For WorldatWork Members

- Sales Compensation Plan: Organizational Inventory, tool

- Sales Performance Management Technology Selection Guide, tool

- Sales Performance Management, research

- Return on Sales Expense, research

For Everyone

- Winning Big: Incentive Strategies for Megadeal Sellers, Workspan Daily article

- Pursuing a Career in Sales Compensation? Here Are 5 Suggestions, Workspan Daily article

- Pondering a Pay Plan Shift from Commission to Quota? Read This First, Workspan Daily article

- Sales Compensation Course Series, education

Sales compensation costs are on the rise. Alexander Group research found total sales expense is projected to rise 6% in 2025, nearly double that of U.S. inflation. To keep costs aligned, organizations must increase their productivity.

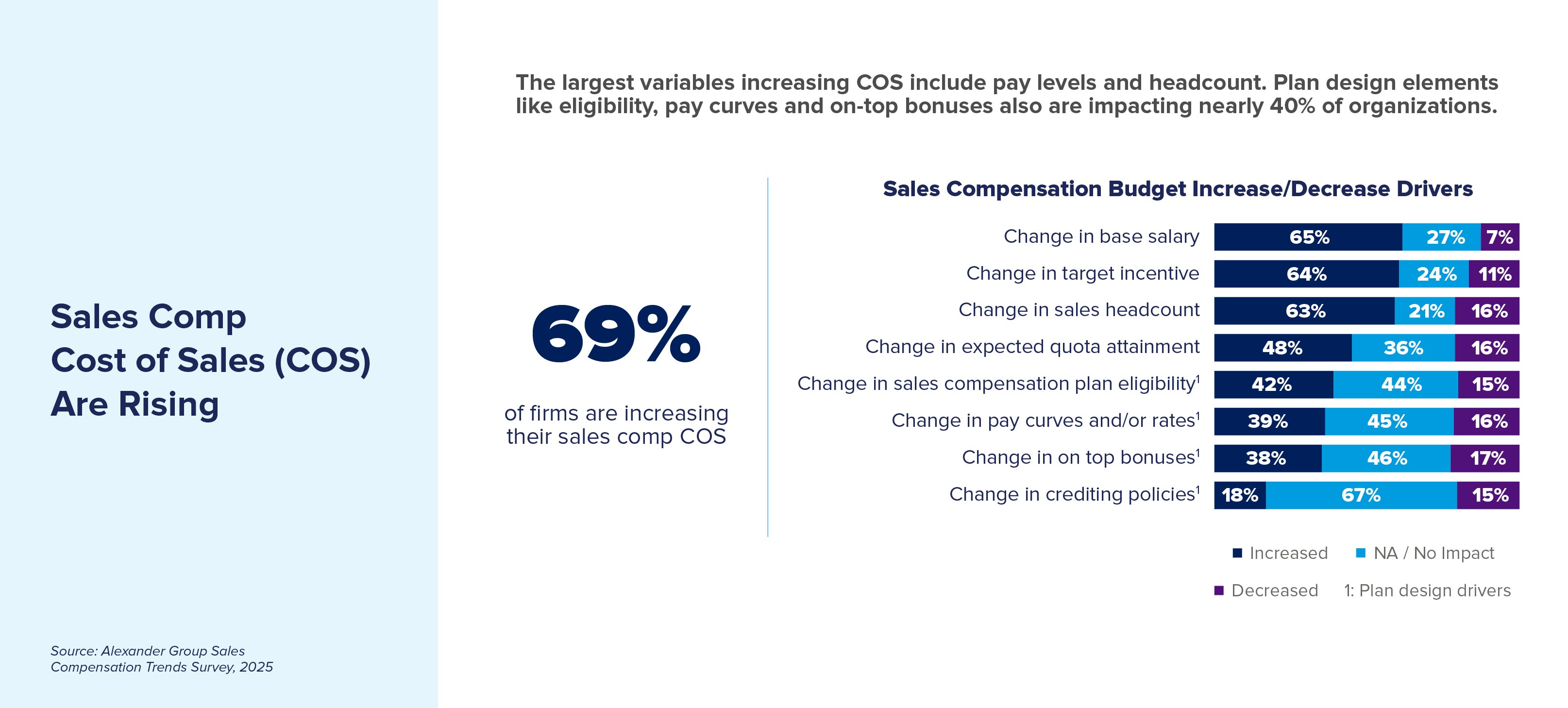

It’s no surprise that the top sales compensation plan design challenge is driving higher productivity. Unfortunately, 69% of surveyed organizations are unable to do so and are expecting to increase their sales compensation cost to sales, primarily due to an increase in pay, headcount and attainment (see figure below). In addition, plan design elements such as eligibility, pay curves and on-top bonuses are impacting approximately 40% of organizations.

As costs increase, organizations must closely revisit their sales compensation plans and increase the return on investment (ROI) from the related program. Leaders need to look for either how the plan can:

- Drive higher productivity;

- Reduce plan leakages; and/or,

- Drive better pay-for-performance alignment.

Diagnosing your sales compensation program is the first step to uncover areas of improvement in the program. To begin your diagnostic, you should start with a few questions, which are laid out as headlines in the subsequent sections.

Does the Program Have Pay-for-Performance Misalignments?

Most sales compensation plans include measures directly tied to revenue (or bookings). However, some plans include measures with a looser correlation revenue. The use of nonrevenue measures is one of the most common ways organizations misalign their sales compensation costs with actual revenue results. In other words, these plans drive a poor ROI from their sales incentive spend.

One type of nonrevenue measure is the use of objective-based measures. Programs tied to management by objectives (MBO) or key sales objectives (KSO) typically include objective-based goals that are set, tracked and measured by their managers. Many organizations don’t deploy the right governance and tools to effectively manage these programs, leading to above-average payouts that often don’t align to revenue results.

Other objective-based measures include the use of activity measures like:

- Number of calls

- Number of proposals

- Completed training

Sellers may complete all the activities but fail to convert those activities into revenue results. Thus, activity measures should be part of the job’s core responsibility and funded by the seller’s base salary.

Measures that sellers have limited influence over are another path to missed revenue results. Low-influence measures include measurement levels beyond a seller’s responsibility (e.g., company goal) or measures that the seller does not control (e.g., margin percentage for most sales jobs). Measures in which sellers have limited influence can be demotivating, particularly when sellers’ payouts don’t meet their expectations.

Nonrevenue measures like objective-based goals, activity metrics and low-influence measures generally don’t directly lead to revenue results. To maximize a sales compensation plan’s ROI, leaders should ensure that measures:

- Are objective;

- Have a direct impact on revenue; and,

- Can be influenced by sellers.

Are the Quotas Being Set Properly?

Sales leaders who participated in the Alexander Group research reported productivity and quotas are the second-most challenging plan design, right behind profitability. However, these two challenges are interrelated. If you set quotas too low, your profitability may decrease. If you set them too high, it can lead to high levels of seller demotivation and potentially turnover, which is likely very expensive.

Organizations have two major challenges when setting quotas. The first is how to set quotas. Organizations should build out a sound methodology to ensure quotas have a stretch component, and are fair and motivating. They also need to build out an effective process and governance to confirm the quotas are set, approved and rolled out in a timely manner.

The second challenge is how much quota to overallocate from leadership to the sales team. Quota overallocation is used by sales leaders as a type of insurance policy to make sure they hit their numbers while recognizing forecasting challenges as well as suboptimized sales territories (due to new hires, ramping, leaves of absence and undesired turnover). Consequently, quota overallocation practices vary significantly. High-growth organizations with many ramping sellers and with challenges forecasting capabilities typically use higher overallocation (e.g., 10% to 20%). Large, mature organizations with stable sales teams and fairly accurate forecasting capabilities typically use low or no overallocation.

Having the wrong approach to setting quotas could hurt your profitability.

How Does the Plan Stack Up to Market?

You go to the doctor for an annual examination. Your organization should get a regular checkup, too. Market checks are critical to confirm corporate practices are healthy and efficient.

Organizations should evaluate their sales compensation programs from multiple perspectives to ensure they are both motivating for employees and financially sustainable.

A total-target compensation check is likely critical to gauge how base salary and variable-incentive pay stack up to the competition. Sellers compare their pay to the competition, so organizations should also review them. Ensuring base salaries and variable incentives are in line with the corporate pay philosophy can be a key to attracting and retaining target talent.

A plan design check will help guarantee the way sellers earn incentives is aligned to the market. Organizations can leverage solutions to challenges that others have already solved. Additionally, a design check can provide insights into practices that were not thought of before. The Alexander Group believes organizations should know what the market is doing but not “copycat” market practices. Ultimately, each organization needs to select the right sales compensation solutions that align to their strategy, phase of growth, job design and reward philosophy.

The final check is to ensure your organization provides market-competitive upside. Calibrating payouts to top performers keeps sellers motivated and makes them feel like valued employees. Top sellers should earn generous upside but not to the degree that it blows out the sales compensation budget. Too much upside leads to less profitability. However, too little upside can lead to a far worse outcome: high turnover of top performers.

Are Other Factors Not Being Considered?

Sales compensation may not be the only factor contributing to low profitability. Other go-to-market factors can have a big impact on profitability, such as low productivity, misaligned headcount ratios, inequitable territories or unfair lead assignment practices.

When running a sales compensation diagnostic, don’t look at it in isolation. Ensure the revenue operations team is evaluating the entire go-to-market model.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics:

#1 Total Rewards & Comp Newsletter

Subscribe to Workspan Weekly and always get the latest news on compensation and Total Rewards delivered directly to you. Never miss another update on the newest regulations, court decisions, state laws and trends in the field.