For WorldatWork Members

- Is Your Sales Compensation Plan Really ‘Self-Funding’? Workspan Magazine article

- Sales Performance Management, research

- Return of Sales Expense, research

For Everyone

- 5 Keys: Using Incentive Comp to Lift Performance, Profits, Innovation, Workspan Daily article

- Maximizing Business Growth Through Strategic Sales Compensation, Workspan Daily article

- Sales Comp ’25, conference

- Sales Compensation Course Series, education

Since mid-2023, a number of industry sectors have pivoted to emphasizing profitable growth over at-all-cost, topline growth. Driving profitable growth quickly became a cross-functional challenge, requiring solutions that span multiple departments.

To entrench this strategy shift, many organizations have deployed a mix of sales compensation and commercial model changes to balance new and current customers for efficient growth.

Despite the instinct to incentivize desired outcomes or behaviors, profitability metrics (e.g., revenue less traffic acquisition costs; margin; earnings before interest, taxes, depreciation and amortization) are rarely used in compensation plans for individual contributors (ICs). If profitability is paramount (and these days, it certainly is), why don’t organizations include it directly in the sales compensation plans for ICs? It likely comes down to influence.

Can the sales representatives directly control the profitability of a deal that has many different channels (programmatic, performance, etc.)? If not, it would likely violate a core sales compensation principle, which is to reward persuasion and influence against strategic goals or plan measures. Unlike at the leadership level, where profitability metrics are common, an IC’s lack of direct control over ultimate deal profitability probably makes it a poor plan measure.

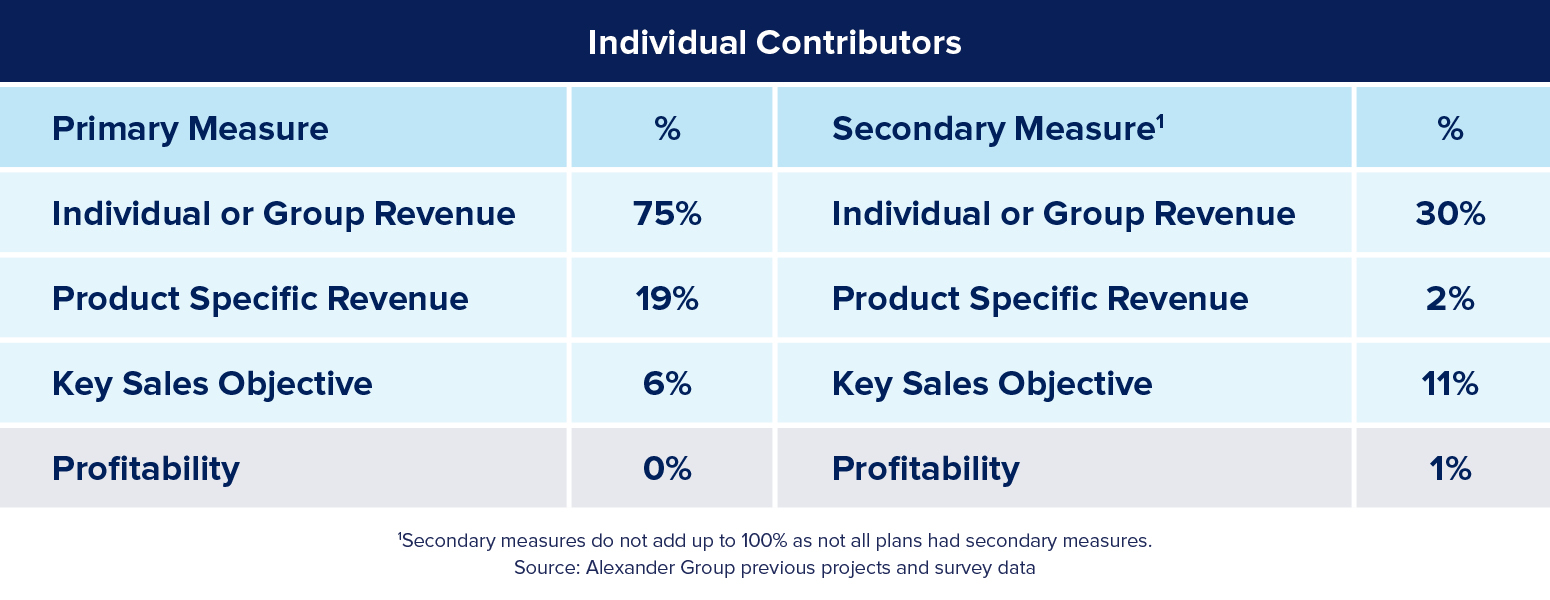

Recent Alexander Group research highlights how organizations compensate ICs and the tools they have at their disposal to emphasize profitability (see figure below). As the data suggests, most of the plan measures for ICs are revenue-driven (greater than 80%). The product-specific measures are typically more profitable, creating a nuanced way to drive profitability via sales compensation.

Mechanisms to Drive Profitability

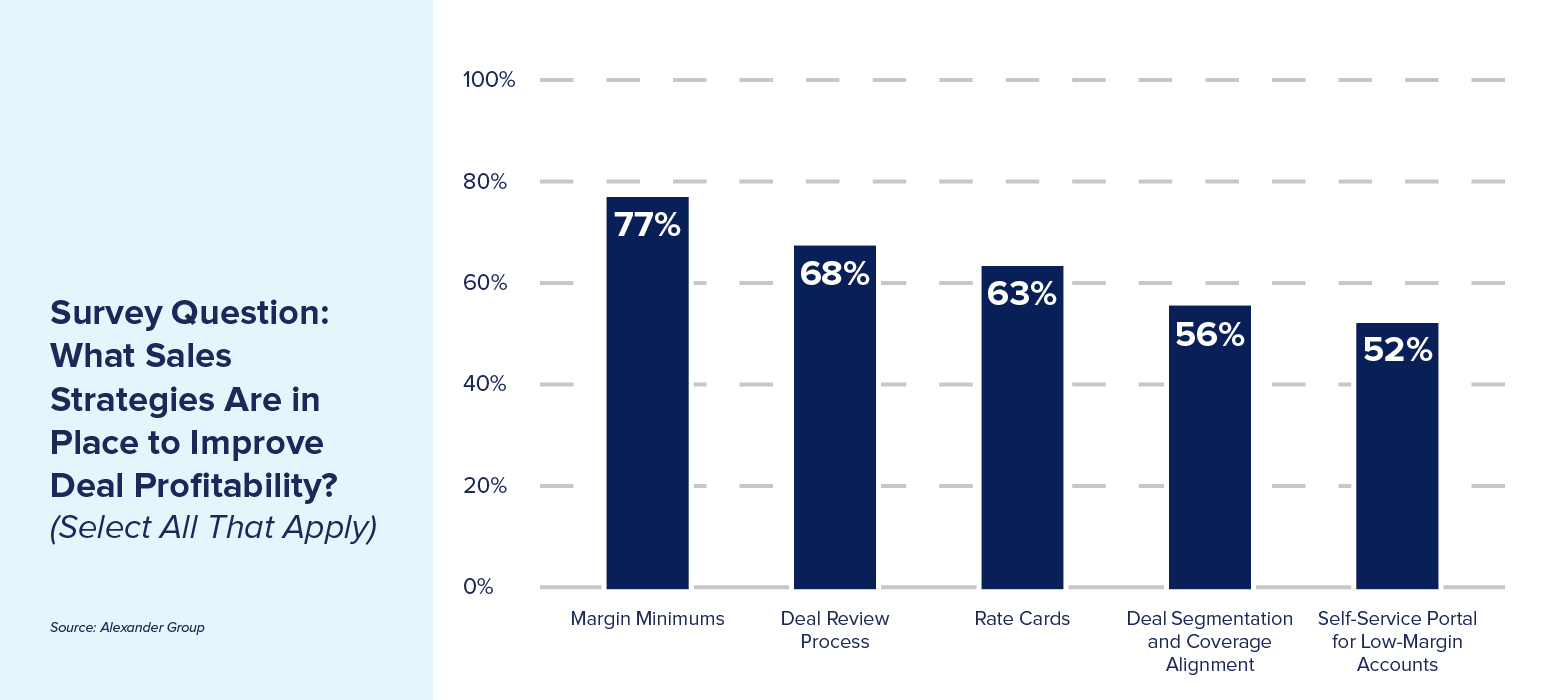

More so than any one specific non-compensation mechanism for driving profitability, Alexander Group data suggests deploying a mix of mechanisms is an effective strategy (see figure below). Almost universally, no mechanism received a “top 1-3” rating less than 25% of the time. This indicates each mechanism is a useful and viable strategy in driving profitability. There are interesting nuances across sectors, but the broad theme applies.

From a sales process perspective, the “multiple mechanisms” strategy comes through most effectively. Each of these mechanisms directly drives profitability without an explicit profitability plan measure.

Efficient leveraging of resources (e.g., increased organizational efficiency via differentiated coverage) is a top focus area among surveyed organizations to drive profitable growth. Implementing tight pricing controls, or deal desks, is the second-most common approach to managing profitability on a deal-by-deal basis.

From a marketing perspective, organizations are reassessing the integrity and actionability of their first-party data, improving data sharing with partners and creating clear buyer personas for specific messaging. Additionally, they are looking to gain a better understanding of what their clients truly value in provided solutions and invest in more advanced, relevant offerings.

Most organizations maintain account management and customer success headcount as these roles have a direct impact on keeping net revenue retention high. They have shifted the time profile of these roles more toward sales execution as opposed to campaign management and optimization.

Sales Compensation Strategies

Sales compensation is a critical component of driving profitable growth. As such, organizations increasingly focus on aligning related compensation plans with their overall business strategy and objectives. Here are some key strategies:

- Business strategy alignment. Design sales compensation plans to align with the organization’s growth objectives and desired sales team behaviors. This increases the likelihood that the sales force is motivated to achieve corporate strategic goals.

- Equitable earnings opportunities. It is essential to link sales compensation plans to equitable earnings opportunities. This can help to motivate and retain top talent while maintaining fairness within the sales team.

- Market-competitive pay levels. Sales compensation plans should be competitive with market pay levels to attract and retain top talent. This involves benchmarking against industry standards and adjusting compensation plans accordingly.

- Simplified and motivational plans. Sales compensation plans should be simple, motivational and easy to administer. Complex plans may confuse and demotivate the sales team.

- Quota setting and plan design. Effective quota setting and plan design are likely crucial to sales compensation plan success. This involves setting realistic and achievable quotas and designing plans that reward performance and drive desired behaviors.

Final Thoughts on Profitability Metrics

To stay competitive in a rapidly evolving industry driven by digital transformation and changing consumer behaviors, organizations should embrace innovative revenue growth strategies, leverage data to drive decisions and invest in digital capabilities. By optimizing sales productivity and enhancing employee motivation, organizations can better navigate market disruptions and achieve profitable growth. As the industry continues to evolve, staying ahead of trends and adapting to new market demands likely will be critical to long-term success.

If your organization is looking to drive profitable growth and stay ahead of industry trends, consider implementing a mix of strategic measures and commercial model changes.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: