For WorldatWork Members

- Compensation Structure Policies and Practices, research

- Compensation Committee Toolkit, tool

- 5 Minutes With … Athar Siddiqee, Micron Technology’s Global Total Rewards Leader, Workspan Magazine article

- Why It’s Time for a Compensation Philosophy Refresh, Workspan Magazine article

For Everyone

- Executive Compensation Immersion Program, course

- Divergent Perspectives Emerge at SEC Executive Comp Roundtable, Workspan Daily article

- The Impact of U.S. Policy Changes on Comp and Talent Management, Workspan Daily article

- How CEO Pay Trends Reflect a Changing Performance Landscape, Workspan Daily article

- Examining the Potential of New Executive Compensation Structures, Workspan Daily article

For companies considering an initial public offering (IPO), one of the most critical items to address is the establishment of a long-term incentive (LTI) plan strategy and share reserve for post-IPO equity awards. WTW’s Global Executive Compensation Analysis Team (GECAT) researched the LTI practices of 98 U.S.-based IPOs since 2022 with $100 million market capitalization or higher. Through this work, we gained insights on key statistics and first-year equity award trends, including that a company’s LTI plan must address four primary issues at the time of its IPO.

This article unpacks the research in sharing details and insights on these issues.

Issue 1: Share Reserve

Typically defined as the number of shares requested for post-IPO equity awards, a share reserve is the “bank” of shares upon which the organization draws as it grants equity-based LTI awards (e.g., stock options, restricted shares). This number typically is expressed as a percentage of the total number of common shares outstanding (CSO) at the time of IPO on an undiluted basis. For example, if a company has 100,000 CSO at IPO and created a share reserve of 5,000 shares, the share reserve percentage is 5% of CSO.

Our analysis revealed the median new equity-plan reserve accounted for 10.3% of total undiluted CSO. The range from 25th to 75th percentile was 8.1% to 13.5% (see below).

|

Share Reserve |

Percentage of Undiluted CSO at IPO |

|

75th percentile |

13.5% |

|

50th percentile |

10.3% |

|

25th percentile |

8.1% |

Issue 2: Evergreen Provisions

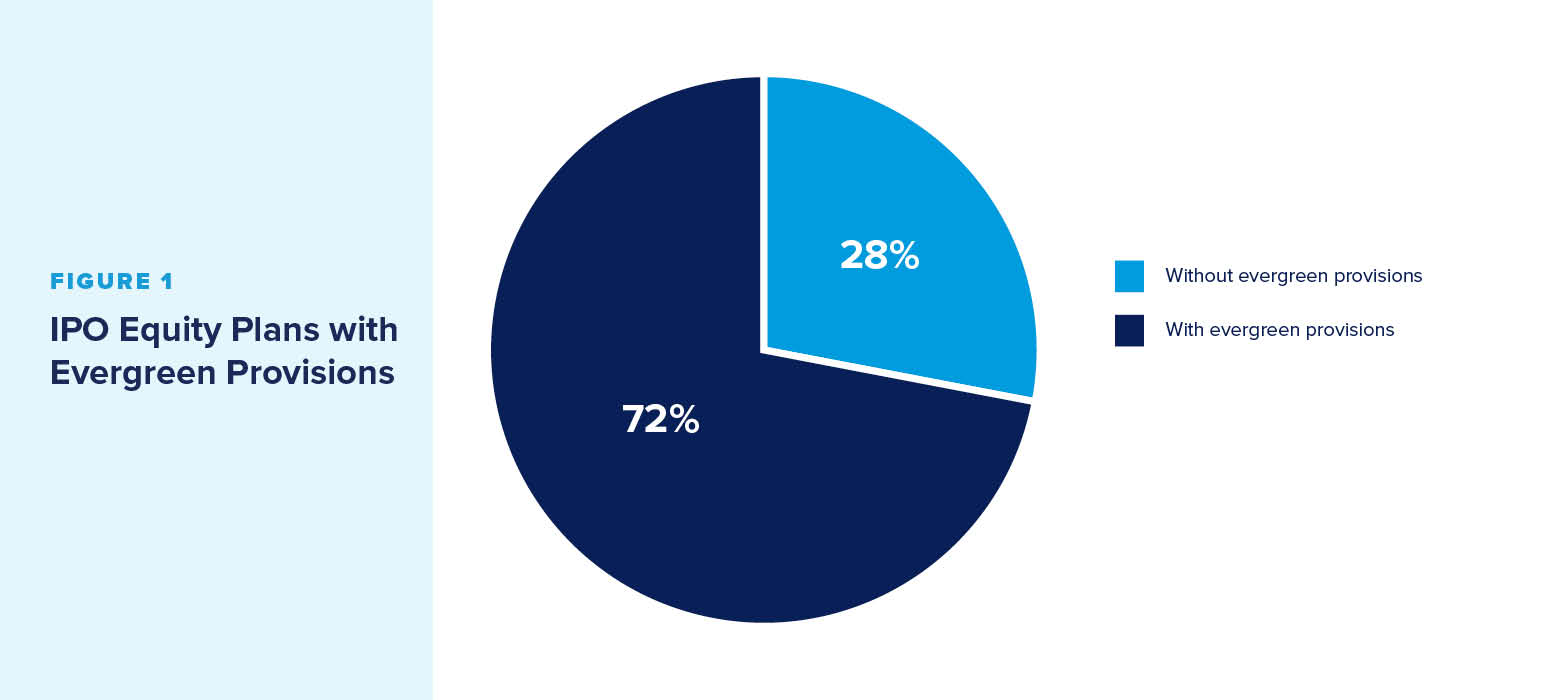

Evergreen provisions allow for an automatic annual replenishment of the share reserve, up to a preset limit. While an evergreen provision is not required in the equity plan at IPO, it has become a more common feature in recent years.

Our analysis found 72% of companies’ equity plans included an evergreen provision at IPO. The standard evergreen provision increases the share reserve by a fixed percentage of year-end CSO, or by a lesser amount if approved by the company’s board of directors (see Figure 1).

The maximum share replenishment ranged from 1% to 10% of CSO, with a median of 5%. Seventy percent of companies that have an evergreen set their maximum at 5% of CSO (see below).

|

Annual Evergreen Increase Maximum as a Percent of CSO |

Maximum Share Replenish |

|

1% of CSO |

9% |

|

2% of CSO |

4% |

|

3% of CSO |

6% |

|

4% of CSO |

9% |

|

5% of CSO |

70% |

Evergreens have become much more prevalent in IPO equity-plan designs in recent years. This is likely due to changes in U.S. income tax law and the increase in the number of companies that completed their public offerings through a “de-SPAC process” (i.e., a merger with an already-public special purpose acquisition company), where evergreens are historically more common.

With that said, evergreen provisions are viewed as generally unfriendly to shareholders by major proxy advisors. Therefore, they typically are removed as a feature when:

- A future material modification to the equity plan requires shareholder approval;

- A company seeks additional equity plan shares to award employees, directors and other service providers; or,

- The current equity plan expires.

Issue 3: Run Rate

Also known as the dilution rate or burn rate, this is the rate at which the share reserve is reduced each year. The run rate provides a measure of the pace at which available equity is being used and, as such, provides an indication of the rate at which investors’ value in the company is diluted each year through equity awards to employees and directors. The run rate typically is expressed as a percentage of total shares or in total accounting cost terms.

The reported median run rate in the year of IPO was 4.5% of undiluted CSO, with a 25th to 75th percentile range from 1.9% to 7.5% of CSO. These share usage rates are well above the typical run rates reported by companies that have been public for several years, as new IPO companies tend to provide larger stock awards to retain and align key staff with new public shareholder interests (see below).

|

Run Rate |

Percentage of Undiluted CSO |

|

75th percentile |

7.5% |

|

50th percentile |

4.5% |

|

25th percentile |

1.9% |

This 4.5% median is substantially higher than prior WTW analyses on IPO equity grant practices. This increase may be linked to the emergence of evergreens as a common plan feature; if companies know they can replenish their available share pool by up to 5% at the conclusion of their first year, the 5% figure may serve as a de facto budget for IPO-year share awards.

Taking this into account, the WTW research shows newly public companies should not see the evergreen limit as an annual “budget.” Rather, they should grant equity awards in a way that is sustainable long term, aligned with shareholder interests and competitive with the external market for executive table.

Issue 4: IPO-Year Equity Vehicles

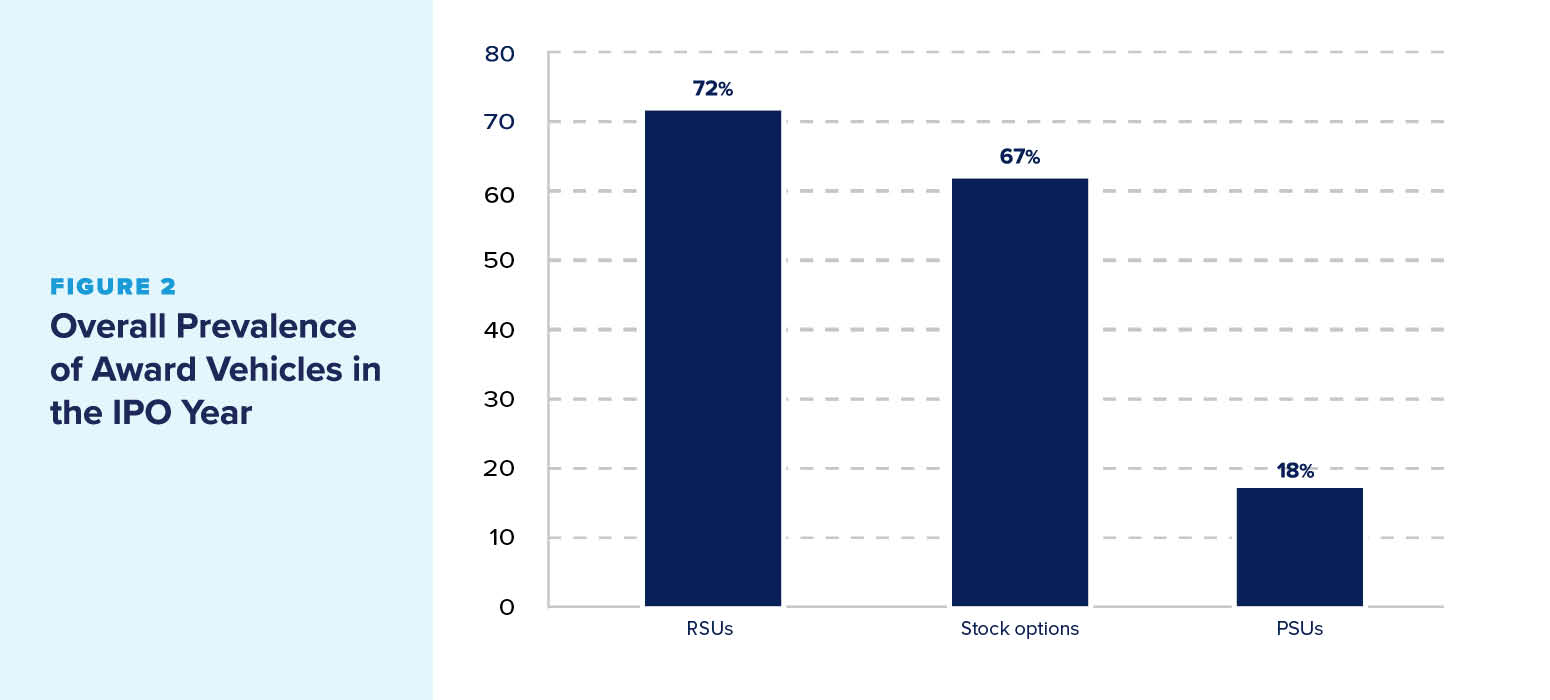

Equity mix is the use of different types of long-term incentive awards: options, time-vested shares, performance shares and so on.

Overall, stock options and restricted stock units (RSUs) remain the most commonly granted equity vehicles in the IPO year, while performance stock units (PSUs) are a distant third. This differs from the practices of longstanding, mature public companies, where PSUs are the most commonly granted form of equity award (see Figure 2).

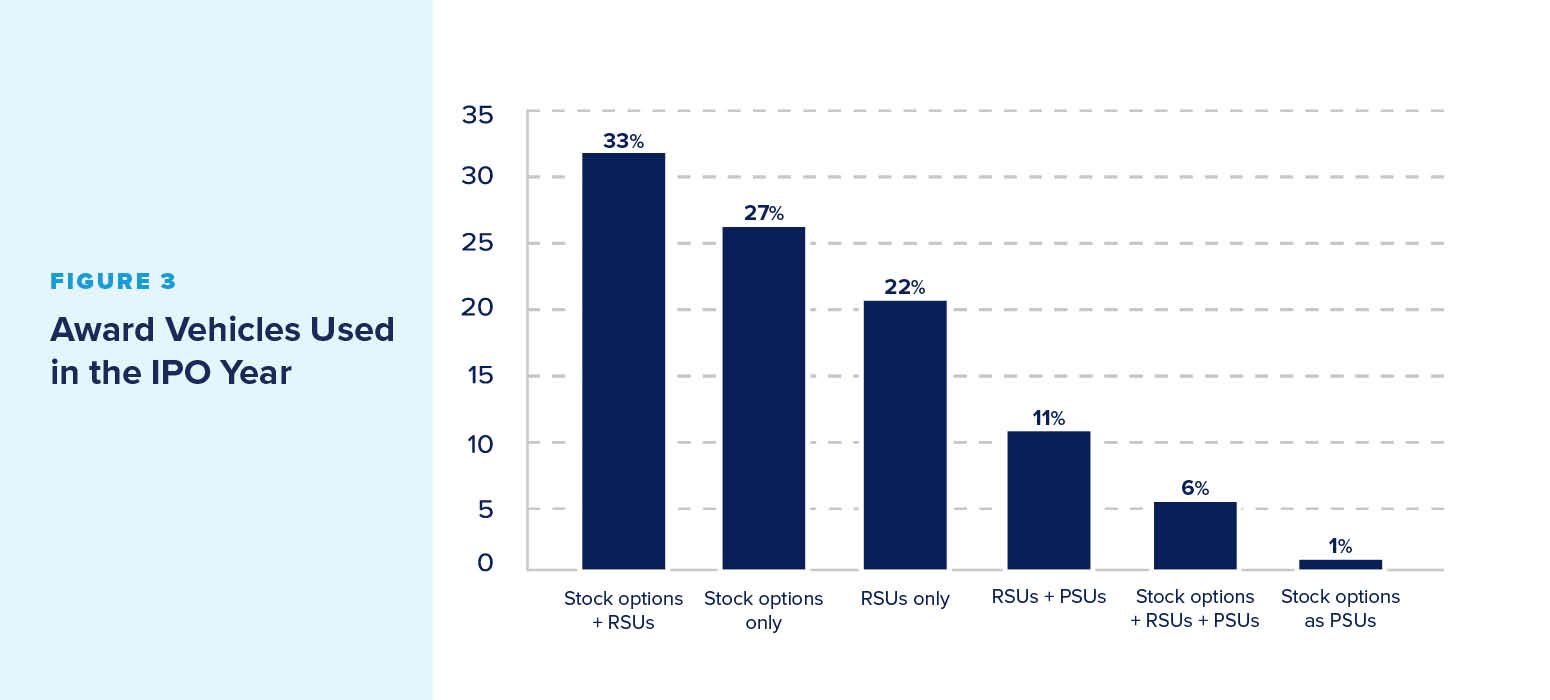

About one-half of all IPO companies granted only one form of equity in the IPO year, with stock options (27% of companies) slightly outpacing RSUs (22%). When companies granted more than one equity vehicle, the most common combination was stock options and RSUs (see Figure 3).

The Role of Equity Vehicles in IPOs

After several years of a post-SPAC slowdown in the number of IPOs, analysts expect interest in going public to rebound in the latter half of 2025 and early 2026. A robust equity plan should be a critical part of these companies’ post-IPO compensation strategies.

The share reserve established in these plans should be used thoughtfully and as part of a total compensation package that aligns the interests of equity plan participants, particularly executives, with the company’s new shareholders.

With that said, equity grant practices in the first year that a company is publicly traded often have goals that are specific to that first year. WTW research found key employee alignment, retention and ownership are most commonly cited as the company’s primary objectives. After the IPO year, a reduced dilution rate and the introduction of PSUs in the equity mix may be advisable.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics:

#1 Total Rewards & Comp Newsletter

Subscribe to Workspan Weekly and always get the latest news on compensation and Total Rewards delivered directly to you. Never miss another update on the newest regulations, court decisions, state laws and trends in the field.