For WorldatWork Members

- 2026 Priorities of Total Rewards Leaders, research

- 2025-2026 Salary Budget Survey, research

- If Workers Feel Squeezed, Reinforce the Sum Total of Your Rewards, Workspan Daily Plus+ article

- Don’t Underestimate the Power of Non-Financial Rewards, Workspan Daily Plus+ article

- Addressing Inflation and Stemming the Turnover Tide, Workspan Magazine article

- Effectively Managing Pay Budgets, Structures and Rates, Journal of Total Rewards article

For Everyone

- COLA, Currency, Comp: How TR Leaders Are Handling the New World Order, Workspan Daily article

- The ‘Salary Squeeze’: How the Workforce Is Weighing Compensation, Workspan Daily article

- How HR and TR Leaders Can Build Future-Ready Rewards, Workspan Daily article

- Compensation Actions in an Inflationary Economy: A Case Study, on-demand webinar

- Geographic Pay Strategies, course

- Market Pricing and Competitive Pay Analysis, course

- Total Rewards Priorities Quiz, tool

Inflation is one of the most significant forces shaping global compensation strategy. As economies continue to adjust to post‑pandemic recovery, monetary tightening, geopolitical disruptions, and volatile food and energy markets, workers in many regions are experiencing the sharpest erosion of purchasing power seen in years.

For employers and, in particular, their HR and total rewards (TR) leaders, this creates a complex environment where traditional compensation cycles are no longer sufficient. Pay structures face compression, minimum‑wage changes cascade upward and currency volatility reshapes the value of take‑home pay.

Against this backdrop, you likely need to adopt compensation approaches that are market‑sensitive, financially sustainable and grounded in transparent communication.

This article aims to examine and delve deep on this topic, considering:

- The macroeconomic forces driving inflation;

- The geopolitical shocks amplifying it; and,

- The practical compensation levers organizations can deploy to safeguard both competitiveness and employee trust.

Macroeconomic Environment

Understanding the macroeconomic environment is essential for HR and TR teams because indicators like inflation, gross domestic product, unemployment and monetary policy collectively influence pay decisions. Inflation has been one of the most heavily scrutinized indicators since 2020, as rising prices reduce real wages and force both employees and employers into rapid adjustment cycles. Analysis by the Organisation for Economic Co-operation and Development (OECD) shows that although inflation eased in many advanced economies after 2022 due to several factors (i.e., restrictive monetary policy, falling energy prices and the gradual unwinding of supply bottlenecks), underlying pressures — particularly in food and rental categories — remain elevated in several markets.

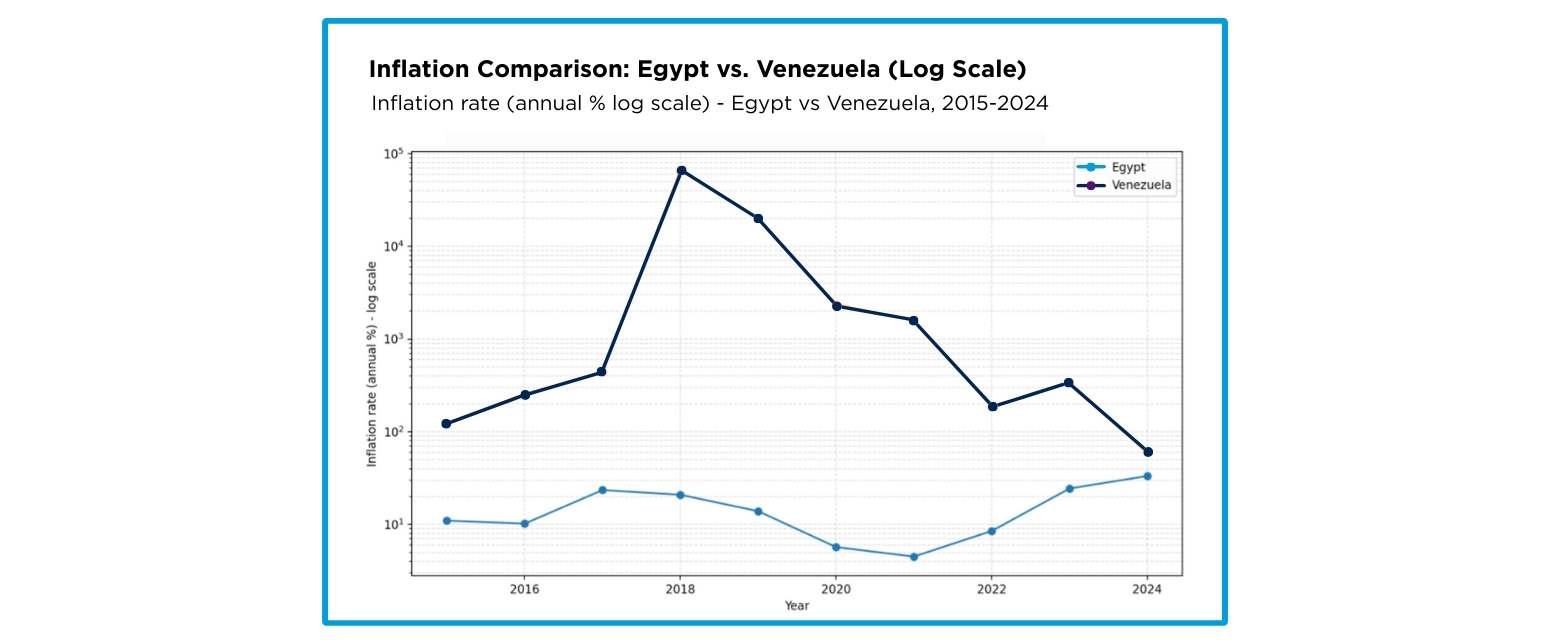

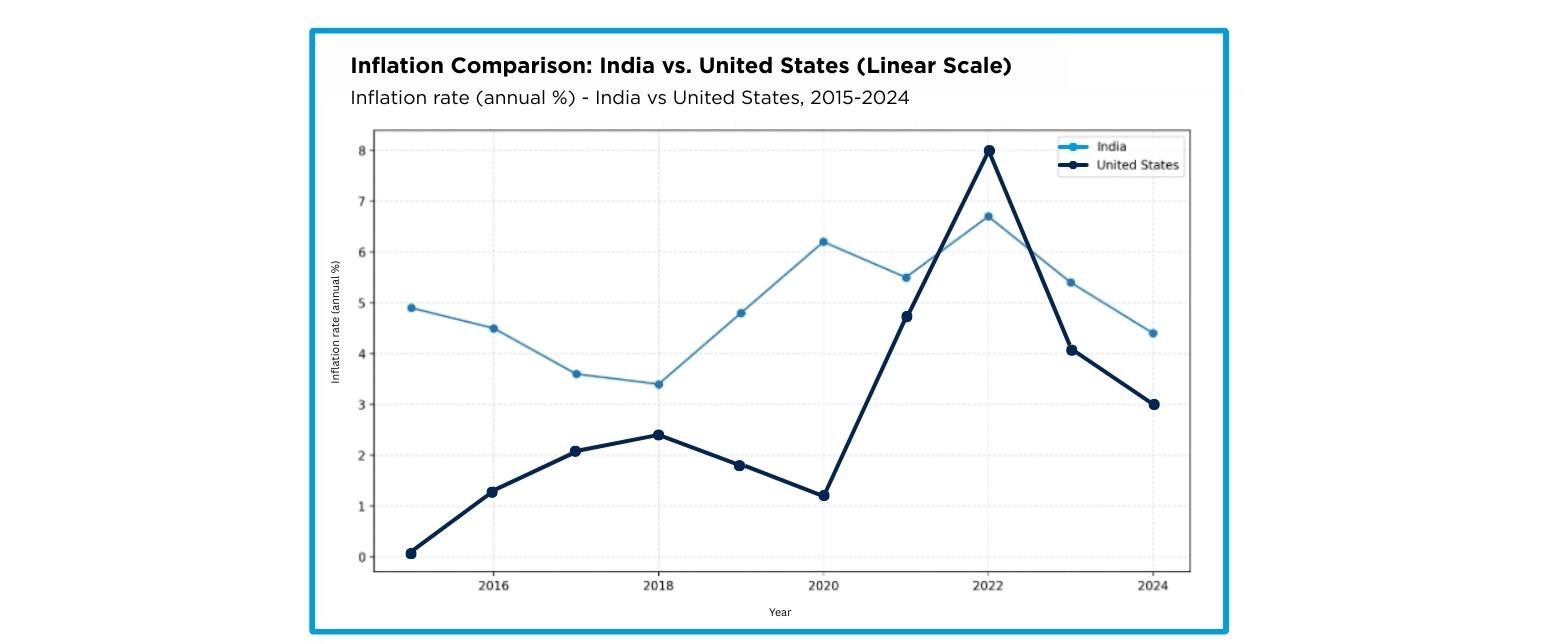

Global inflation patterns illustrate why compensation strategies should be locally calibrated. For example, Egypt saw inflation rise sharply, reaching 28% to 32% between 2022 and 2024. Venezuela’s inflation, although far below the hyperinflation peaks of 2018, remained extremely high at 59.6% in 2025. India maintained comparatively moderate inflation at 4.4% in 2024. U.S. inflation peaked at 8% in 2022 before stabilizing to 3% in 2024. (See the charts below for details.) These divergent trends show inflation is not a uniform phenomenon but a regional and structural one, requiring differentiated pay responses.

Geopolitical Impact and Inflation

Geopolitical disruptions (e.g., wars, terrorism, political instability) have significantly magnified inflationary pressures, particularly for food-importing or energy-dependent economies. The global food security analysis performed by the Food and Agriculture Organization of the United Nations (FAO) highlights how the war in Ukraine reduced grain exports, disrupted fertilizer supply chains, and pushed up global food and energy prices. This had a disproportionate effect on developing countries, where food constitutes a larger share of household consumption. OECD reviews similarly show the sharp increases in energy and commodity prices were heavily linked to geopolitical instability, contributing to headline inflation surges worldwide.

In extreme cases like Venezuela, prolonged political and economic instability has contributed to chronic inflation, eroded currency value and impaired purchasing power for nearly a decade. These examples underline that geopolitics and inflation are deeply intertwined, influencing employer costs, talent mobility and employee expectations.

Minimum Wage Impacts

Minimum wage policies have become a critical lever for governments responding to rising living costs, but they also create cascading consequences for employers. Egypt’s National Wages Council implemented six private-sector minimum wage increases between 2022 and 2025 — including the raise to EGP 7,000 from March 2025 (and from EGP 2,400 in March 2022) — to protect low-income households amid climbing inflation. Government statements emphasize the protective intent of these measures, citing food inflation and currency shifts as major drivers.

For organizations, however, rising minimum wages trigger upward pay compression. Jobs positioned above entry level begin to overlap, requiring recalibration of salary structures to preserve differentiation, fairness and retention. The financial impact is not limited to the lowest tier but ripples through entire pay bands, making careful modeling and phased adjustments essential.

What Inflation Does to Compensation Mechanics

Inflation affects compensation mechanics through three primary, stepped pathways.

- Real wage erosion reduces employees’ ability to meet basic needs, heightening expectations for timely intervention.

- Pay compression intensifies when statutory minimum wages or market pressures lift lower grades faster than mid‑level ones, forcing structural adjustments.

- Inflation can outpace the frequency at which market pricing is usually updated, requiring more agile benchmarking cycles to avoid falling behind.

Seven Action Levers

In response to this environment, consider seven compensation levers that typically work in inflationary cycles.

- Lump‑sum payments: These payments allow organizations to offer quick financial relief during sudden inflation-spike periods without raising the long-term fixed cost on the base salary. They work well when inflation is expected to cool, though employees may feel they do not fully address ongoing erosion in purchasing power.

- Multiple or mid‑year salary increases: Introducing more than one salary increase within the year helps maintain pay competitiveness during sustained inflation and prevents compression between grades. However, this approach increases recurring costs and must be supported by strong affordability modeling.

- Targeted allowance adjustments: Adjusting specific allowances such as fuel, meal or commuting support can directly relieve pressure in categories where employees feel the most immediate cost increases. However, these allowances can quickly become embedded if not clearly positioned as temporary; and in acquired-rights jurisdictions, offering such benefits even once may legally or culturally prevent employers from withdrawing them later.

- Selective market adjustments for critical talent: If you cannot do everything for everyone, you likely can do something for someone. Providing targeted increases to crucial roles can enable employers to protect scarce or business-critical skills and ring-fence talent without the expense of enterprise-wide salary adjustments. Such targeted actions should be communicated in a sensitive manner to avoid perceptions of inequity across the wider workforce.

- Controlled use of hard currency or U.S. dollar-linked elements: Hard-currency pay can stabilize real income in markets facing extreme foreign exchange (FX) volatility or partial dollarization, giving employees a sense of security. The challenge is these elements can create administrative complexity and set precedents that may be hard to reverse when conditions normalize. Payroll services company keyHRinfo notes that moving employees to hard-currency pay can introduce long-term expectations and operational complexity. Data, software and training company ECA International has warned that responding to devaluation by switching local currency earners into hard-currency pay can create unsustainable precedents and should be avoided except in extreme, temporary scenarios.

- Shift or productivity-linked premiums: Premiums tied to output or nonstandard shifts may allow employers to increase earnings while maintaining a clear link between pay and productivity. This is especially effective in operational or hourly roles, though it may not be suitable for all job families.

Effective Communication Is Key

Communication is the cornerstone of effective compensation strategy during inflationary periods. Employees typically judge pay decisions not only by the outcome but by the clarity, tone and transparency of the rationale.

Research consistently shows trust strengthens when organizations explain:

- How inflation affects business performance;

- What constraints leaders are balancing; and,

- What principles guided their decisions.

WorldatWork insights highlight that leaders who frame decisions candidly — acknowledging real pressures and outlining what may trigger further action — significantly reduce anxiety and speculation. Manager alignment is equally critical; employees typically look to their immediate leaders for credible interpretation, making leadership visibility and consistent messaging essential.

WorldatWork guidance notes that communication also should be future-oriented, helping employees understand what indicators the organization will monitor and how future adjustments might unfold.

Clear, empathetic and proactive messaging increases the likelihood that, even when budgets are constrained, employees feel respected, informed and included in the organization’s response to inflation.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics:

#1 Total Rewards & Comp Newsletter

Subscribe to Workspan Weekly and always get the latest news on compensation and Total Rewards delivered directly to you. Never miss another update on the newest regulations, court decisions, state laws and trends in the field.