)

(The bulleted numbers are reflected in the figure below.)

The other 23% of named interim CEOs did not receive additional compensation for their temporary service; however, 80% served in the interim CEO role for three months or fewer.

Non-Executive Board Members as Interim CEO

When executive candidates are unavailable or not ready to take the helm even temporarily, it is common to appoint an interim CEO from the organization’s board of directors. Of directors who were appointed interim CEO, 38% were the non-executive board chair.

Pay for a non-employee director serving as interim CEO switches from typical board pay — generally comprising cash and equity retainers — to compensation that more closely mirrors that of the executive team. Among directors serving as interim CEO, 88% received compensation in recognition for their service. At the median, directors serving as interim CEO received $1.3 million cash compensation (cash plus bonus).

In several cases, director interim CEOs received higher fixed pay compared with the outgoing CEO’s pay to offset limited participation in incentive programs (e.g., just 29% of directors participated in the organization’s annual incentive plan). However, 22% received a special bonus; these were provided for either signing on to serve as interim CEO or for the successful completion of the interim service. The median value for this special bonus was $500,000.

In addition to cash compensation, directors received $1.5 million in stock-based compensation at the median. Ninety-one percent of stock compensation received was in the form of restricted stock/restricted stock units (RSUs), most commonly cliff-vesting after one year. While restricted stock/RSUs were the most prevalent vehicle, 20% of interim CEOs were granted stock options (see figure) and another 14% were granted performance-based LTIs.

In the below figure, consider:

- Lines 1 and 3 reflect the ratio of pay received by the interim CEO vs. the former CEO. For example, on Line 1, interim CEOs from the board received 100% of the former CEO’s salary (at the median); on Line 3, interim CEOs from the executive team received 82% of the former CEO’s salary (at the median). Then note that Lines 2 and 4 reflect the prevalence of those interim CEOs receiving that element of pay.

- For the “bonus” column, for Lines 1 and 2, only 31% of interim CEOs from the board participated in the annual bonus plan (Line 2); however, of those who did participate, they did so at the same rate (100%) as the former CEO. So, if the median value for the former CEO was 150% of base salary, then the interim CEO also participated in the plan at 150% of base salary.

Set Your Organization Up for Smooth Sailing

While organizations hope to not encounter an unexpected interim CEO situation, the reality is that such situations take place — as some of your own board members may have experienced at other companies. Be prepared and have a game plan in place.

- Ensure the board has established CEO succession management for not only planned transitions but also quick and unexpected vacancies.

- Determine answers to the important questions of “who?” and “for how long?”

- Establish overall contribution expectations and agree on guiding principles for compensating the interim CEO, grounded in organization stewardship and overarching principles of executive pay (purpose, alignment, accountability and engagement).

- Prepare to be agile.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: