- The law specifics. The EU Directive passed in June 2023, and member states have until June 2026 to adopt its requirements. Employers with 250 or more workers will need to immediately comply.

- Pay reporting requirements. EU employers will be required to report on their mean and median gender pay gaps. Pay gap reporting must include variable compensation components and be segmented to include categories of workers (i.e., workers performing the same work or work of equal value).

- Pay equity components. Employers are obligated to remedy pay gaps of 5% or more and increase pay transparency for job candidates and employees. In cases of pay discrimination, the burden of proof shifts to the employer.

This article is Part 1 of a two-part series that examines requirements for the European Union’s Pay Transparency Directive. Part 1 focuses on specifics of the law and what it means for EU employers. Part 2 focuses on how U.S.-based employers with operations in the EU may go about developing a global pay equity strategy and reporting plan.

While pay transparency legislation continues to expand and take shape in the United States, the European Union (EU) is positioning itself as a model.

The EU passed its Pay Transparency Directive in June 2023, with a goal of addressing the 12.7% gender pay gap within the union. Member states have until June 2026 to adopt the directive’s requirements, with immediate compliance stipulated for employers with 250 or more workers.

Read: EU Pay Transparency Rule Promises Big Impact on Reward Policies

Organizations that are unprepared to comply risk fines, penalties and reputational damage. Thus, the onus is on employers with operations in the EU to develop a comprehensive pay equity strategy and reporting plan.

What’s Required?

Under the directive, EU employers must publicly report on gender pay gaps annually or triennially (based on employer size), with initiation as soon as legislation is incorporated by the member states. Countries such as Spain, which already have extensive pay data reporting laws in place, are expected to adopt the EU requirements well ahead of the June 2026 deadline. Under the overarching directive, pay gap information must encompass both base pay and “any other form of compensation.”

Applicable employers will be required to calculate the following:

- Mean and median gender pay gap

- Mean and median gender pay gap in complementary or variable components of pay (e.g., bonuses)

- Proportion of female and male workers receiving complementary or variable pay components

- Proportion of female and male workers in each quartile pay band

- Pay gaps between categories of workers (i.e., workers performing the same work or work of equal value), broken down by base salary and complementary or variable pay components.

Each member state will decide organization compliance requirements. While workforce size will determine applicability, it’s important to note the directive deliberately uses the wider term of “worker” vs. “employee” to account for contractors.

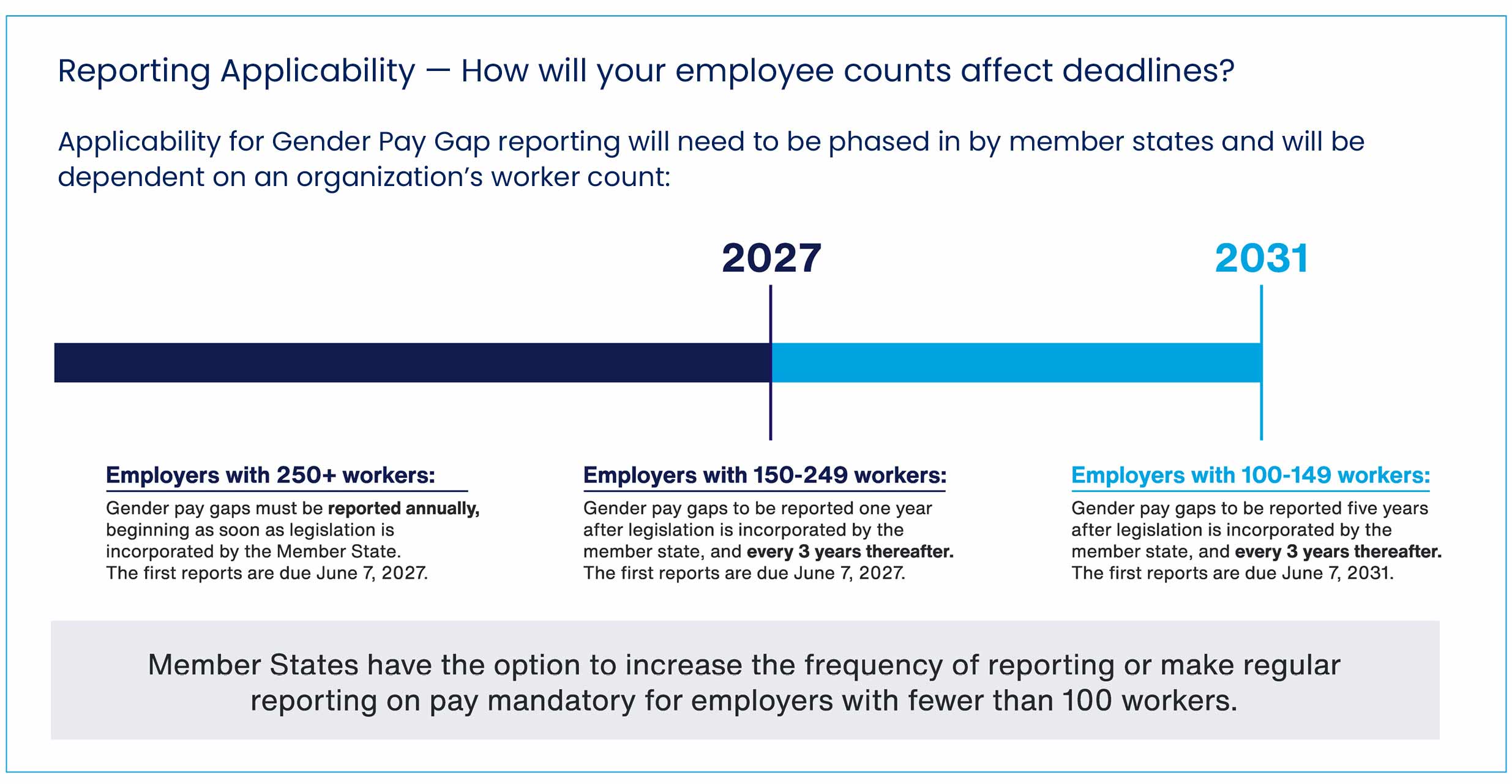

The directive has a gradual rollout to account for the significant enhancements to employers’ reporting requirements, plus the additional burden on smaller employers.

The below figure illustrates the reporting timeline by employer size, with those with 100 to 149 workers having until June 7, 2031, to comply.

Also of note, EU member states can adapt reporting requirements as they choose, including frequency of reporting and size of employer required to report.

In addition to reporting requirements, employers are obligated to remedy pay gaps of 5% or more that cannot be explained based on objective gender-neutral factors. Employers will be subject to penalties and legal action if they have not closed the gap within six months.

Further, the directive calls for employers to increase pay transparency for current and prospective workers. And, in cases of pay discrimination, the burden of proof shifts to the employer.

The State of the EU

Directive compliance will likely be a significant shock to the system for employers in many EU countries; however, some countries, such as Belgium and Spain, have minor pay gaps and robust reporting requirements in place relative to many of their EU counterparts. Thus, employers in those member states appear well positioned to adapt.

Read: Researching the Expanding World of Pay Transparency

Others (e.g., Estonia, Austria, Switzerland, Germany) currently have gender pay gaps well above the EU average and minimal pay data reporting requirements. Thus, employers in those countries will likely need to overhaul their existing pay equity and transparency practices and policies.

The gradual nature of the timeline, plus the availability of various resources for employers, may prove helpful for organizations in those countries to assemble and mobilize an action plan toward compliance.

Action Items for Employers to Prepare

The directive puts a fairly clear task on EU employers. Initial steps toward compliance for employers in the union should include:

- Provide information about the pay level of their job listings prior to job interviews.

- Provide workers information on their individual and average pay levels, categorized by gender, for workers doing the same work or work of equal value.

- Consider the legal impact since, in cases of alleged pay discrimination, the burden of proof is on the employer.

- Consider “intersectional discrimination,” which is defined for the first time in EU legislation as discrimination and inequality based on the crossover of multiple identities, such as race, gender, disabilities, age, etc.

- Consider the needs of workers with disabilities.

In addition to these, employers likely should reevaluate their recruitment processes to comply with salary range and history requirements. One way to achieve this is to create equitable, explainable and competitive salary ranges. Toward this, employers should consider: Is the base salary competitive and commensurate with employee skills?

Other items for employer consideration include:

- Explain aspects of pay. Prepare to explain how you differentiate and define performance in setting base salaries. Pay transparency legislation means workers must receive access to criteria used to define salary and pay raises.

- Analyze pay gaps. Identify the causes where pay disparities exceed 5%. If there is no objective justification, consider ways to address any anomalies to remove those gaps.

- Audit intersectional pay equity. Assess and identify where instances of intersectional discrimination/inequality (as defined above) have occurred, are occurring or may have the tendency to occur.

Some employers can cater their strategy to ensure compliance with their specific jurisdiction. However, given the state of remote work and proximity between many EU countries, organizations should consider implementing a global pay equity strategy to prepare for the nuances adopted by different member states.

Moving toward a global pay equity strategy is not only increasingly becoming a legal requirement, it is, in many cases, a business imperative. Employers that create such a strategy are more apt to achieve pay equity and experience hiring and retention benefits, and increased levels of engagement, trust and inclusiveness.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: