For WorldatWork Members

- A Realistic Framework for Sales Performance Management Selection, Workspan Magazine article

- Sales Performance Management, research

- Return on Sales Expense, research

For Everyone

- The Role of Profitability Metrics in Sales Compensation Plans, Workspan Daily article

- 5 Keys: Using Incentive Comp to Lift Performance, Profits, Innovation, Workspan Daily article

- Maximizing Business Growth Through Strategic Sales Compensation, Workspan Daily article

- Sales Comp ’25, conference

With the current economic concerns and disruptive business environment, organizations are unsure about their growth prospects (and from where that growth will come). Worries about tariffs and a potential recession are leading them to revisit their sales compensation plans.

In response to rising costs and potential declines in spending, businesses are increasingly implementing pay-for-performance strategies. The Alexander Group’s recent sales compensation trends survey found 71% of polled organizations are emphasizing this approach in their comp plans.

What Is Pay for Performance?

Pay for performance is a powerful compensation strategy that directly ties employees’ pay to the achievement of their individual measurable performance goals. Essentially, it links pay to business performance, motivates continuous performance, differentiates top versus bottom performers and aligns compensation spend with financial goals (i.e., return on investment [ROI]).

There are multiple sales compensation components that organizations can use to increase pay for performance in their plans. These include:

- Eligibility. Place more jobs with persuasion on an at-risk sales compensation plan.

- Pay mix. Put more pay at risk (a 60%/40% base-to-variable mix versus one that is 70%/30%).

- Accelerators. Provide richer pay for higher performance.

- Thresholds. Provide no pay or reduced pay for lower performance.

- Measures. Use financial-focused metrics versus activity, non-financial ones.

- Measurement. Use more individual versus team metrics.

- Crediting. Use crediting rules that align to financial results (bookings or revenue versus pipeline).

Defining Your Pay-for-Performance Strategy

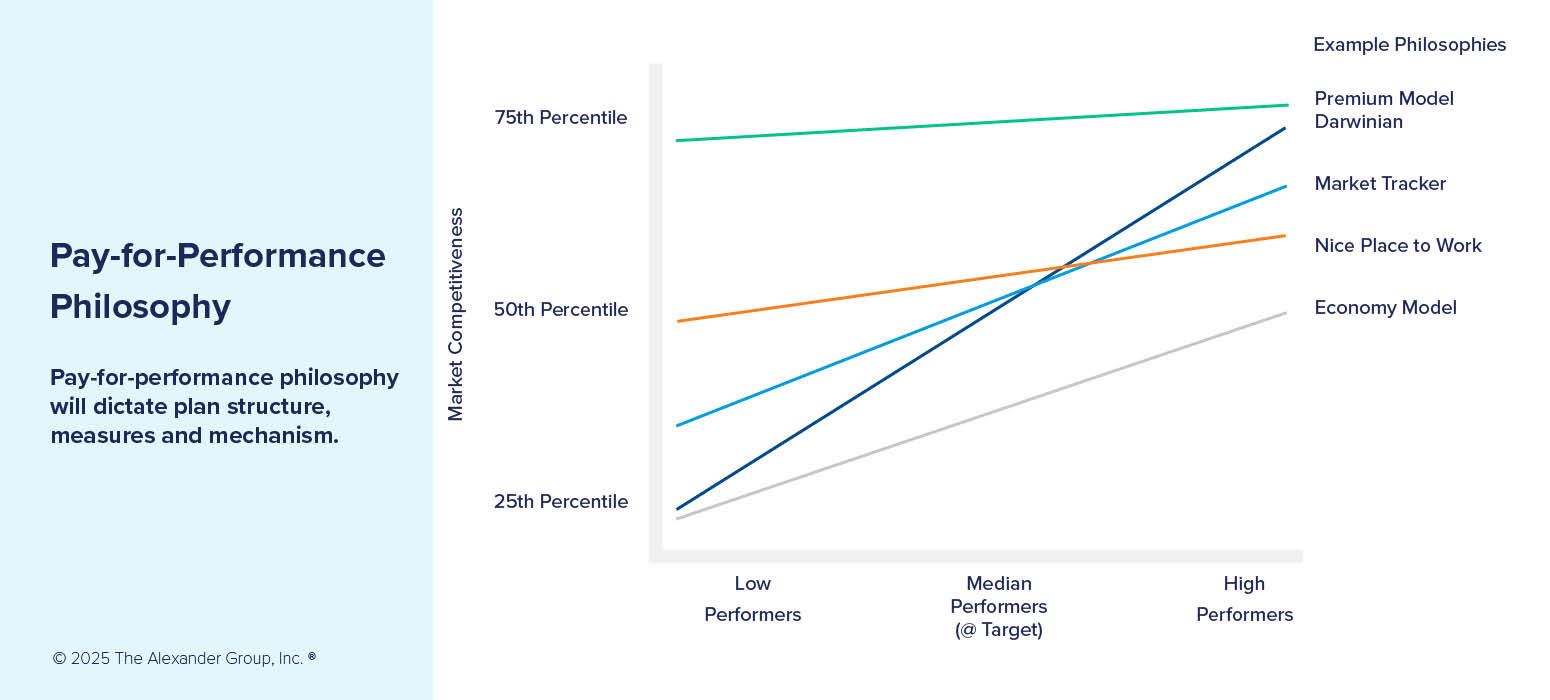

Before designing your plans, it is important to define your pay-for-performance philosophy. Do you want to pay lower than the market, at the market level or higher than the market? Do you want to drive an aggressive “Darwinian” sales culture that pays top performers a lot while exiting poor performers? Do you want to have a “market tracker” philosophy that aligns to market? Or, do you want to promote a “nice place to work” environment where everyone wins together?

The figure below illustrates some sample pay-for-performance philosophies. The y-axis is your organization’s total target compensation (or on-target earnings) market pay philosophy, and the x-axis is how much you desire to differentiate your top and bottom performers. Tip: Chart your own graph and socialize it with leadership for confirmation.

Manufacturer Company Case Study

A leading construction equipment manufacturer was struggling to achieve its financial goals while experiencing high seller turnover, so they designed a new market-competitive pay-for-performance plan. For their core sales job, they used a 60%/40% base-to-variable pay mix, with 100% of the target incentive focused on individual revenue. The monthly payouts were calculated based on performance to an annual quota using a bonus formula that paid a percentage of target incentive for each percentage of quota achievement. To ensure focus on profitable sales, they provided three accelerator rates (1x, 1.5x and 2x) based on achievement of different profit percentage goals (i.e., they used a gate). Additionally, management provided stretch, achievable quotas based on sales potential in their territories.

The results: Sellers were motivated by the plan and quotas. Sales leadership believed the plan aligned to the company’s revenue and profit goals. Finance concurred that the plan’s costs yielded an appropriate ROI. HR was able to use the plan to recruit and retain top talent. Over three years, the company increased productivity by 25% and reduced seller turnover by 15%.

Sales Compensation Design Challenges

While pay-for-performance strategies can drive results, their success depends on thoughtful execution. Organizations that are on this path should address three key challenges.

Lack of Job Clarity

Job design should precede sales compensation design. There are many common job issues. For example, job titles do not align to job roles, particularly if roles vary across geographies or segments. Or, job descriptions do not align to current/future expectations. Another example is a blended or corrupted job with too many sales and/or non-sales activities. Lack of job clarity drives plan complexity, inconsistency and poor ROI. The manufacturer avoided this pitfall by clearly defining the core seller’s focus — selling a full portfolio of products at the right price to the assigned customer — before designing their pay-for-performance plan.

Defining High Performers

Many organizations struggle to define what constitutes a high performer. A high performer is an employee who consistently exceeds expectations through dedication and hard work without relying on luck or easy targets. High performers should be defined based on job roles and specific sales plays assigned to those jobs, such as driving new logo sales, selling a balanced product portfolio or achieving profitability goals. The manufacturer’s success in the above case study highlights the importance of this step: defining a top performer as someone who exceeds their revenue quota with the right level of profitability.

Seller Dissatisfaction

Poorly designed compensation plans can demotivate sellers and lead to turnover. Common issues include below-market pay levels, unachievable quotas, an uncontrollable metric or midyear changes to pay opportunities. The manufacturer drove high seller satisfaction and motivation by providing market-competitive pay curves/upside opportunity and a stable annual plan design, along with stretch but achievable quotas.

The Plan, in a Nutshell

Your organization’s largest sales expense is compensation. Are you maximizing its return? To effectively design and execute a pay-for-performance plan:

- Involve cross-functional stakeholders from sales, sales operations, finance and HR to balance input and priorities.

- Create a cost model to simulate different scenarios, ensuring payouts align with the budget and that the organization achieves an ROI on its spend.

- Use change management practices to implement the plan.

- After implementation, track the plan’s performance against defined metrics.

Editor’s Note: Additional Content

For more information and resources related to this article, see the pages below, which offer quick access to all WorldatWork content on these topics: