For WorldatWork Members

- Stay Interviews: A Simple Way to Boost Retention, Workspan Daily Plus+ article

- Reimagining Rewards Strategies in the New Landscape of Work, Journal of Total Rewards article

- How Qualitative and Quantitative Data Can Influence Benefits Design, Workspan Daily Plus+ article

For Everyone

- Pulse Survey Reveals Tech Industry Holding the Line on Stock-Based Compensation, Workspan Daily article

- Recent HR Software Acquisitions Point to More AI-Focused Future, Workspan Daily article

- How An Industry Leader Sees Technology Transforming Total Rewards, Workspan Daily article

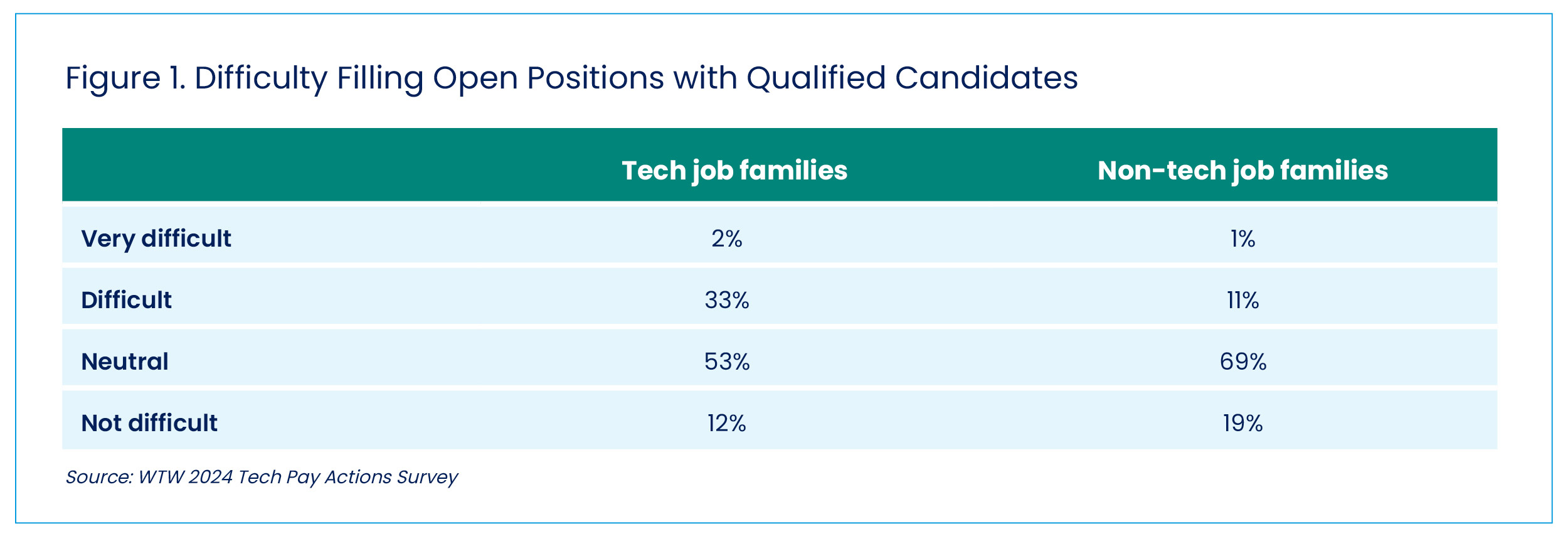

Notwithstanding a persistent string of layoffs in the technology sector over the past year, attracting the right tech talent continues to pose challenges for employers. According to the findings from WTW’s 2024 Tech Pay Actions Survey (see Figure 1), 33% of respondents said it was “difficult” to find qualified candidates to fill open positions for tech-related jobs. For comparison, just 11% of respondents categorized the current talent acquisition environment as difficult for non-tech jobs.

As the tech industry shifts its focus from staffing for growth to managing productivity and costs, given the current economic climate, the survey’s results provide insights into some of the actions companies are taking to drive pay program effectiveness and return on investment.

Overall Investment Stays Steady

According to the survey, most tech companies plan to maintain their overall level of investment in pay programs. The maintenance theme carried through several specific areas.

- Base pay. Pay increase budgets are moderating, with only 4% of companies expecting to fund pay increase budgets above 6% (down from 27% of companies in 2023). However, nearly 1 in 3 companies still expect to fund pay increase budgets at 5% or higher this year.

- Annual bonuses. Despite 2023 headwinds, 75% of companies report funding 2023 bonuses (paid in 2024) at 100% or more of target. That said, 11% expect to fund at less than 50%. Most survey participants said they had no plans to change individual target-incentive levels. Fifteen percent said they planned to increase targets, which is more than double the percentage that planned to do so in 2023.

- Long-term incentives (LTI). Most companies do not plan to change eligibility for LTI this year. The 2023 survey showed some companies pulling back at entry and individual-contributor levels, but this year’s survey shows more of an uptick at entry levels. Tech companies plan to hold the line on LTI grant values in 2024 for both tech and non-tech job families, and most companies expect share spend to remain roughly the same, with some burn-rate decreases expected for larger companies.

- Pay mix. Most firms plan to maintain their direct compensation pay mix. Those companies planning a change in pay mix are shifting more weight to variable pay.

- Overall investment in total direct compensation. For 2024, just 5% of survey participants said they plan to enhance the monetary value of the overall rewards package.

In addition, increased emphasis is being placed on preparation and effectiveness.

- Preparing for pay transparency and pay program effectiveness. Survey participants reported a focus on building or refreshing foundational programs (e.g., job architecture, leveling frameworks, skills frameworks, performance management programs) to build confidence in the integrity of pay program outcomes and decisions and to drive higher effectiveness. Additionally, U.S. and European pay equity and transparency legislation is driving a focus on pay communication and more scrutiny of pay practices, prompting many companies to refresh their foundational programs.

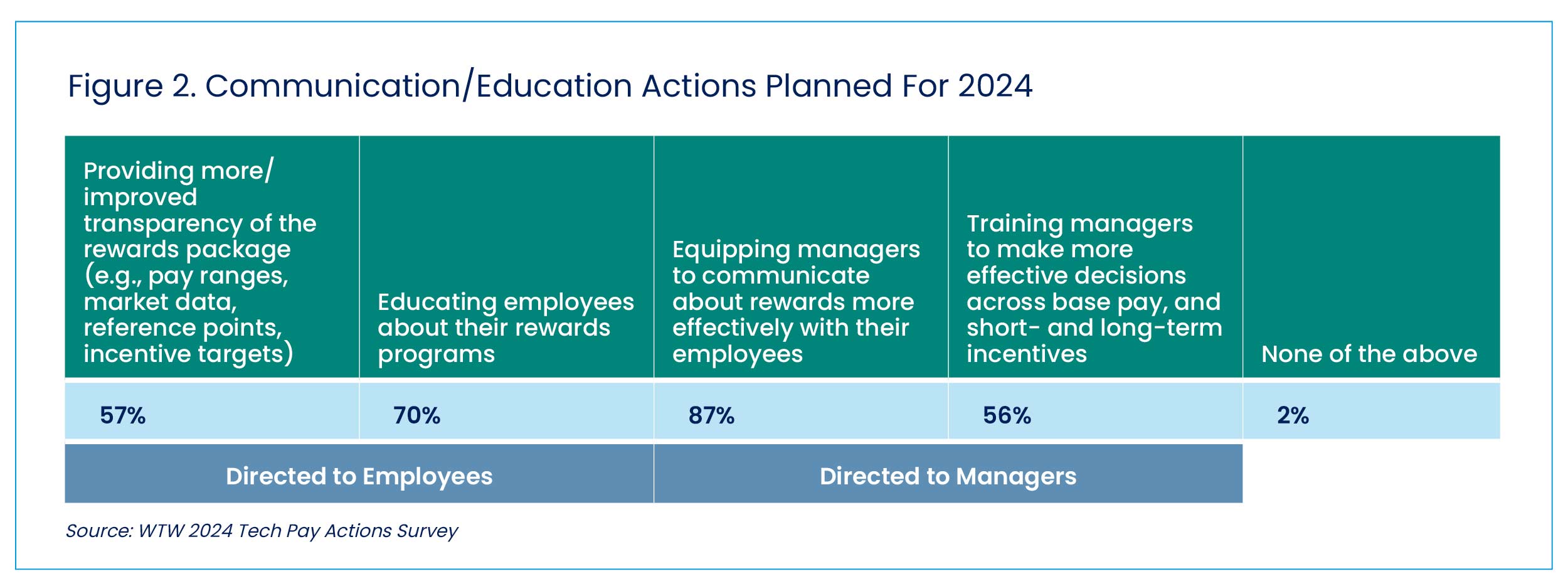

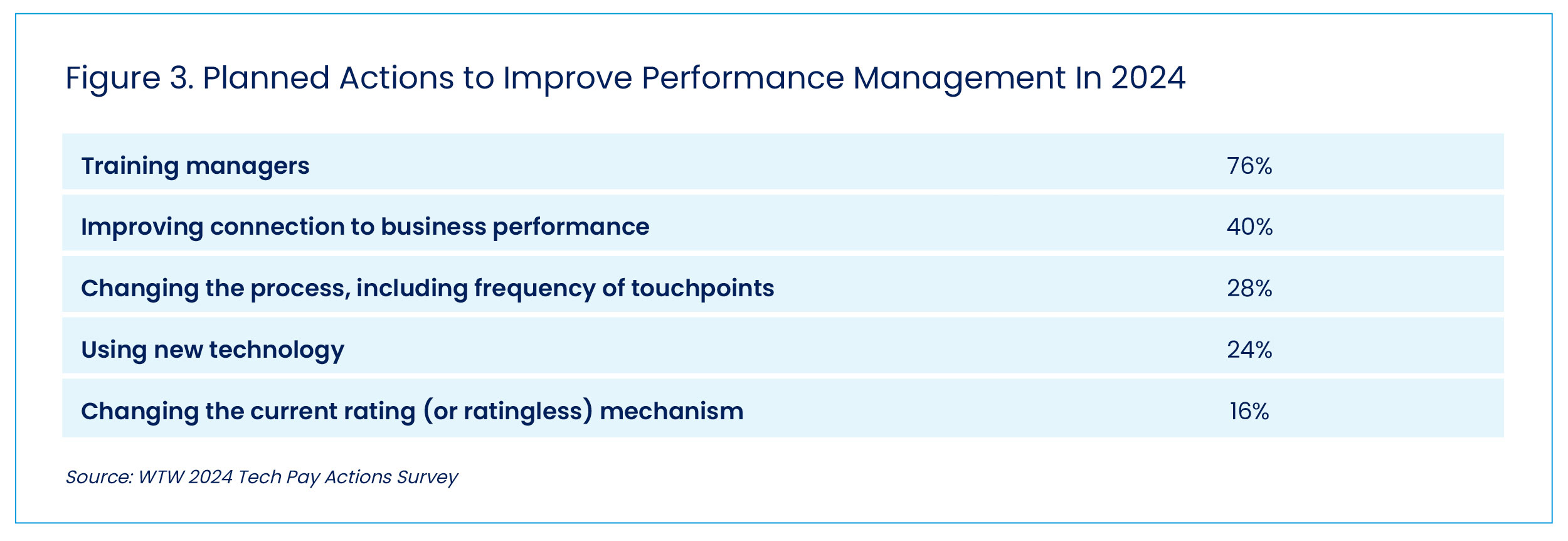

- Investing to build awareness and manager effectiveness. Though few tech companies plan to enhance the monetary value of their 2024 rewards package, most do plan to invest in employee communication and manager training. Top priorities this year include equipping managers to use performance management more effectively, make better compensation decisions and communicate rewards more effectively (see Figures 2 and 3). Companies also plan to invest in direct-to-employee communication to build awareness and appreciation.

Skills Frameworks Eyed to Support Talent Development, Retention

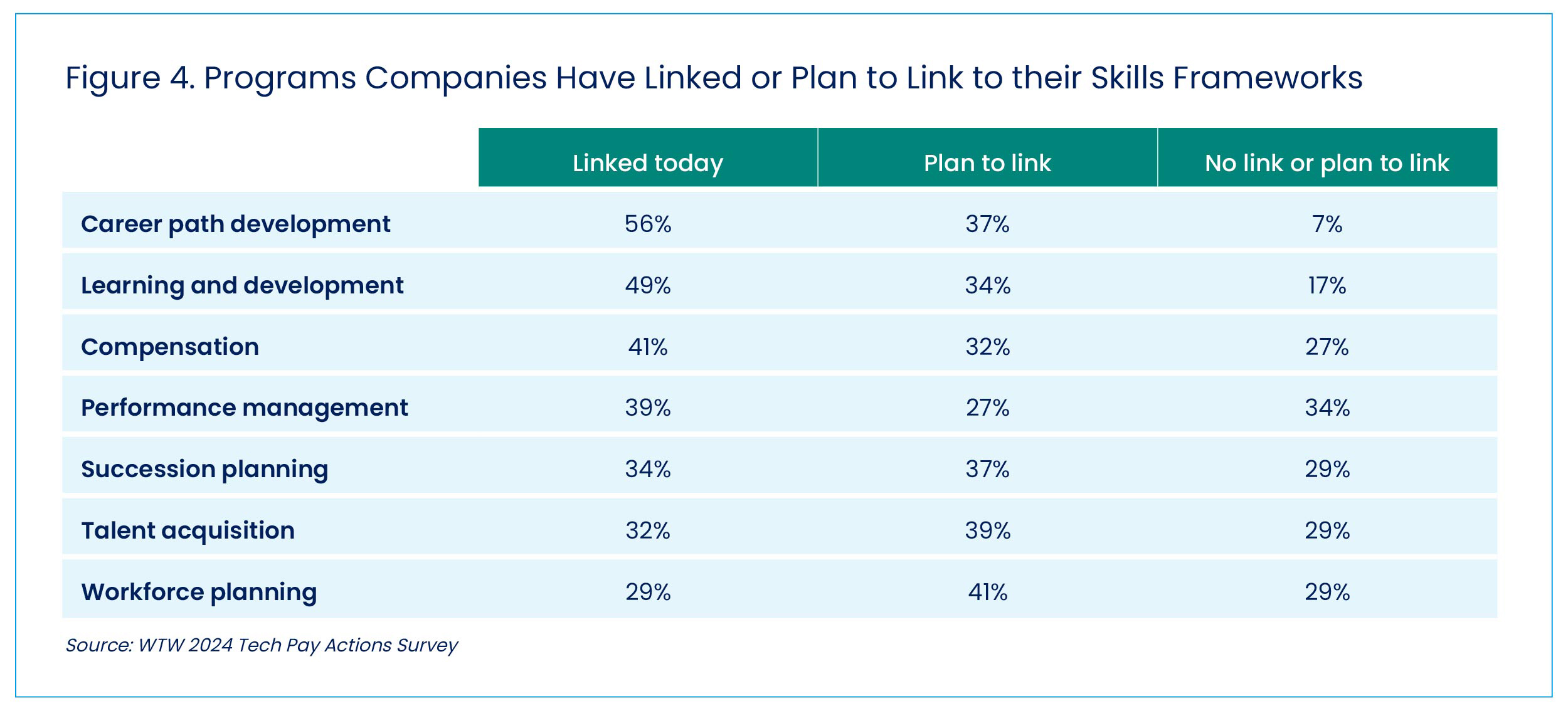

Among survey participants, 24% reported having a skills framework in place for tech jobs, and another 47% are either developing or planning to develop one. For those that have or are developing a skills framework, the top priorities are to link it to career path development and learning and compensation to drive retention (see Figure 4).

Innovative Reward Approaches May Deserve a Closer Look

Relatively few survey respondents reported the use of innovative key- or top-talent reward approaches, despite the strategic differentiation these programs can provide. Some similarity was found when examining short-term and long-term plans.

- Short-term incentive/bonus plans. Although pay for performance is a universally stated objective for short-term incentives, most companies reported only moderate differentiation, with top performers earning less than 150% of target. To strengthen pay-for-performance differentiation for top performers, about 10% of companies use supplemental bonus-pool funding.

- Long-term incentive plans. Similarly, only about 20% of companies reported using top-talent long-term incentive grants. This was a surprising finding, given these programs are an effective way for companies to attract and retain mission-critical talent.

Three Findings-Driven Opportunities to Consider

When considering ways in which tech companies can drive effectiveness and ROI from their pay programs, three prime opportunities emerge from this year’s survey findings:

- Search for missing pieces. Evaluate the less prevalent but strategically differentiating practices highlighted in the survey. Might they be implemented for competitive advantage at your organization?

- Scrutinize to build integrity. Remember that any strategic pay differentiation — be it based on job family, skills or performance — needs to stand up to increased scrutiny related to pay transparency and equity. Establish or refresh your foundational programs, practices and governance as needed to build confidence in the integrity of your pay program decisions.

- Elevate training and communication. Consider investing in manager training and direct-to-employee communication to increase employee awareness and appreciation of your company’s pay package.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: