For WorldatWork Members

- Should Your Next Total Rewards Professional Come from Finance? Workspan Magazine article

- The FTE Factor: Measuring and Utilizing Your True Workforce Size, Workspan Daily Plus+ article

- How to Calculate the ROI on Your Wellness Program, Journal of Total Rewards article

For Everyone

- Accounting & Finance for the HR Professional, course

- Business Acumen for Compensation Professionals, course

- How to Measure the Success of Your Annual Compensation Cycle, Workspan Daily article

- 5 Keys: Using Incentive Comp to Lift Performance, Profits, Innovation, Workspan Daily article

- The Role of Profitability Metrics in Sales Compensation Plans, Workspan Daily article

As the epicenter of employee engagement, attraction and retention, the total rewards (TR) function within the human resources department has always carried a hefty price tag. But with affiliated costs such as payroll and insurance continuing to surge, it’s perhaps never been more important for its professionals to be able to show their work when it comes to the return on investment (ROI) of programs and offerings.

The solution is no longer just to work hand-in-hand with the finance department, although that’s important — today, more than ever, the TR leader needs to “think like a chief financial officer (CFO).”

Access a bonus Workspan Daily Plus+ article on this subject:

What Does It Mean to ‘Think Like a CFO’?

Total rewards can represent up to 70% of an organization’s budget — and as the stewards of that investment, it makes perfect sense that HR and TR leaders would need a finance mindset, said Marta Turba, the vice president of content strategy at WorldatWork.

“With this accountability, it must be managed — not based on hunches or sentiments but on performance and impact,” Turba said. “At their core, rewards are designed to enable the workforce to be productive, which translates to bottom-line results.”

That means leaning on data-informed decision-making when it comes to keeping, boosting or pulling back on various compensation and rewards programs, said Peter DeBellis, a managing director and human capital insights lead at Deloitte Consulting LLP.

“The set-it-and-forget-it approach to rewards seems to be a vestige of an era gone by,” he said.

Indeed, today’s TR leaders need to not only think like a CFO with an eye on ROI — they also should be thinking like a chief marketing officer by understanding their “customers,” the employees, DeBellis added.

“What do those customers want and need?” he said. “What are the tradeoffs between their preferences and perceptions of value? How might these customers be segmented and engaged? It is a balance of macro and micro thinking and knowing when to use each one.”

Make These Key Moves

To successfully think like a CFO in the TR leadership role, the following steps are critical, Turba said:

- Understand the organization’s financial dynamics — revenue streams, cost structures, and how selling, general and administrative (SG&A) expenses affect profitability.

- Understand and account for the organization’s business strategy and revenue generation model.

- Seek out non-HR business knowledge, and network across industries.

- Establish and monitor key performance indicators (KPIs) for rewards programs — and adapt as needed to meet goals.

- Align incentive programs with your business’ performance objectives.

- Design rewards programs to drive employee productivity.

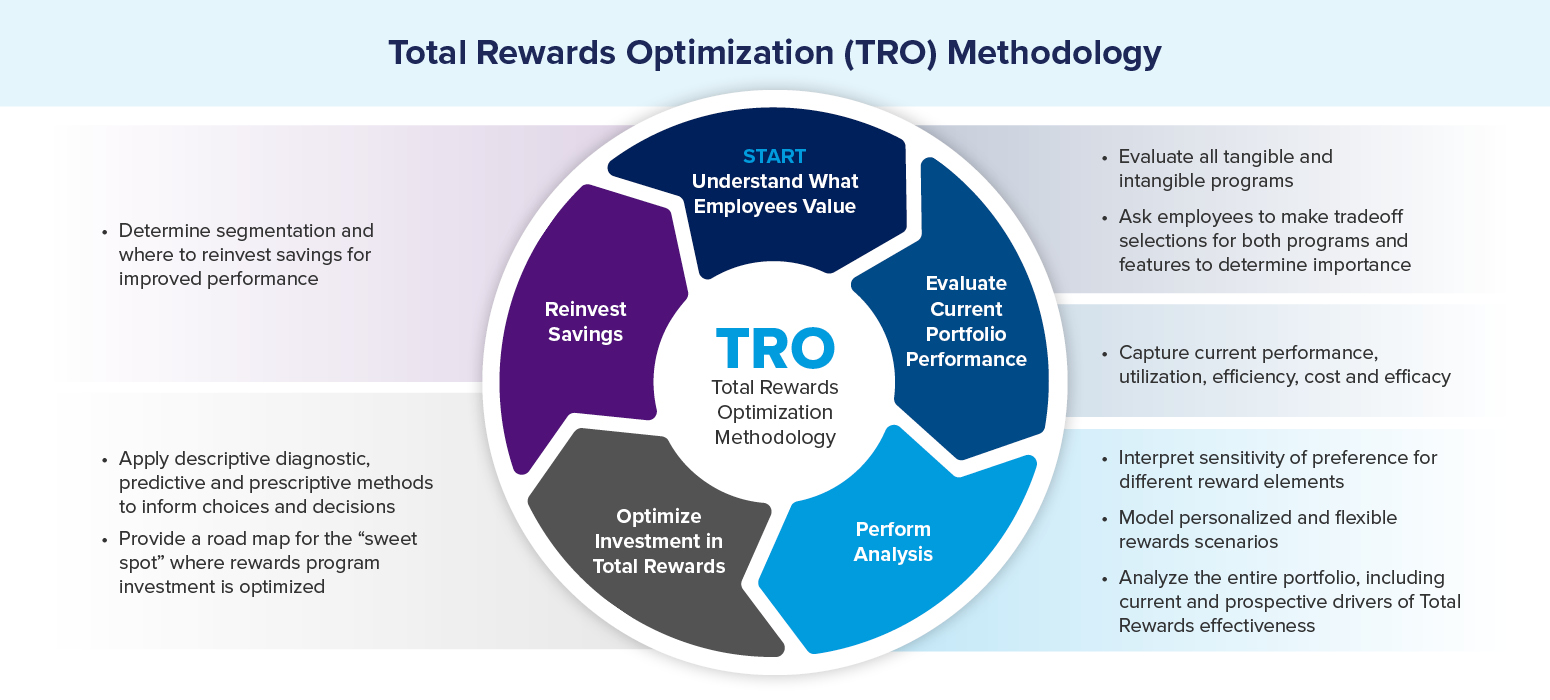

Turba said such thinking is encapsulated within WorldatWork’s Total Rewards Optimization Methodology (see figure below).

Measuring Progress and Success

After making changes to a rewards program or implementing a new one, now-and-then comparisons of employee satisfaction, turnover rates, absenteeism, productivity or the amount of time it takes to onboard new employees all can indicate measurable value.

Certain areas of the TR package, such as coaching or recognition culture, have been historically challenging to quantify despite their undeniable impact on recruitment and retention, Turba noted. One way to boost productivity and rewards investment value is by focusing on employee experience in rewards over program design.

“Employee experience may sound like the ‘soft side’ of HR, but the numbers are real,” Turba said. “For example, organizations that invest most heavily in employee experience are found to be four times more profitable than organizations that do not. Employee experience is critical to rewards.”

Use Tech to Your Advantage

Artificial intelligence (AI) and analytics tools allow TR pros to go beyond traditional HR information system (HRIS) data tracking — melding demographics, customer experience, financial data and more into a holistic picture of the impact of rewards programs, Turba said.

While technology is increasingly being seen as a solution to help streamline HR processes, improve outcomes and reduce rewards costs, early and regular analysis of tech solution impact is vital to ensure it’s having the intended impact.

Self-service portals and other tools for workers also can improve employee experience and increase the value of rewards, DeBellis said.

“The increased availability and sophistication of rewards tech can enable and improve the rewards experience for both individual workers and rewards pros,” he said. “And for rewards professionals, it’s not just an improved experience. These rewards technologies can help them wrangle and apply a treasure trove of data, enabling them to think — and act — like a CFO.”

Don’t Abandon Your TR Roots

Optimizing total rewards sometimes means pulling back on certain programs that are found to not deliver a significant ROI — but it’s important to do so strategically. Tools like conjoint analysis can help determine the most effective mix of rewards, Turba said.

In addition, communicating openly with employees about the reason for adjusting rewards programs or reallocating resources can help smooth out changes.

“If there is a program that workers seem to like that has to be scaled back or taken away, then I believe there is no substitute for transparency,” DeBellis said.

As TR pros embark on the necessary transition to incorporate CFO-like thinking, it’s still important to retain their TR core, Turba said. As you do the math and seek a balance between employee satisfaction through rewards and cost, keep in mind that certain programs (think: annual volunteer days, walking programs, time off for school functions) may appear to put you in the red — on paper.

But, as the experts in this article shared, those programs likely have a key impact on organizational culture and values — the intangible ingredient that often helps tip the scale in favor of improved employee engagement and retention. They still offer an ROI; it just looks different.

“Don’t overlook the rewards that can transform workplace dynamics and help employees reach their full potential,” Turba said. “This perspective may extend beyond a CFO’s typical financial lens, but it’s where total rewards professionals excel.”

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: